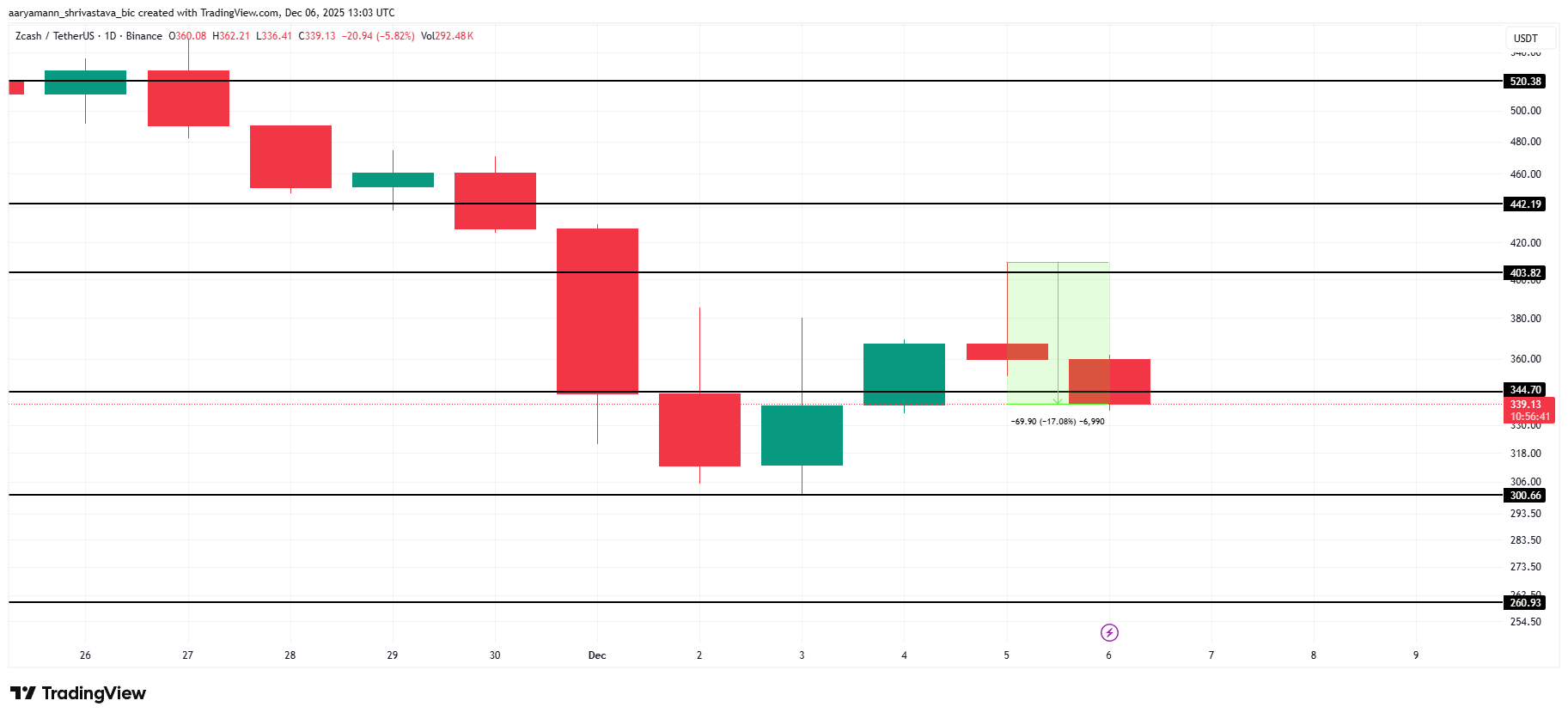

Zcash price has faced renewed selling pressure after a sharp 16% decline in the last 24 hours, pulling the altcoin down from its attempted move above $400.

The rejection has delayed ZEC’s attempt to reclaim higher levels, and the extended wait could introduce further challenges for traders if market sentiment weakens again.

Zcash Pulls Away From Bitcoin

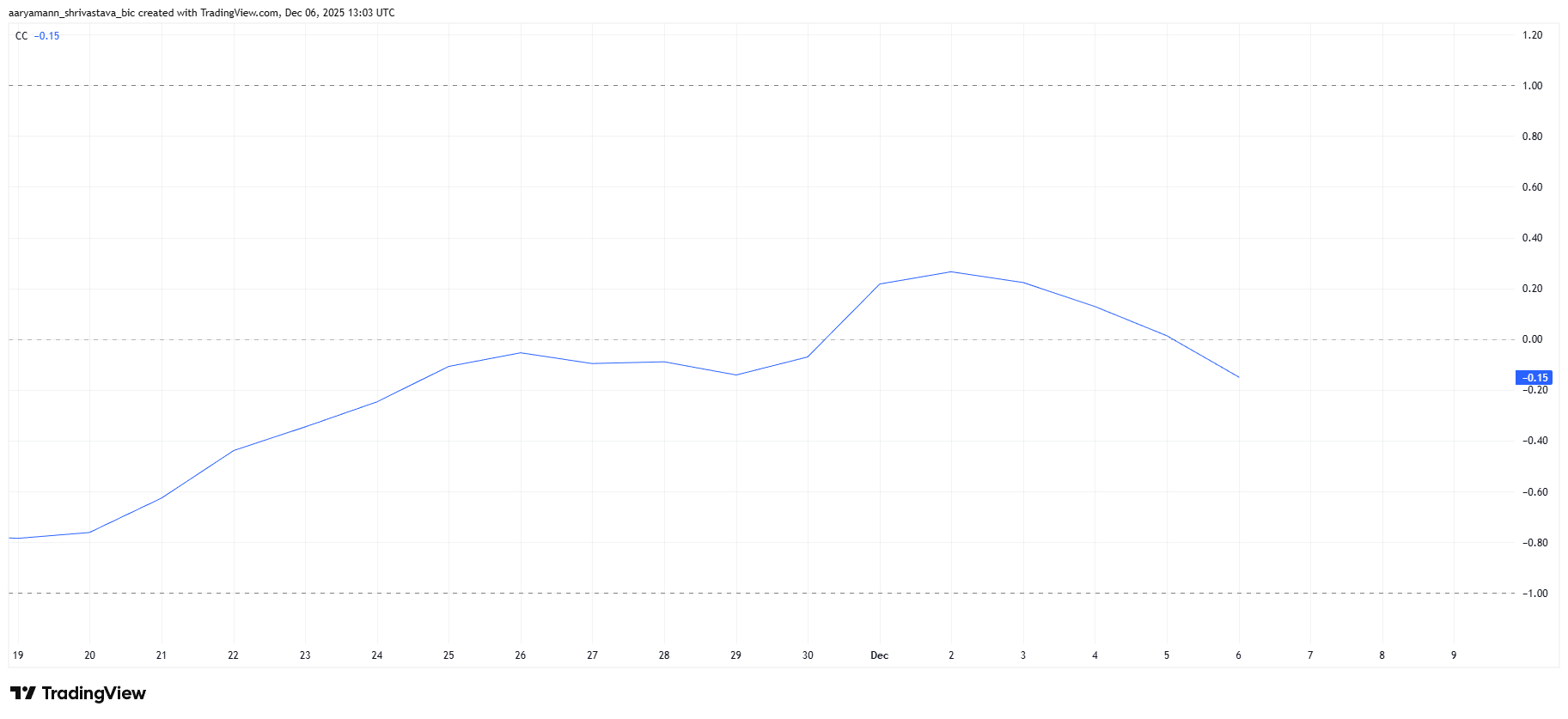

The correlation between Zcash and Bitcoin has been slipping in recent days, dipping back below the zero line. A negative correlation means ZEC is no longer moving in tandem with BTC’s price direction.

While this may initially seem neutral, it introduces an unusual risk dynamic. If Bitcoin rallies, Zcash may fail to benefit from broader market optimism.

Conversely, if Bitcoin falls sharply, ZEC could unexpectedly move higher, but with no guarantee of sustained strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

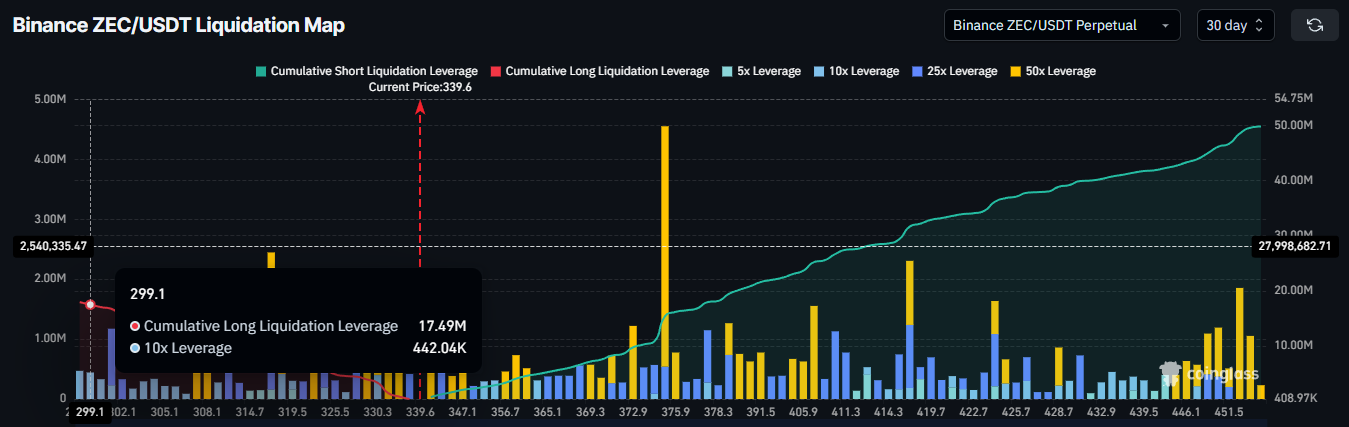

The liquidation map adds another layer of caution for ZEC holders at the moment. Long traders are facing elevated liquidation risk, with nearly $17.49 million in long contracts exposed if ZEC drops to $300 or below.

These potential liquidations represent a major pressure point for bullish sentiment.

If prices approach this threshold, cascading liquidations could accelerate downward movement. Such events often prompt traders to exit long positions and discourage new long exposure, contributing to a feedback loop that reinforces bearish momentum.

ZEC Price Faces Resistance

ZEC is trading at $339 and is hovering around the $344 support level after its steep decline from intra-day highs. The sharp sell-off and weakening market structure suggest that further downside is possible in the near term.

If bearish momentum continues, ZEC could fall toward the critical $300 support. Losing this level would likely trigger the $17.49 million liquidation cluster. This could potentially push the price down to $260 as forced selling intensifies.

However, if momentum shifts and buyers return, ZEC could stabilize at $344 and attempt a recovery toward $403. A successful breakout above this level would invalidate the bearish thesis and restore confidence among long traders.