The total crypto market cap is closing in red over the last 24 hours, having lost $35 billion in value. Bitcoin (BTC) noted a slight drop as well, but it is holding above $70,000 while Official Trump (TRUMP) led the altcoins’ decline with a 5% drop.

In the news today:-

- The FBI arrested John Daghita, son of a US government contractor, for allegedly stealing over $46 million in cryptocurrency from the US Marshals Service. The arrest followed an investigation by crypto sleuth ZachXBT, who traced stolen funds back to Daghita’s wallet, linked to broader thefts.

- Coinbase CEO Brian Armstrong and other top executives face a derivative shareholder lawsuit over alleged misrepresentations related to custody practices, token listings, and AML compliance. The suit claims that misleading statements between April 2021 and June 2023 breached fiduciary duties, exposing Coinbase to legal and reputational risks.

The Crypto Market Holds Support

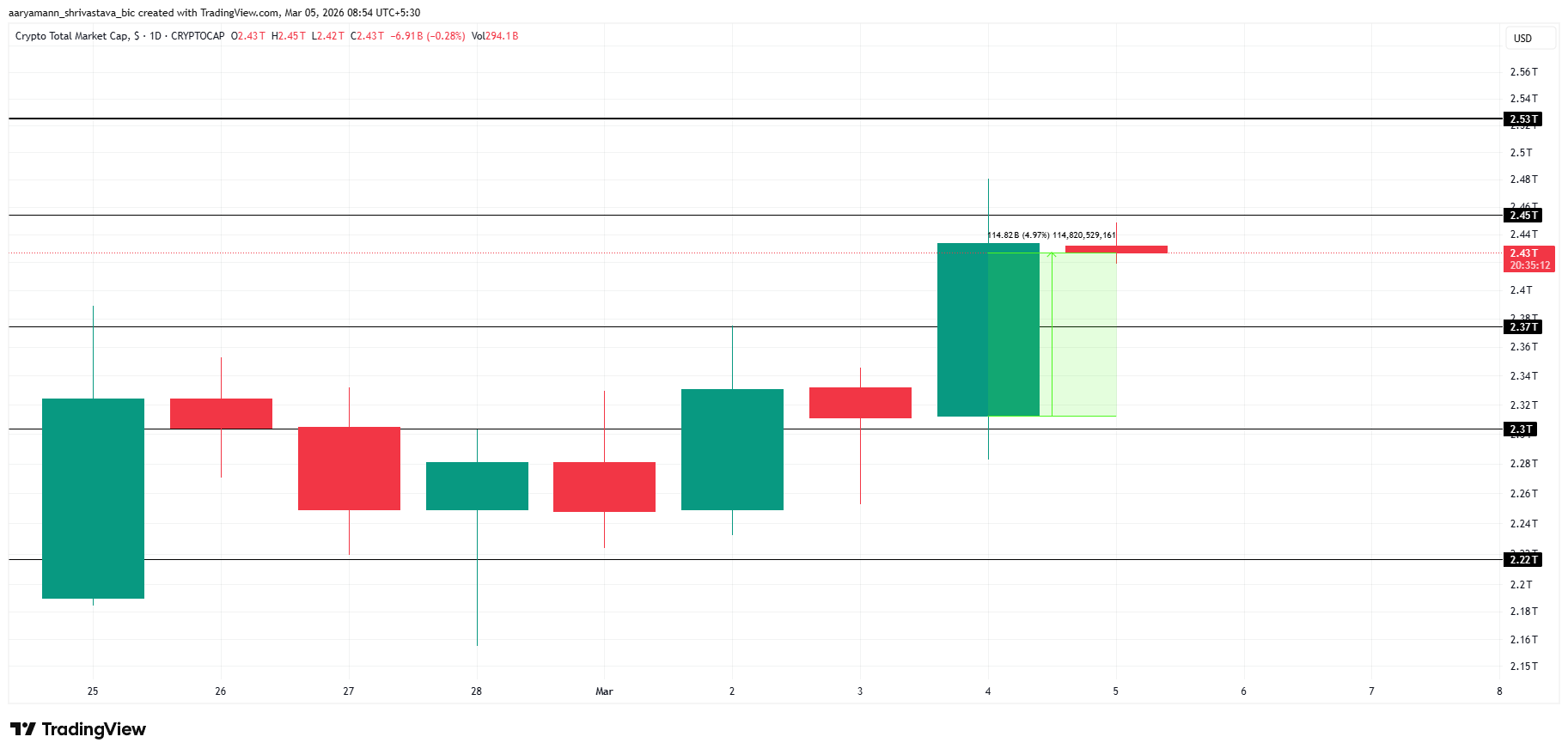

The total crypto market cap is currently down $35 billion, sitting at $2.39 trillion. Rising global tensions related to oil prices, particularly stemming from the Middle East crisis, are adding pressure to crypto tokens. These external factors are influencing investor sentiment and contributing to the market’s current decline.

TOTAL is holding above the $2.37 trillion support, but the market remains vulnerable to bearish forces. If the selling pressure intensifies, the total market cap could fall to $2.30 trillion, signaling further downside risk. Investor confidence remains shaky amid ongoing geopolitical concerns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, if market conditions improve, especially as we head into the weekend, there is potential for a recovery. If TOTAL pushes back up toward $2.45 trillion, it would invalidate the bearish outlook and signal renewed investor optimism, setting the stage for possible upward movement.

Bitcoin Is Positioned Above $70,000

Bitcoin’s price is currently $71,181, holding above the critical $70,000 support level. However, the crypto king has struggled to break the $72,294 resistance. This lack of movement has left Bitcoin stuck in a tight range, with investors closely monitoring any signs of a breakout or breakdown.

The market conditions haven’t deteriorated enough for investors to be concerned about an immediate crash. However, if Bitcoin loses the $70,000 support level, it could test $68,830 next. This decline would signal growing bearish pressure and could trigger a deeper pullback if the support fails to hold.

If Bitcoin finds support at $70,000, it could attempt another push towards $72,294. A successful breakout above this level would pave the way for a rise toward $75,000. This would invalidate the current bearish outlook and potentially set the stage for a more substantial rally.

Official Trump Takes a Hit

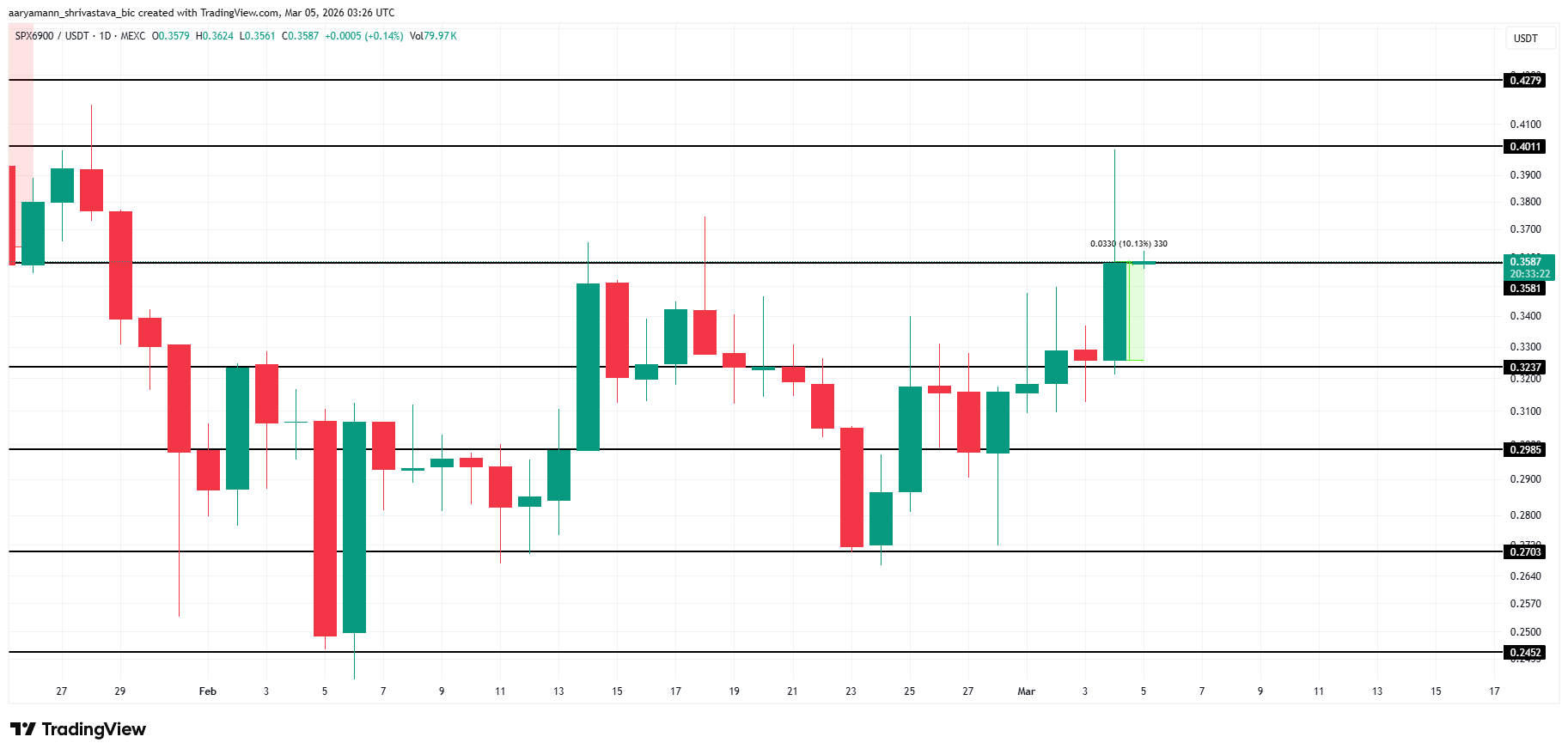

TRUMP has emerged as the biggest loser among altcoins, falling by 5% over the last 24 hours. While most altcoins have posted gains, TRUMP’s price has declined, although the market conditions for this drop were not extreme. The recent volatility highlights the unpredictable nature of the token.

TRUMP is experiencing the typical volatility seen with most crypto tokens. No specific news or event is directly influencing the price decline, and it is primarily being driven by broader market cues. Currently, TRUMP is sitting at $3.25, holding above the $3.18 support level, but the outlook remains uncertain.

If market conditions improve, TRUMP could see a bounce off the $3.18 support. A successful breach of $3.28 could open the door for a rise to $3.44, allowing TRUMP to recover a portion of its recent losses. This would invalidate the bearish outlook and signal potential for a rebound.