XRP recently attempted to form a new all-time high but faced resistance due to market top pressure. The failure led to significant losses for investors as selling pressure increased.

Now, the cryptocurrency’s recovery hinges on Bitcoin’s trajectory, with its price movement influencing XRP’s future performance.

XRP Loses Key Supports

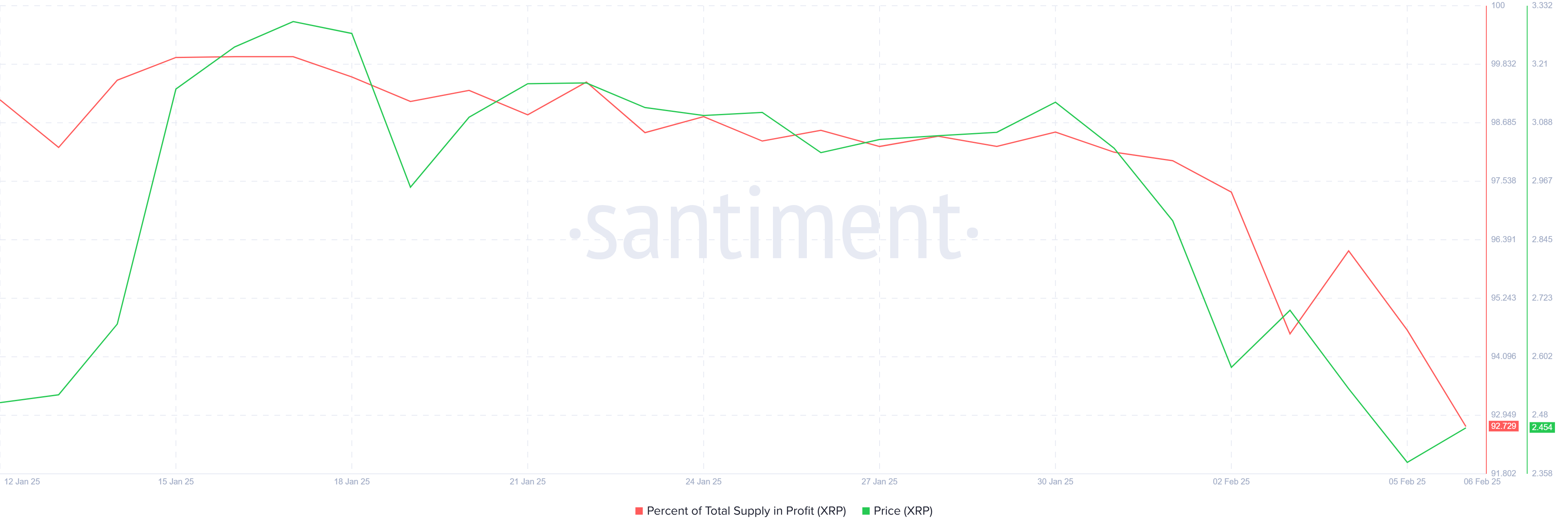

The percentage of XRP’s supply in profit surpassed 95% earlier this week, signaling a market top. This development triggered a wave of selling pressure, resulting in a sharp drawdown. As a consequence, 3% of the profit supply has already been wiped out, increasing concerns among investors.

Declining profits present a significant risk, as more holders may sell to lock in gains. If this trend continues, downward pressure could further drive prices lower. The asset’s ability to retain investor confidence will be crucial in determining its next move.

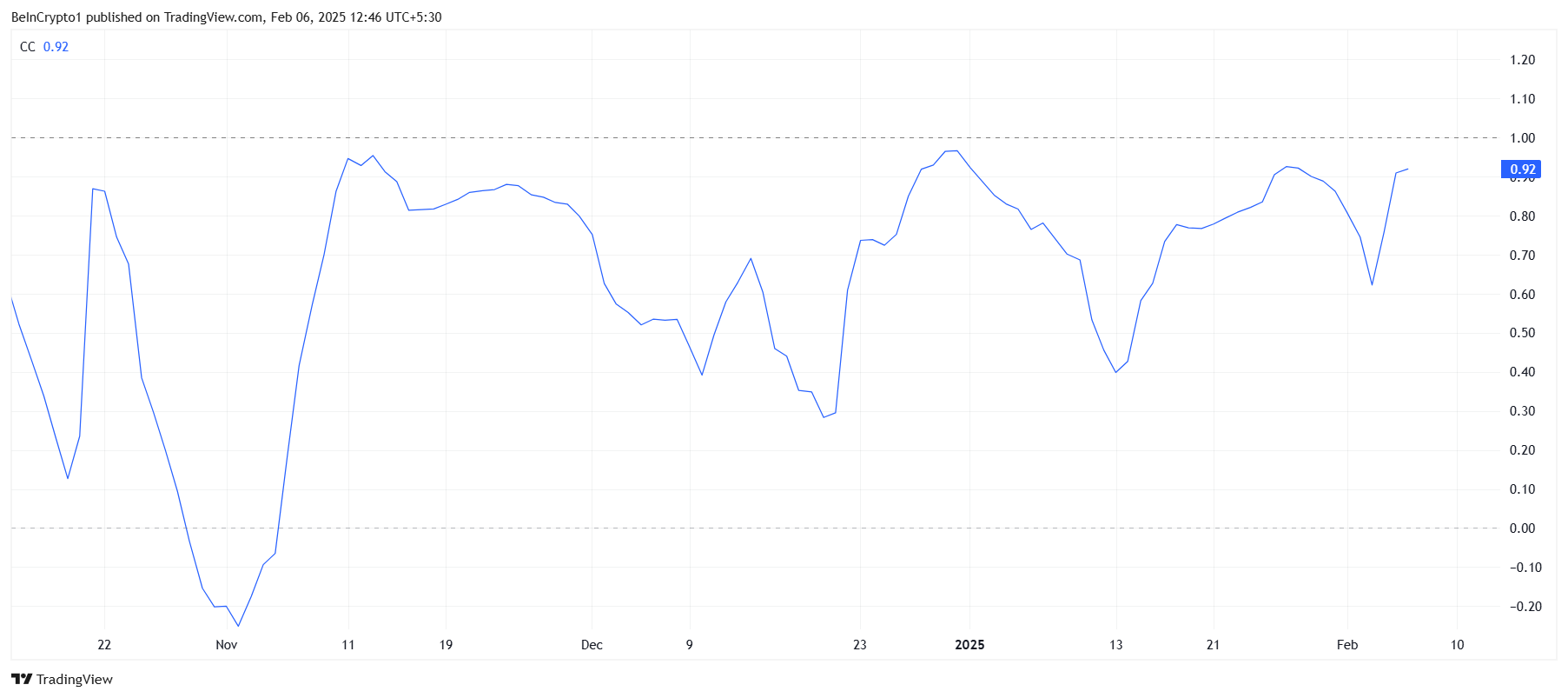

XRP’s macro momentum remains closely tied to Bitcoin, with its correlation now at 0.92. This strong relationship means XRP is likely to mirror Bitcoin’s price movements, which could be beneficial given Bitcoin’s bullish outlook.

Bitcoin appears poised to reclaim support at $100,000, which would likely uplift the broader market, including XRP. If Bitcoin’s price stabilizes and trends upward, XRP could find the support it needs to resume its own recovery.

XRP Price Prediction: Escaping The Bears

XRP is currently trading at $2.46, having dropped below critical support levels at $2.95 and $2.70. The price decline paused when the altcoin tested support at $2.33, preventing further losses for the time being.

The altcoin’s next challenge lies in reclaiming lost ground. However, breaking past $2.70 may prove difficult, as resistance at this level remains strong. Consolidation under this price point is a possible scenario unless stronger bullish momentum emerges.

If XRP follows Bitcoin’s lead, a significant recovery could be on the horizon. Reclaiming $2.70 would be a key turning point, potentially opening the path for further gains. A move beyond $2.95 would invalidate the current bearish-neutral outlook, paving the way for a full recovery and further upside.