Ripple’s XRP shows signs of weakening bullish support as its price continues to move sideways with the leading coin, Bitcoin.

Despite holding its range since last Thursday, two key on-chain metrics have declined over the past week. This drop suggests cooling investor interest, increasing the risk of a potential downside move.

New Wallets Vanish, Futures Volume Drops

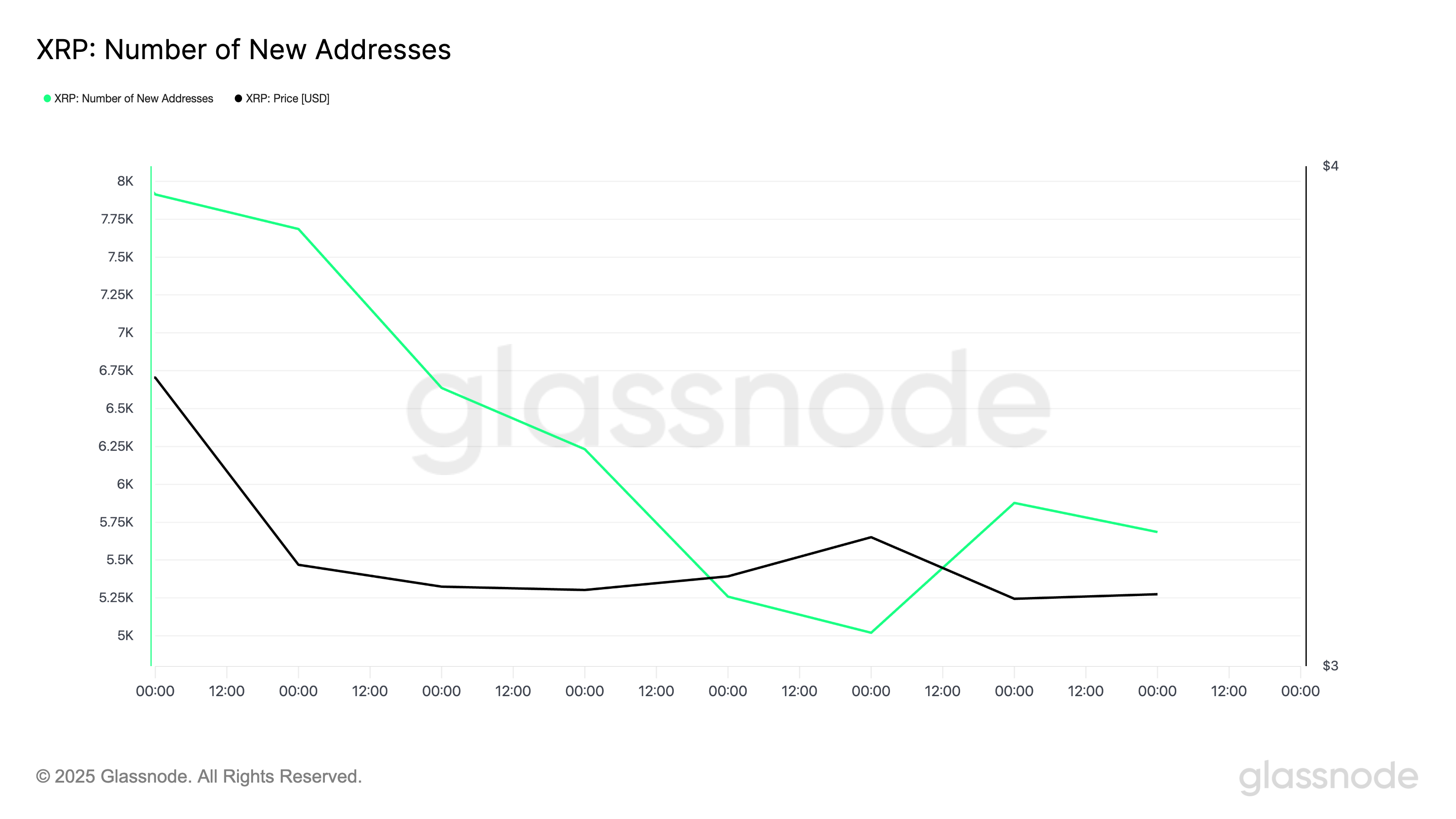

According to Glassnode, new XRP demand has plummeted over the past seven days. Yesterday, only 5,685 new addresses completed at least one transaction involving the altcoin, a 28% dip from the 7,914 addresses recorded seven days ago.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A decline in new demand signals weakening interest from fresh capital and new market participants, both essential for sustaining upward momentum in any asset. In XRP’s case, this lack of new capital leaves the asset more vulnerable to bearish pressures, which could trigger a break below its narrow price range in the near term.

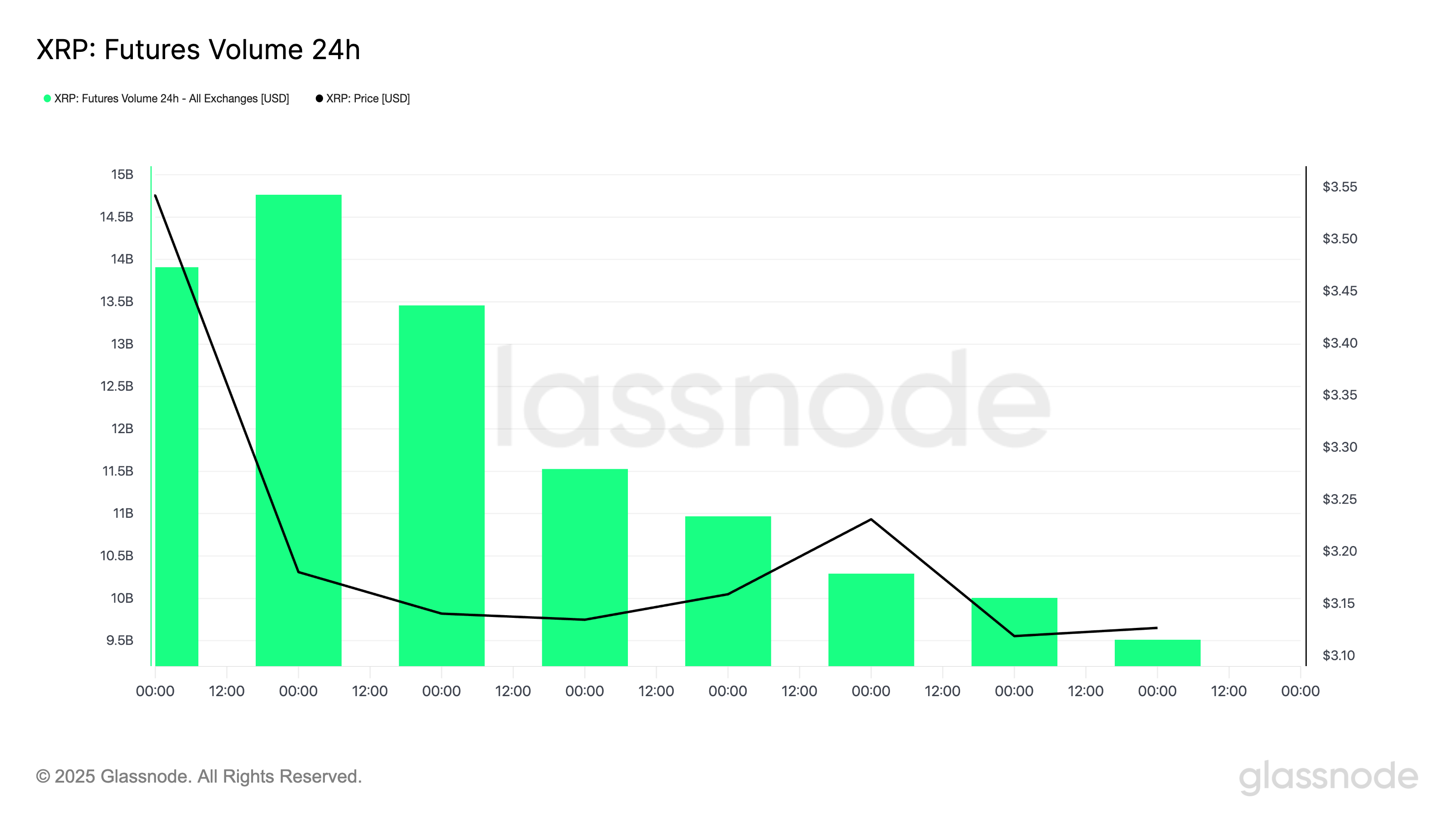

In addition, futures market activity has seen a notable decline, further signaling a loss of momentum. Per Glassnode, the total daily volume of XRP futures contracts—measured using a seven-day moving average—has plunged over 30% in the past week.

This suggests that leveraged traders, often key drivers of short-term volatility and price discovery, are stepping back. When futures volume drops while the spot price moves sideways, it points to market indecision and a lack of conviction in either direction.

Without speculative interest to push prices higher, XRP risks slipping out of its current range into a decline, especially if selling pressure increases.

XRP Futures Sentiment Turns Bearish

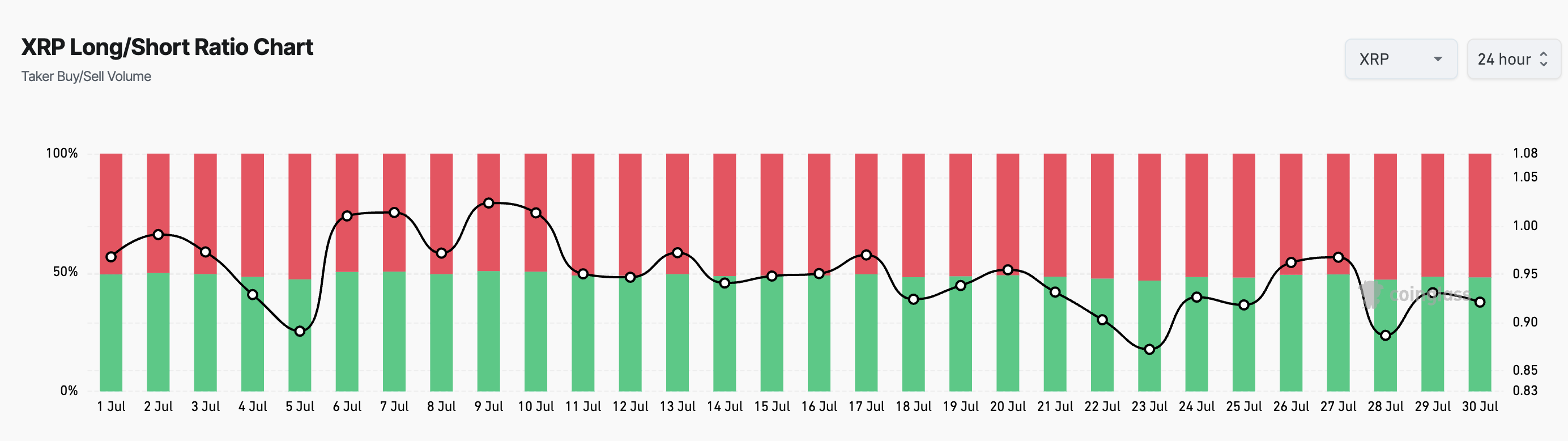

Unfortunately, the desire to push XRP higher is not the dominant sentiment across its futures market. This is reflected by its long/short ratio, which is currently at 0.92.

The long/short metric measures the proportion of long bets to short ones in an asset’s futures market. A ratio above one signals that there are more long positions than short ones. This indicates a bullish sentiment, as most traders expect the asset’s value to rise.

On the other hand, a long/short ratio below 1 means that more traders are betting on the asset’s price to decline than those expecting it to rise.

Therefore, XRP’s current long/short ratio suggests that most traders are increasingly positioning for a downside, confirming the bearish outlook in its spot markets.

XRP Struggles to Find Buyers—Will $3 Hold or Break?

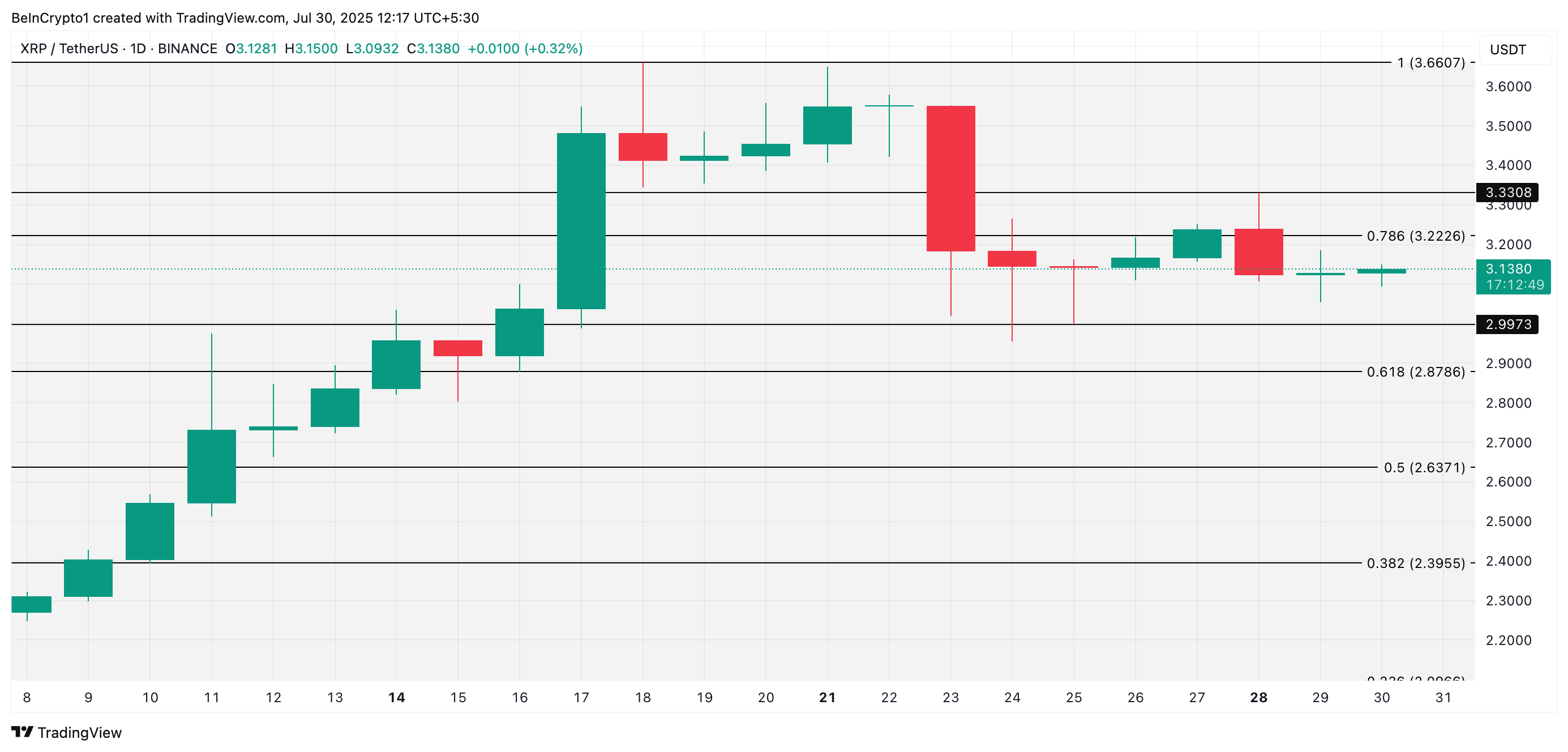

As of this writing, XRP is trading at $3.13, hovering below the $3.22 mark, which is increasingly acting as a strong resistance level. If sellofs intensify and the token breaks out of its sideways trend, its price could fall below $3 to reach $2.99.

Conversely, if new demand re-enters the market, it could trigger a rally past $3.22 and toward $3.33.