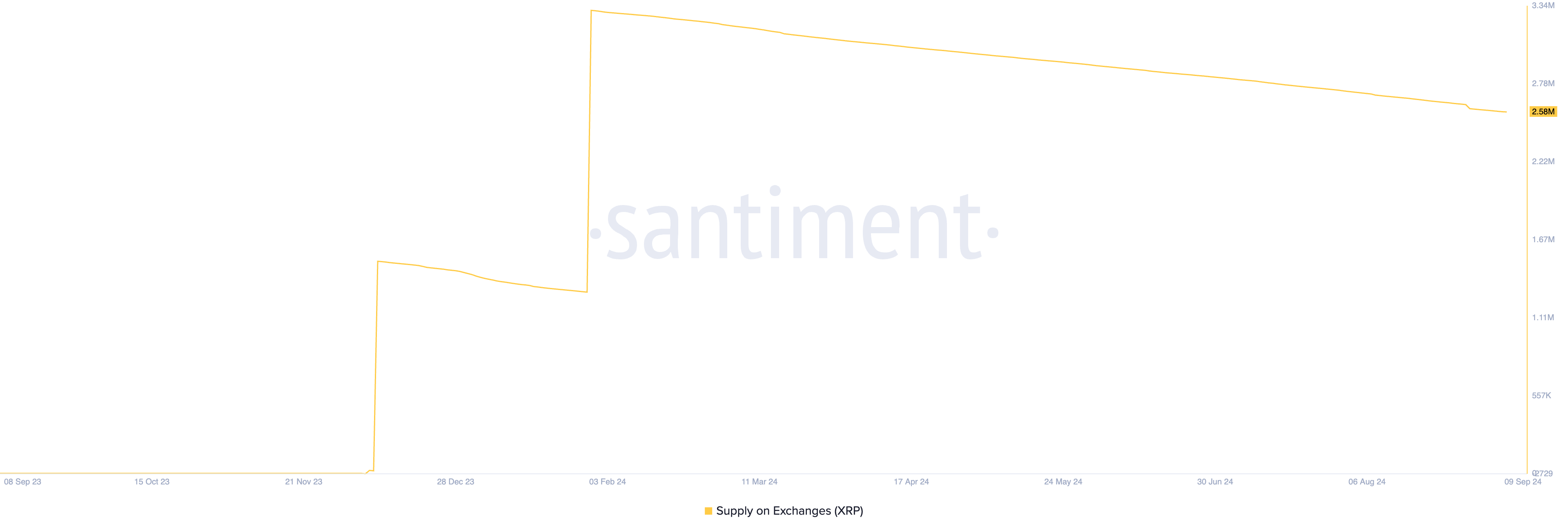

Since February, the amount of Ripple’s XRP held on cryptocurrency exchanges has been steadily declining, typically a sign of reduced selling pressure, which can often lead to price increases.

However, despite this trend, XRP’s price has continued to fall, defying the usual expectations of a price boost under such conditions.

Ripple’s Reaction Muted Despite Fall in Selling Pressure

As of this writing, 2.58 million XRP tokens, valued at $1.32 million at current market prices, are held on cryptocurrency exchanges. According to Santiment, this amount has decreased by 28% since February 1.

When the supply of an asset on exchanges decreases, it generally signals that fewer units are available for immediate sale, as investors choose to hold onto their tokens. This typically reduces selling pressure and can drive the price up.

Read more: 7 Best Crypto Contract Trading Platforms in 2024

However, for this to happen, there must be a corresponding surge in demand. In XRP’s case, this surge in demand has been lacking, despite the reduced exchange-held supply.

Since reaching a year-to-date high of $0.71 on March 11, XRP has moved downward, with its value dropping 24%, now trading at $0.53. This price decline has also affected the percentage of XRP’s total supply held in profit.

XRP Price. Source: Santiment

On March 11, 91.21% of XRP’s supply was in profit. However, as the token’s price fell, this percentage plunged to a 16-month low of 67.38% by July 4.

Fortunately, there has been a rebound, with the figure now recovering to 76.79%, per Santiment’s data.

XRP Price Prediction: Token Attempts to Retest Support

Ripple’s price movements on the one-day chart show that the altcoin has been trading within a horizontal channel since July 17. This pattern occurs when an asset’s price moves within a set range, with the upper line acting as resistance and the lower line as support.

XRP’s price fell below the channel’s lower support line on September 5 but has since begun to rally. This indicates a retest of the former support, which will only be successful if demand for XRP remains strong.

Read more: 10 Best Altcoin Exchanges In 2024

If the retest holds, XRP could resume its uptrend, with price targets of $0.56 and potentially $0.60. However, if the retest fails, the price could drop to $0.46, invalidating the bullish outlook.