In a June 16 court filing, the US Securities and Exchange Commission (SEC) asked the US Court of Appeals for the Second Circuit to pause its appeal proceedings in the ongoing case against Ripple.

The request comes in light of a pending motion for an indicative ruling in the district court, further delaying the final resolution of the long-standing legal battle. While this means that the appeals have now been moved till August, XRP’s price has shown resilience, holding steady over the past 24 hours.

Ripple-SEC Appeal on Hold

According to a June 16 filing, the SEC has requested that the appeals court pause ongoing proceedings, citing a pending motion for an indicative ruling in the district court. This request effectively halts the appeals process until the lower court decides whether to alter its original judgment.

This development follows a joint filing on June 12 by Ripple and the SEC, in which both parties renewed their request for an indicative ruling to dissolve the injunction outlined in the Final Judgment.

The SEC outlined three key reasons for the appeal pause request. They include the proposed settlement between the parties, a noticeable shift in the SEC’s approach to crypto enforcement, and a mutual interest in avoiding protracted litigation.

The regulator is now scheduled to file another status report in the Second Circuit by August 15.

XRP Holds Strong Ahead of Key Ruling

Despite the delay, XRP’s price has not experienced any significant dips. It has held steady as bullish sentiment gradually returns to the broader market.

This resilience is also supported by growing demand for the altcoin as investors await Judge Torres’ anticipated ruling on Ripple’s request to lift the injunction and reduce the proposed penalty to $50 million. That decision could serve as a more immediate catalyst for price action.

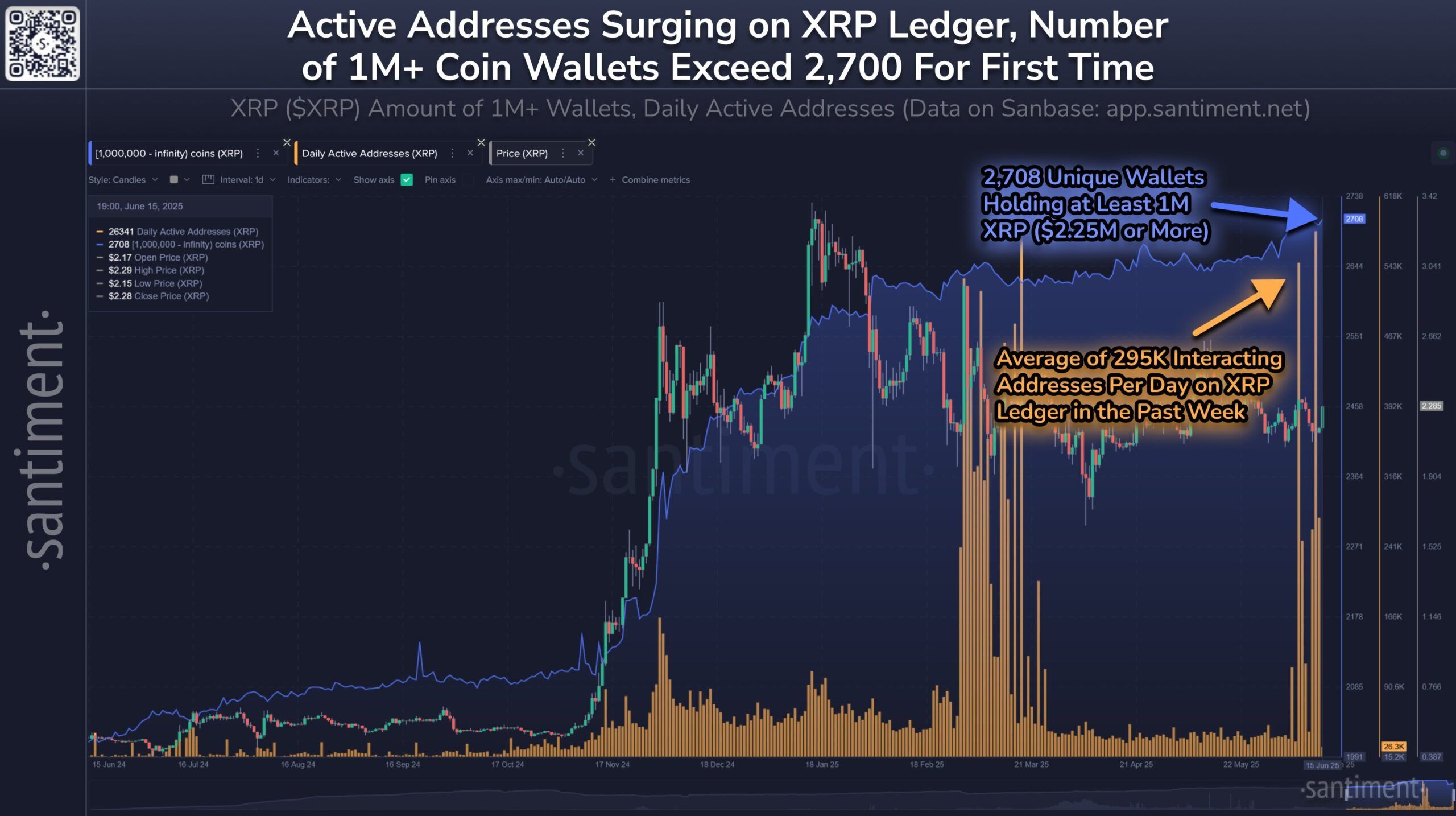

On-chain data has revealed a notable uptick in user activity on the XRP Ledger. According to on-chain analytics provider Santiment, the number of active XRP addresses has surged to an average of over 295,000 per day over the past week, starkly contrasting the 35,000–40,000 daily average seen over the last three months.

In addition, the number of whale and shark wallets (holding at least 1 million XRP) has climbed to over 2,700, marking the first time in XRP’s 12+ year history that this large-holder accumulation has been recorded.

This flurry of activity comes as the market prepares for a potentially favorable ruling from Judge Torres.

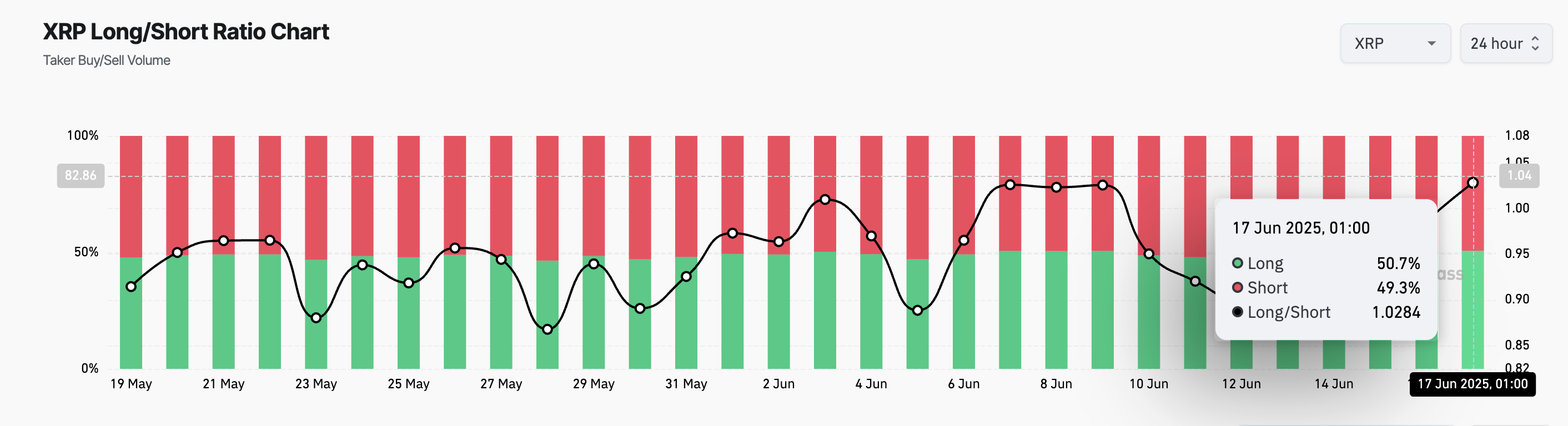

Moreover, XRP’s Long/Short Ratio supports this bullish outlook. The ratio is 1.02 at press time, indicating that more traders are betting on a sustained price rally.

The Long/Short Ratio compares the number of long and short positions in a market. When an asset’s long/short ratio is above one, there are more long than short positions, indicating that traders are predominantly betting on a price increase.

XRP Holds $2.22: Bullish Setup or Bearish Trap Ahead of Ruling?

XRP trades at $2.21 at press time, recording a 1% gain over the past day. With strengthening network activity and a bullish long/short ratio, a favorable ruling could fuel a renewed price rally.

In that case, XRP could climb toward $2.29. With a successful breach of this resistance, it could potentially hit $2.45. However, if the ruling is unfavorable for Ripple, the bears could regain dominance and drag the token down to $2.08.