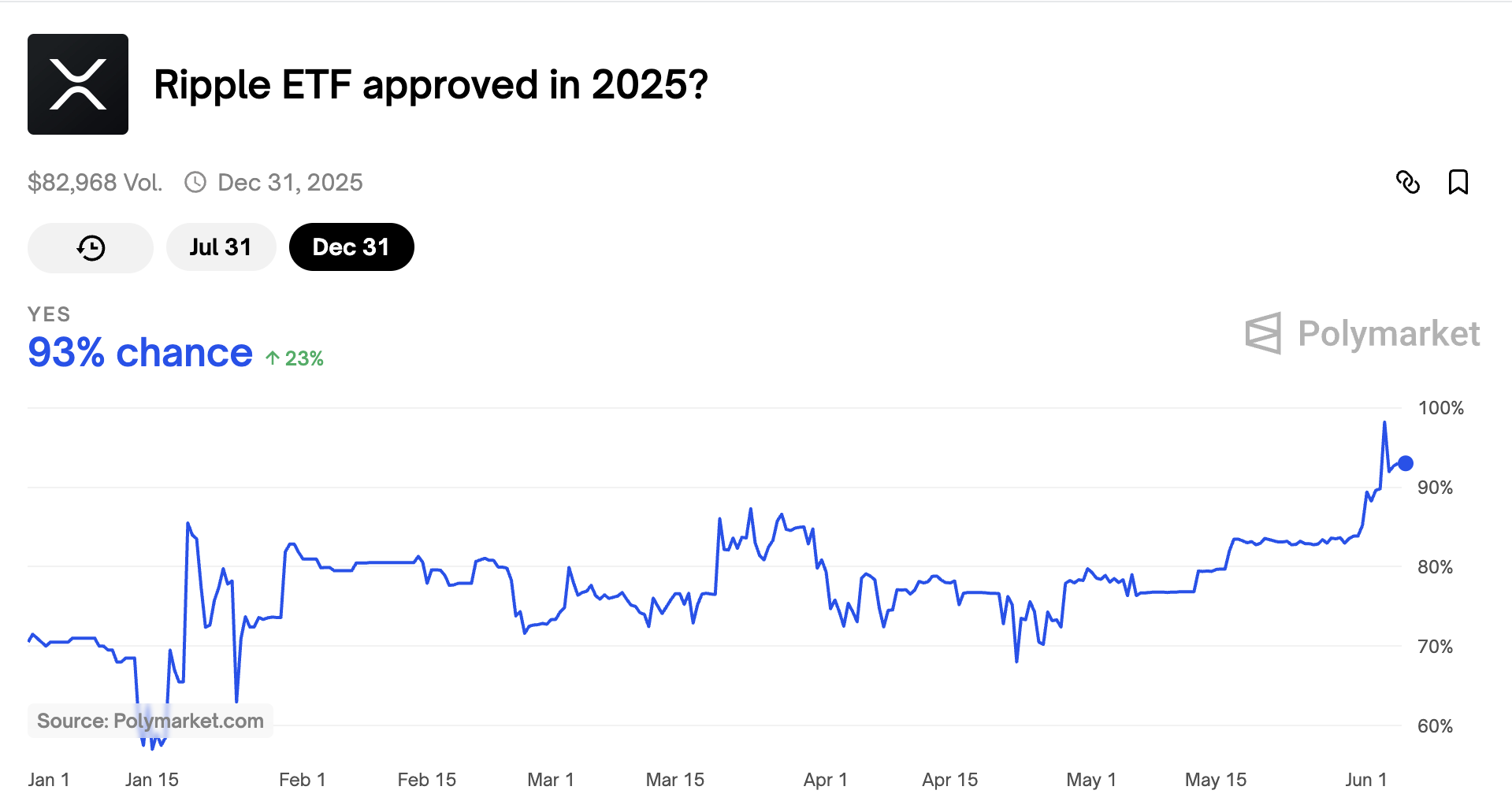

On June 3, the probability of an XRP (XRP) exchange-traded fund (ETF) gaining approval by 2025 skyrocketed to an all-time high of 98% on the prediction platform Polymarket.

This surge in optimism among investors comes despite recent delays by the US Securities and Exchange Commission (SEC) on spot XRP ETF decisions. This signals confidence in the altcoin’s future within traditional financial markets.

Why XRP ETF Approval by 2025 is Likely?

In April, BeInCrypto reported that the SEC had delayed its decision on Franklin Templeton’s spot XRP ETF application. The regulator set a review deadline for June 17. Furthermore, 21Shares’ XRP ETF application faced a similar delay in late May.

These setbacks have dampened short-term confidence in the market. Polymarket data revealed that the chances of an XRP ETF getting SEC greenlight by July 2025 have plummeted to a historic low of 19%.

Despite these challenges, long-term sentiment remains overwhelmingly positive. At the time of writing, the odds of XRP ETF approval by December 2025 were recorded at 93%, after hitting 98% yesterday.

This indicates that many still expect the products to launch in 2025, likely in the final quarter, coinciding with the SEC’s final decision deadline. Bloomberg’s ETF analyst James Seyffart previously predicted that a final decision could come around October 18.

“If we’re gonna see early approvals from the SEC on any of these assets — I wouldn’t expect to see them until late June or early July at absolute earliest. More likely to be in early 4Q,” Seyffart wrote in an X post.

Moreover, the launch of XRP futures on May 19 has further bolstered expectations. Experts believe this could increase the chances of the SEC approving a spot XRP ETF.

“A key reason for past ETF rejections by the US SEC has been the absence of a regulated and mature futures market. If the futures are regulated by the CFTC and exhibit strong price linkage with the spot market, this would increase market transparency and strengthen the case for ETF approval,” Bitunix analyst Dean Chen told BeInCrypto.

Meanwhile, it is worth noting that XRP currently leads all altcoins with the highest number of ETF filings. Major asset managers, including Bitwise, 21Shares, Canary Capital, Grayscale, Franklin Templeton, ProShares, WisdomTree, CoinShares, Volatility Shares, Hashdex, MEMX, and Teucrium, have submitted applications to the SEC. These firms, managing billions in assets, are betting on XRP’s growing appeal among institutional investors.

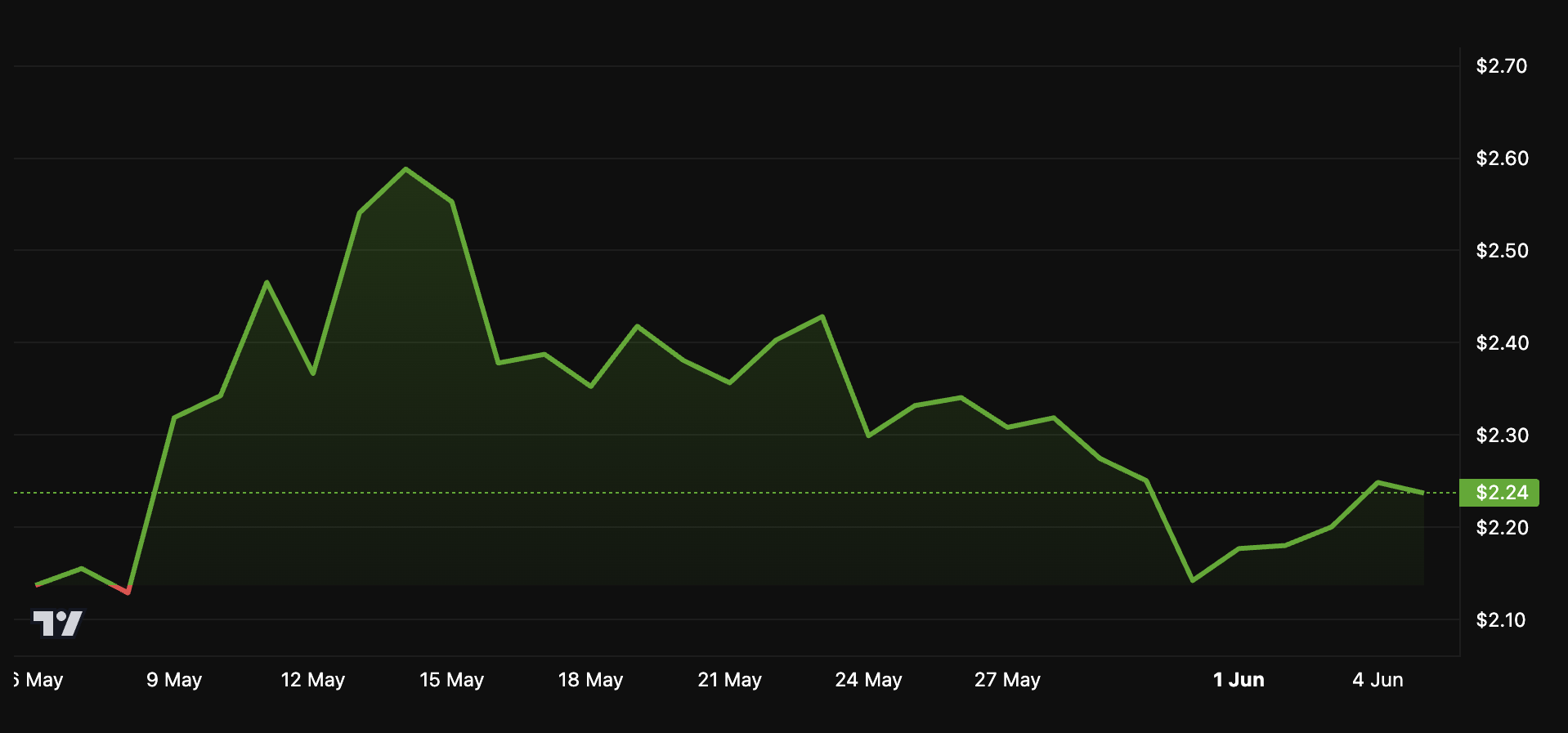

The growing confidence in ETF approval has also positively impacted the price. According to BeInCrypto data, between May 14 and May 31, the altcoin experienced a notable decline of 23.08%.

However, since the start of June, XRP has been in a steady recovery rally, regaining 10% of its previous losses. At press time, it was trading at $2.2, marking a 1.8% increase in the past 24 hours.