XRP has been on an impressive rally, forming a new all-time high (ATH) in July. While the price slightly declined from that peak, XRP remains within striking distance of its ATH of $3.66.

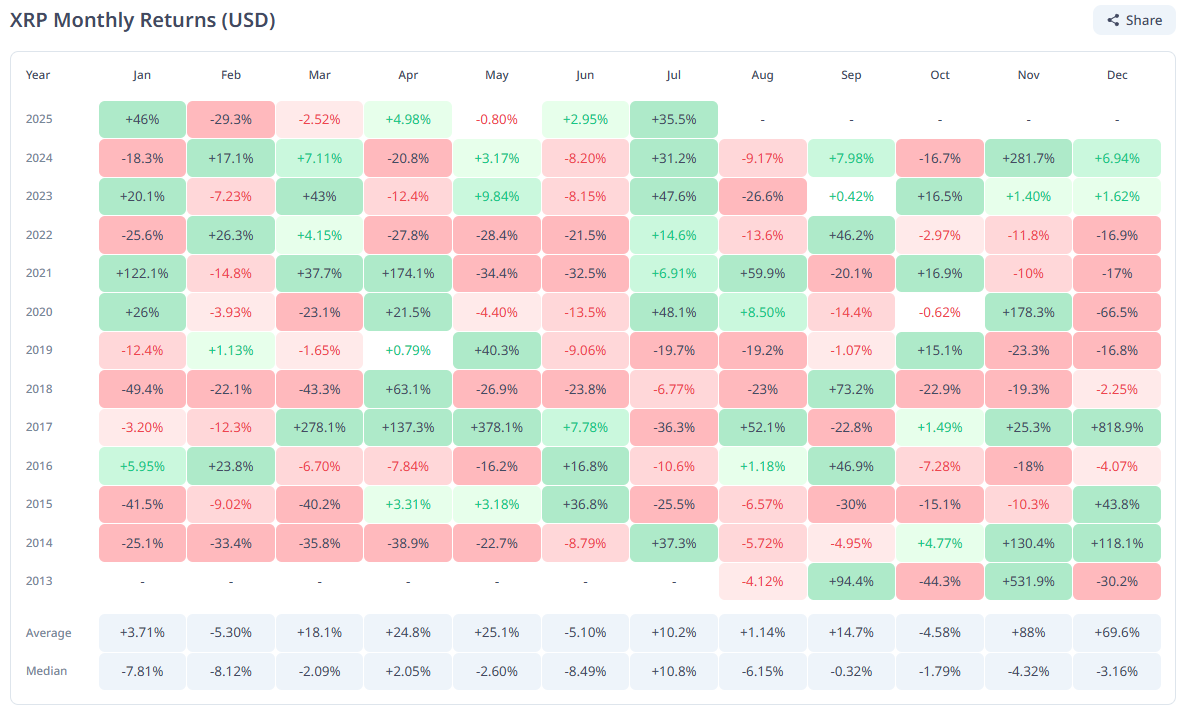

Historically, XRP has struggled in August, but this time may be different, with positive market signals on the horizon.

XRP Investors Have Been Proactive

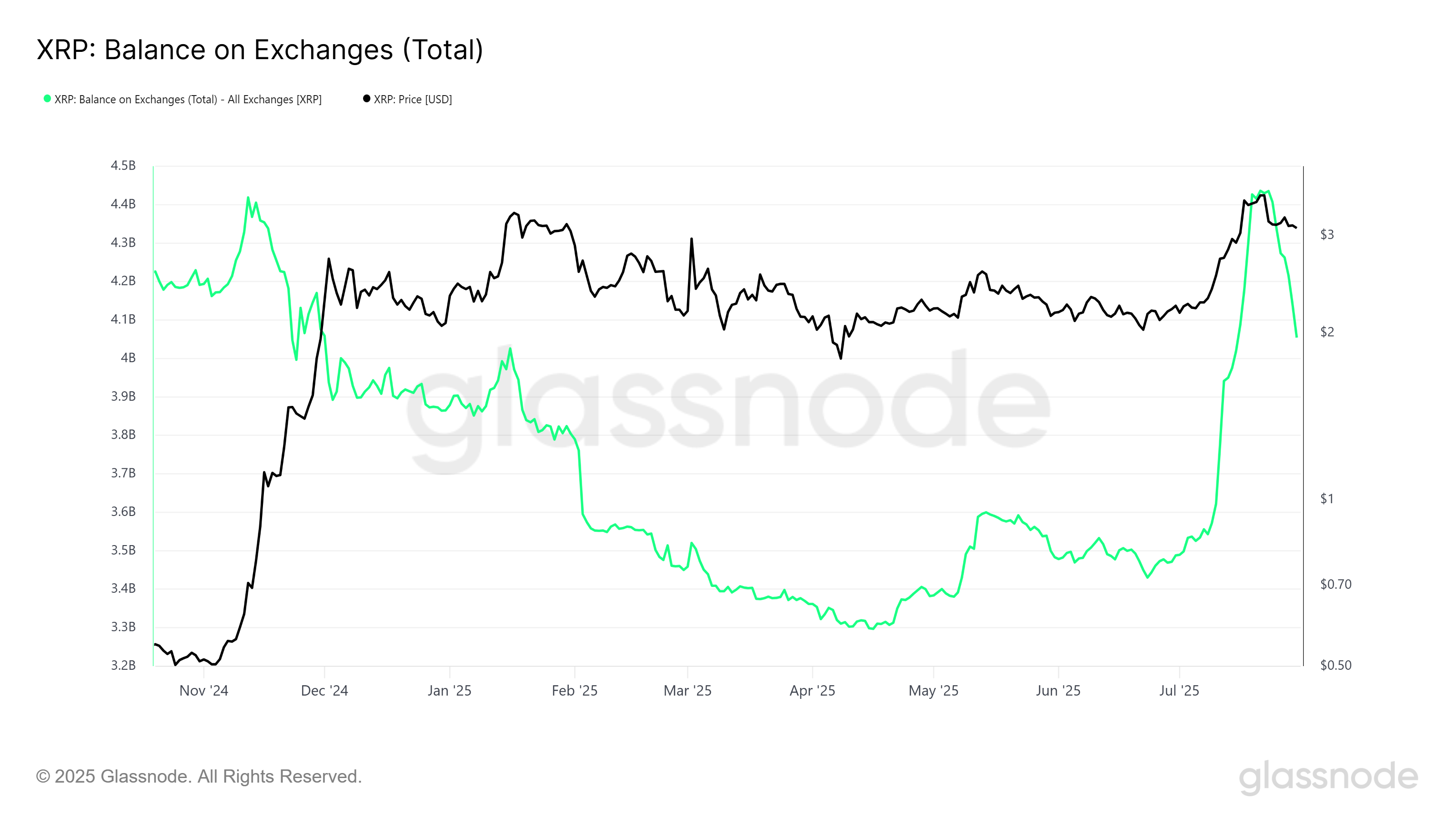

Recent market activity for XRP shows a dramatic shift in investor sentiment. Over the course of two and a half weeks, nearly 946 million XRP worth over $2.86 billion was sold to exchanges, signaling a significant amount of profit-taking and sending the supply to an eight-month high. However, Alexis Sirkia, Captain at Yellow Network, told BeInCrypto that this selling spree was short-lived.

“This sort of post-ATH selling is business as usual, specifically in a still confidence-establishing market. Importantly, this last ATH, most retail and institutional players used the breakout as a chance to de-risk. However, I believe the pressure is temporary. What is different this time is that XRP’s rally was not driven by speculation, it’s underpinned by real compliance, cross-border finance, and infrastructure developments,” Sirkia stated.

Just a week later, investors rebought more than 400 million XRP worth over $1.2 billion. This rapid reinvestment highlights strong confidence in XRP’s future performance, signaling that the market sentiment is shifting back towards optimism.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

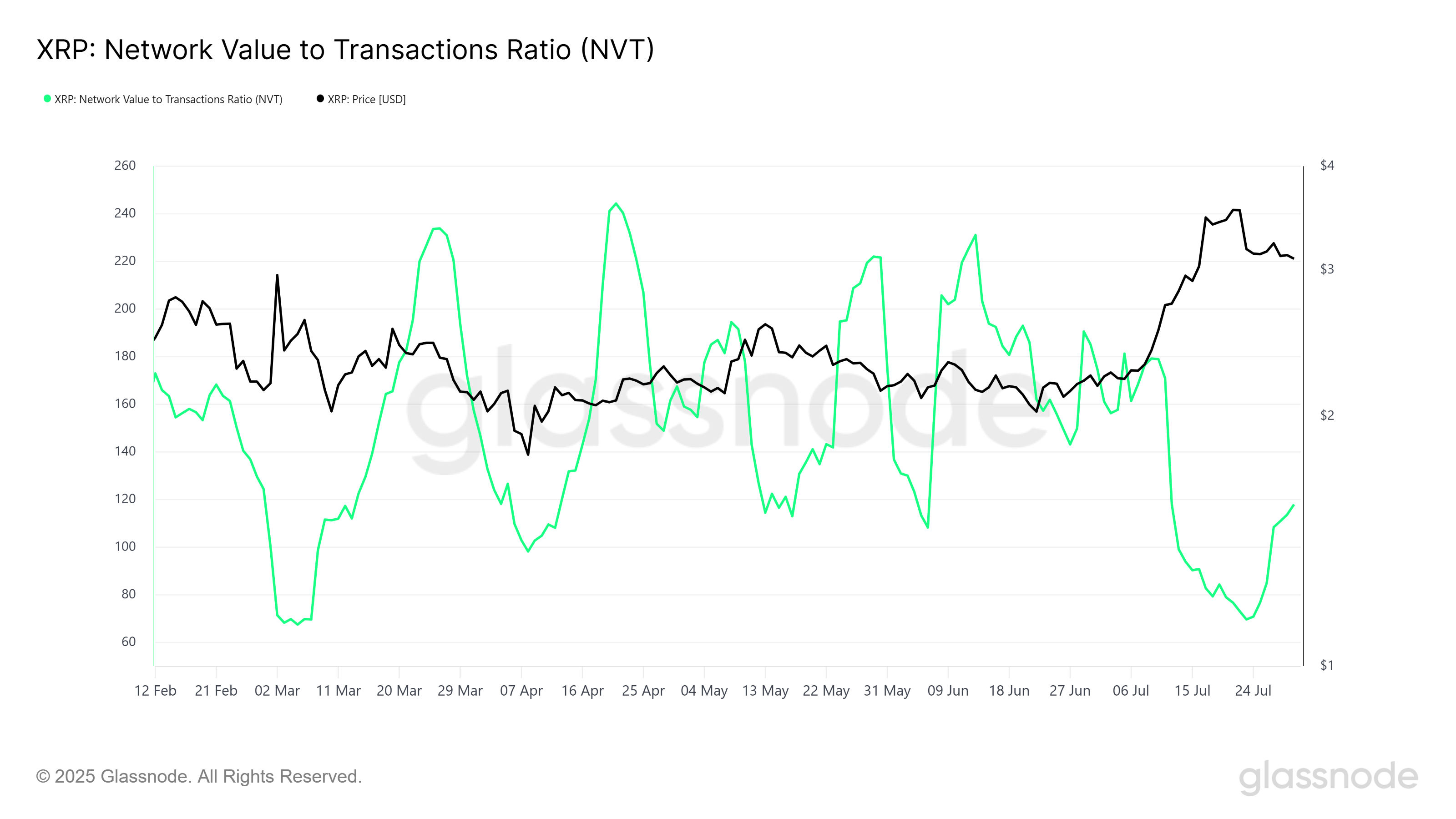

XRP’s macro momentum is also supported by positive technical indicators, especially the NVT (Network Value to Transaction) Ratio. This ratio is currently at a five-month low, signaling that the network value has not yet outpaced transactional activity. This is crucial for XRP, as it indicates that the cryptocurrency has not overheated.

Without the pressure of an inflated network value, XRP is better positioned to experience steady growth without the risk of significant corrections. This sets the stage for a potential recovery and rally, particularly given the healthy transactional activity on the XRP ledger.

Can XRP Price Bounce Back?

Currently, XRP is trading at $2.99, slipping through the key support level of $3.00. While the altcoin is still over 22% away from its ATH of $3.66, the foundation for potential growth remains strong. Historical data has shown that August typically brings bearish momentum for XRP, with median monthly returns of -6%.

However, given the strong buying activity observed recently and the positive technical indicators, this August might defy the usual trend. If XRP manages to secure support above $3.41, the altcoin could push towards its ATH once again. Sirkia also discussed with BeInCrypto how XRP’s future could be looking like.

“Institutions that have been in the market for a while are gaining momentum. We’re also, in the meanwhile, in a macro environment where funds are doing risk rotation…XRP is taking its stand with regulation and infrastructure, not hype. That’s what will endure in the long run. Short-term flows are fleeting, but the groundwork laid today will define the cycle to follow.”

However, there’s a downside risk. If XRP fails to reclaim the $3.00 support, the price could fall to $2.65, invalidating the bullish thesis. A drop to this level would mark a four-week low and would likely lead to further selling pressure.