On-chain market analyst Willy Woo believes that bitcoin’s market movement will soon cease to correlate with that of traditional markets, as has been the case until now.

Writing on his Twitter account, Woo shared data from Glassnode showing a clear multiyear uptrend in bitcoin adoption.

In his view, this is part of a growing body of evidence that bitcoin now functions as a long-term store of value for a growing number of ‘HODLers.’ This, he says, will exert more influence over the bitcoin price than “hedge fund and whale traders,” which will effectively decouple bitcoin’s performance from the S&P 500.

If you want to see data behind the upcoming decoupling of BTC from the stock markets powered by BTC's internal adoption, here's some @glassnode data. This is the active users of BTC after filtering for unique players (ignores multi wallet addresses belong to one entity). https://t.co/FvGWUUlSc8 pic.twitter.com/gEweb9vYOY

— Willy Woo (@woonomic) September 26, 2020

Background of Woo’s Prediction

Woo’s prediction comes against a backdrop of a significant correlation between bitcoin and stocks. This has led to fears in some quarters that macroeconomic factors such as interest rates, unemployment and inflation could exert influence over the bitcoin price — and by extension the entire crypto market, which largely defers to bitcoin.

#Bitcoin, like Gild, is inversely correlated to the $USD – *not* the stock market.

Don’t be fooled by randomness https://t.co/UIbu7hiW5m

— Max Keiser (@maxkeiser) September 22, 2020

Not every analyst, however, agrees that there is in fact a correlation. Heisenberg Capital founder Max Keiser believes that in fact “bitcoin…is inversely correlated to the USD — not the stock market.” He adds, “Don’t be fooled by randomness.”

The charts below illustrate an apparent correlation between stocks and bitcoin over a five-year period

Woo’s Decoupling Prediction

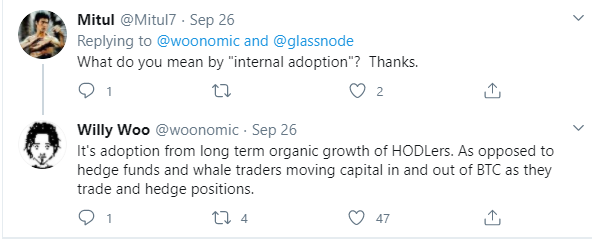

According to Woo, bitcoin is nearing a point in its life cycle where something he describes as “internal adoption” is exerting greater influence over market movements than investment from external sources. Explaining what “internal adoption” means, he wrote in a tweet:

“It’s adoption from long-term organic growth of HODLers. As opposed to hedge funds and whale traders moving capital in and out of BTC as they trade and hedge positions.”

Woo’s view is that traditional investors interact with bitcoin as a hedge, with the unintended consequence of creating correlation. This position on mainstream bitcoin investment is in line with that described by Fortune Brainstorm Finance Co-Chair Robert Hackett in June 2020.

According to Woo, however, bitcoin’s user adoption rubicon has already been crossed. This, he says, effectively reduces the importance of institutional investment as a fundamental driver of bitcoin’s price.