Cow Protocol’s COW token soared by over 30% after World Liberty Financial (WLFI), a DeFi project linked to Donald Trump, executed a $2.5 million USDC trade to acquire 759.36 ETH through the platform.

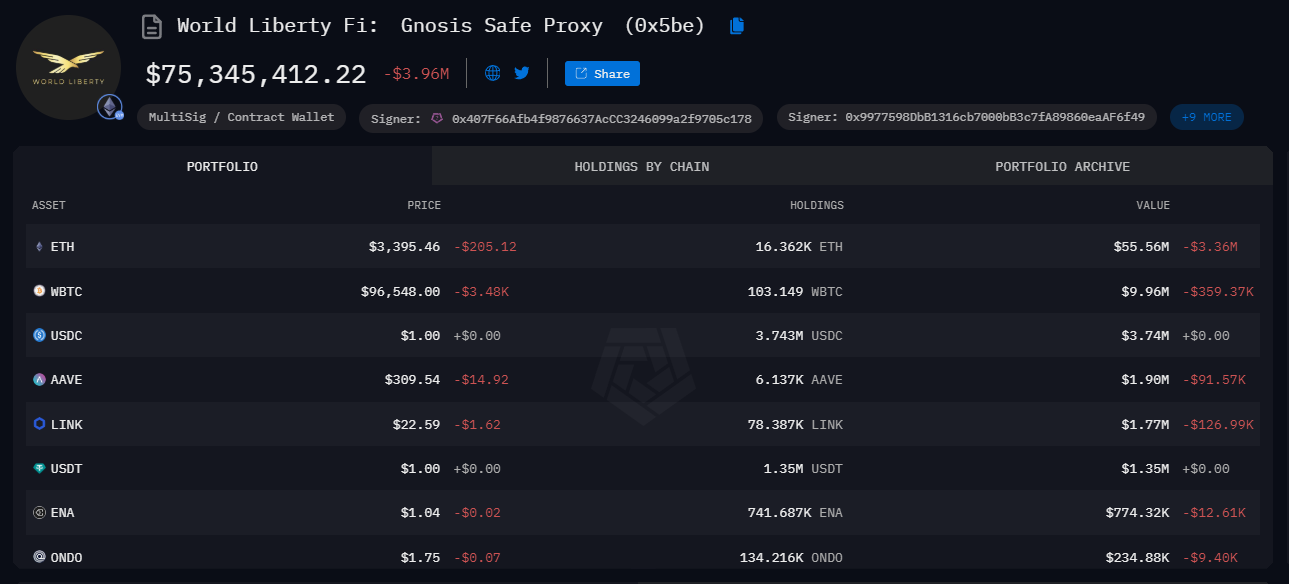

World Liberty Financial currently holds approximately 16,400 ETH, valued at $53.73 million.

Trump’s World Liberty Financial Continues to Impact Altcoins

According to Arkham data, the project has been actively purchasing various assets, including ETH, WBTC, AAVE, LINK, ENA, and ONDO. These tokens have faced losses in recent days, coinciding with broader market volatility caused by Federal Reserve rate cuts and inflation forecasts.

Meanwhile, WLFI’s consistent use of the CoW Protocol has drawn attention, driving speculative interest in the platform. The COW token rose nearly 35% today, edging closer to $1.

WLFI’s investment patterns have triggered market rallies throughout December. Earlier this month, the project spent over $45 million, including purchases of Ethereum, Ondo (ONDO), and Ethena (ENA), pushing COW to $1.02, its highest value in over a year.

Other transactions this month included acquiring AAVE and Chainlink’s LINK token, which caused LINK’s price to spike to $28, a three-year high.

Additionally, WLFI and Ethena Labs recently added sUSDe as collateral on WLFI’s Aave v3 instance, boosting its functionality.

Also, recently the project swapped $10.4 million of cbBTC for WBTC, following Coinbase’s delisting of cbBTC. Justin Sun, a key investor and advisor to WLFI, has publicly supported WBTC, citing its stronger governance and transparency compared to cbBTC.

Despite these developments, Trump’s World Liberty Financial has faced challenges since its launch. The project slashed its presale target from $300 million to $30 million, a 90% reduction.

WLFI tokens remain non-transferable and are limited to non-US and accredited US investors. These restrictions are contributing to the project’s early sales difficulties.