The US Securities and Exchange Commission (SEC) has officially appealed its case against Ripple Labs over XRP. This comes after speculation about whether the regulator missed its deadline to do so.

Since the filing, XRP has been on a downward trajectory, sliding 2% in the past 24 hours. As bearish sentiment builds around the altcoin, the decline could deepen. The key question now is: How much further will it fall, and for how long?

Ripple’s Legal Challenges

In its October 17 civil appeal pre-argument statement, the SEC is not challenging the ruling that XRP sales to retail investors through exchanges are not securities. Instead, it seeks clarification on whether the US District Court for the Southern District of New York erred in its proceedings involving Ripple CEO Brad Garlinghouse and co-founder Chris Larsen.

The agency has also requested that the issues be reviewed “de novo,” meaning the court will re-examine the case with a fresh look at how the law was applied.

“No surprises here — once again, it’s been made clear. The Court’s ruling that ‘XRP is not a security’ is NOT being appealed. That decision stands as the law of the land,” Ripple’s chief legal officer, Stuart Alderoty, said.

How XRP Has Reacted

XRP’s trading activity has plummeted since the appeal was filed. The altcoin currently trades at $0.54, noting a 2% decline over the past 24 hours.

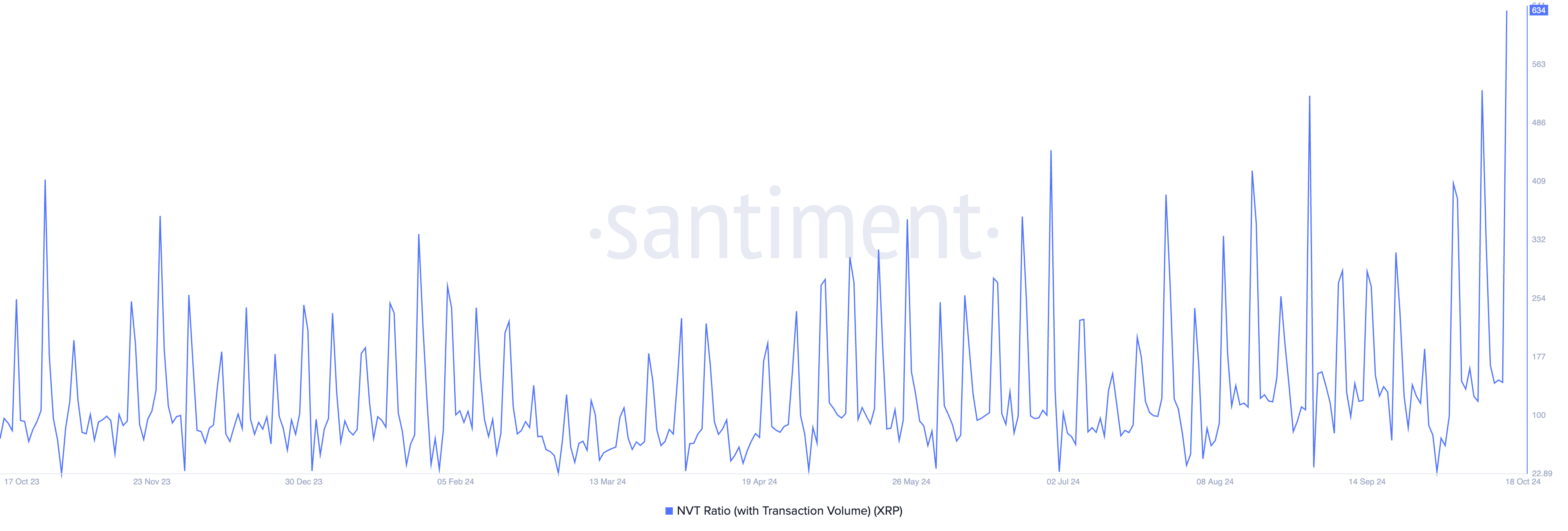

This price drop has been accompanied by an uptick in XRP’s Network Value to Transactions (NVT) ratio. The NVT ratio, which gauges whether an asset is overvalued or undervalued by comparing its market capitalization to transaction volume, has reached a yearly high of 634.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

A rising NVT ratio alongside a falling price is a bearish signal for two reasons. This implies that the asset is overvalued even as the price declines and the decrease in price reflects weak buying pressure. This combination presents a ‘double jeopardy’ scenario, increasing the likelihood of further price drops.

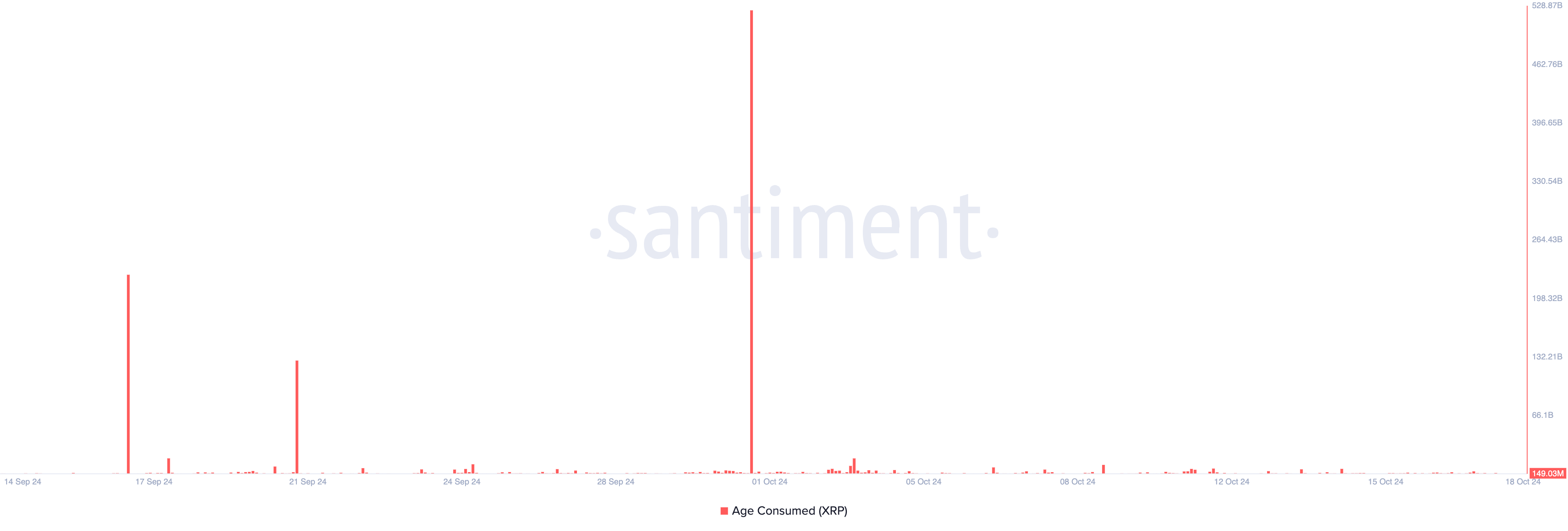

Interestingly, despite the SEC appeal and the surge in selling activity, XRP’s long-term holders (LTHs) have remained calm. This is reflected in the token’s age-consumed metric. According to Santiment’s data, this metric, which tracks the movement of long-held coins, has shown no significant spikes over the past 24 hours.

When an asset’s age consumed spikes, it signals that many previously inactive coins or tokens have been moved or traded. Conversely, when it remains relatively stable, it implies that most of the selling activity is concentrated on newer coins, and there is no significant selling pressure from long-term holders.

XRP Price Prediction: Short-Term Holders Should Be Feared

While XRP’s long-term holders (LTHs) remain steady, short-term traders (STHs) have begun selling, potentially driving near-term price fluctuations. XRP trades at $0.54 at press time, just above the support level at $0.52. If this selling pressure intensifies, XRP’s price could drop toward this support. If it fails to hold the support, the price may plunge to $0.38, a 30% decline from current levels.

Read more: XRP ETF Explained: What It Is and How It Works

However, if selling subsides and new demand emerges, XRP’s price could rally, breaking past resistance at $0.56 and potentially reaching $0.65.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.