XRP has been one of the standout performers in the crypto market over the past month. Its price has soared by 72% amid a broader altcoin rally fueled by Bitcoin’s march to new all-time highs.

However, two critical on-chain indicators now suggest that this uptrend may be losing steam, raising the risk of a near-term reversal.

XRP Traders Brace for Pullback as On-Chain Signals Flash Red

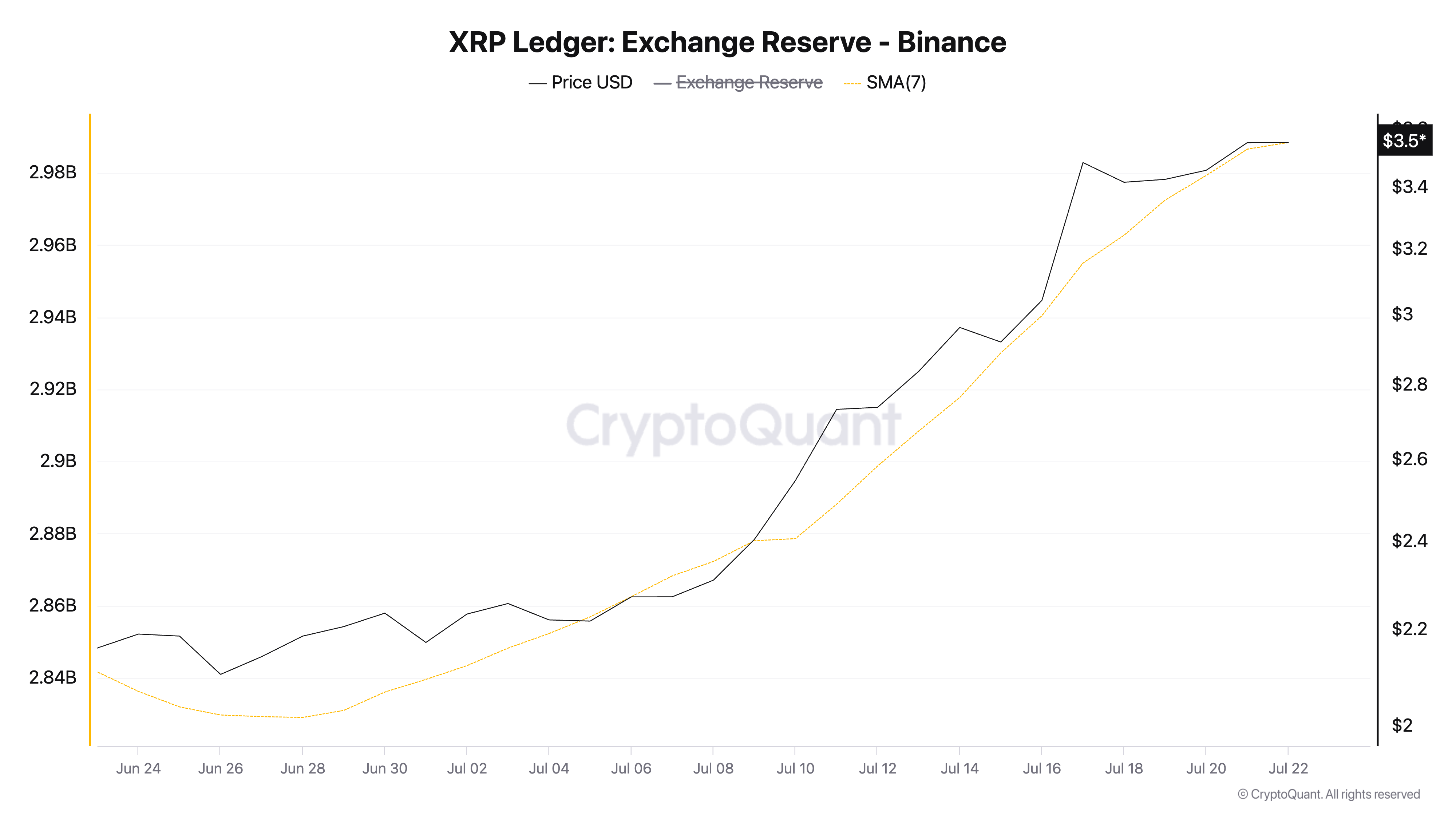

First, XRP’s exchange reserve on leading exchange Binance has spiked sharply, reaching its highest level of the year. According to CryptoQuant, XRP’s exchange reserve—measured using a seven-day moving average—closed at a year-to-date high of 2.98 million tokens on July 22, valued over $10 million at current market prices.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A spike in an asset’s exchange reserve indicates that more tokens are being moved onto centralized exchanges, often in preparation for selling. When investors transfer large amounts of a coin to exchanges, they may be positioning to take profits or exit positions.

In XRP’s case, the surge to a 2.98 million token reserve implies heightened selling intent. If this influx of supply is not met with equal or greater demand from buyers, downward pressure on XRP’s price could quickly build.

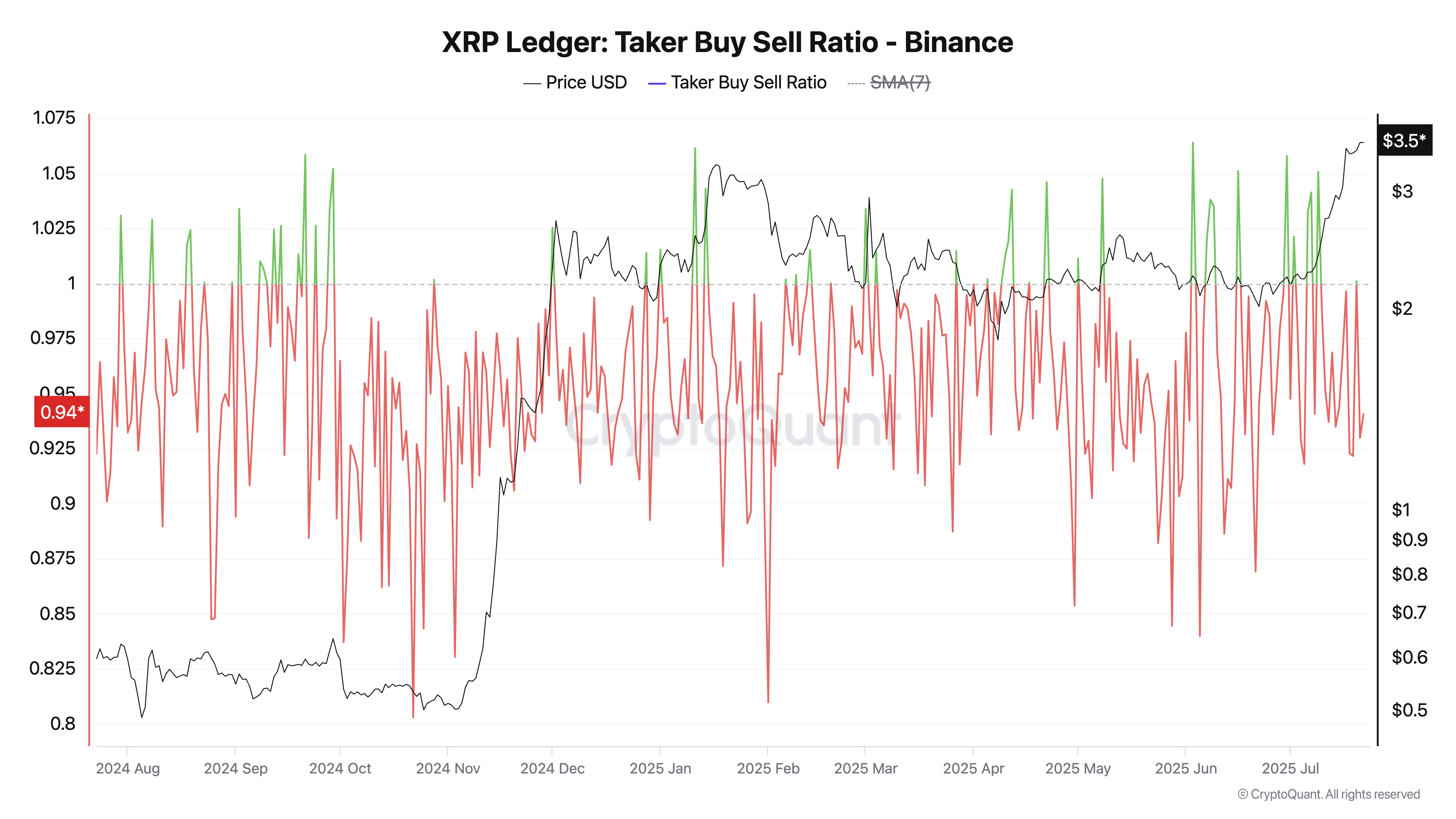

Furthermore, CryptoQuant’s data shows that XRP’s taker buy/sell ratio has consistently remained below one since July 10. As of this writing, the metric stands at 0.94

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

The fluctuation in XRP’s taker buy/sell ratio below one over the past two weeks points to a sell-off trend among futures traders as its price climbs. This mounting sell-side pressure confirms weakening sentiment and could trigger price declines over the next few sessions if it continues.

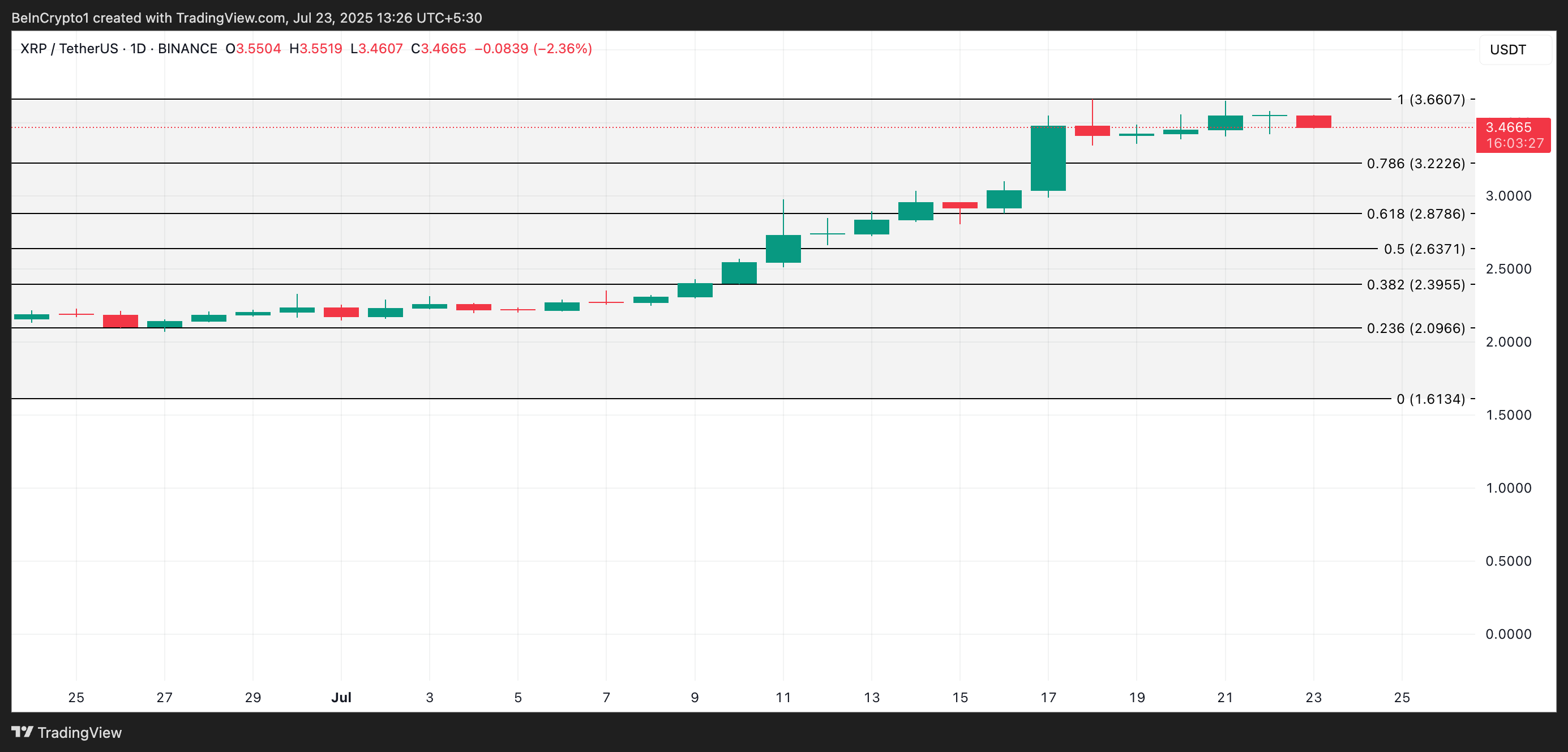

XRP Bulls Face Key Test at $3.22

At press time, XRP trades at $3.47, just below its all-time high of $3.66. However, mounting sell-side pressure increases the probability of a near-term correction toward the $3.22 support level.

Should this floor give way, XRP could extend its decline to around $2.87.

However, if selling pressure eases and fresh demand enters the market, the altcoin may reclaim its price peak and potentially chart new gains beyond $3.66.