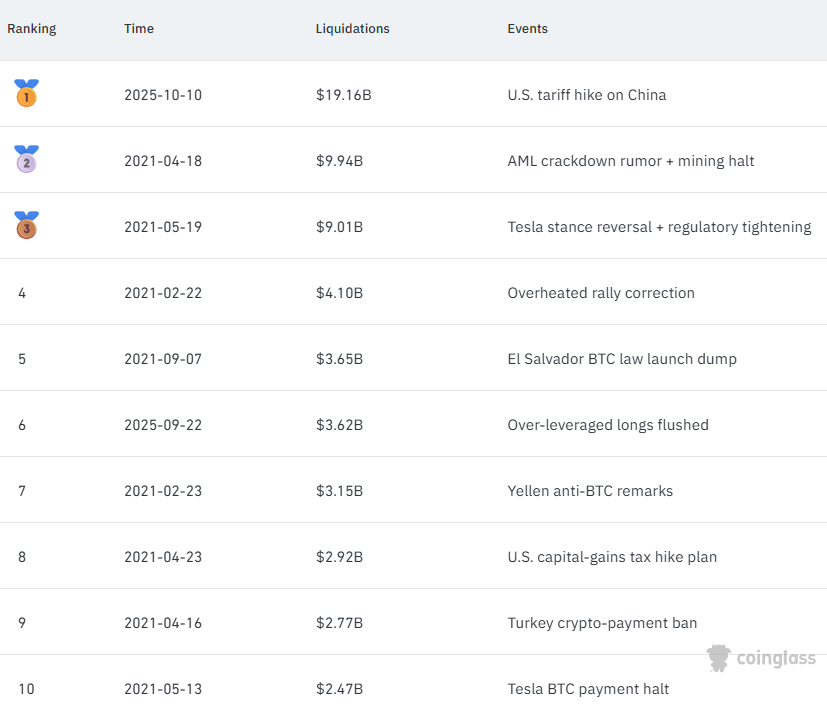

The October 10 crypto crash wiped out nearly $19 billion in leveraged positions within hours, shocking both traders and analysts.

In an exclusive BeInCrypto podcast, World Liberty Financial advisor and Glue.Net founder Ogle broke down what really caused one of the largest single-day collapses in recent crypto history.

A Perfect Storm: Multiple Factors Converged

According to Ogle, there was no single trigger behind the sell-off.

“You don’t die from heart disease because you only ate a lot of burgers,” he said. “It’s a thousand things that come together that cause catastrophes.”

He explained that the crash stemmed from a combination of liquidity shortages, over-leveraged traders, and automated sell-offs sparked by macroeconomic jitters.

“In those precipitous drops, the bids to purchase simply were not there. There’s just not enough people who are interested in buying even at lower prices,” Ogle noted.

He added that Donald Trump’s remarks on US–China relations amplified panic in algorithmic trading systems, triggering a wave of automated short positions that accelerated the decline.

Liquidity Gaps and Over-Leverage Made It Worse

The advisor, who has been in crypto since 2012 and helped recover more than $500 million from hacks, pointed to over-leverage on professional exchanges as the most damaging element.

Many traders used “cross margin,” a system that links all positions together — a design flaw that can wipe out entire portfolios when prices dip sharply.

“My personal belief is that over-leveraging in professional exchanges is probably the most important part of it,” Ogle said. “It’s a cascade — if one position collapses, everything else goes with it.”

The Centralized Exchange Dilemma

Ogle criticized the community’s continued reliance on centralized exchanges (CEXs) despite repeated failures.

He cited Celsius, FTX, and several smaller collapses as reminders that users still underestimate custody risks.

“I don’t know how many more convincing events we need,” he said. “It’s worth spending an hour to learn how to use a hardware wallet instead of risking everything.”

While CEXs remain convenient, the future lies in decentralized finance (DeFi) and self-custody solutions — an evolution even centralized players recognize.

“Coinbase has Base, Binance has BNB Chain — they’re building their own chains because they know decentralization will disrupt them,” he explained.

Gambling Mindset and the ‘Gold Rush’ Mentality

Beyond technical failures, there’s a deeper cultural issue plaguing the crypto space. Speculative greed. Ogle compared today’s meme coin frenzy and 100x trading to the 1800s California gold rush.

“Most people who went there didn’t make money. The people selling shovels did. It’s the same now — builders and service providers win, gamblers don’t,” said Ogle.

He warned that excessive speculation damages crypto’s image, turning a technological revolution into what outsiders see as “a casino.”

Isolated Margin Is Critical

When asked for practical advice, Ogle gave a clear takeaway:

“If they take nothing else from this podcast, and they want to do perpetual trading, you must use isolated margin.”

He explained that isolated margin limits losses to a specific position, unlike cross margin, which can liquidate an entire account.

“The very best suggestion I can give people is this — always trade isolated,” he emphasized.

Overall, the October 10 crypto crash was not caused by a single failure. It was the inevitable outcome of systemic over-leverage, low liquidity, and a speculative culture that treats risk as entertainment.

Until traders learn to manage risk and take self-custody seriously, crypto will keep repeating the same mistakes — just with larger numbers.