Bitcoin’s price action has remained in a consolidation phase, which at first glance may seem bearish. However, this setup actually signals bullish potential.

The cryptocurrency has received strong backing from long-term holders (LTHs), a key cohort that typically influences major market moves. With this support, BTC appears primed for a rally.

Bitcoin Investor’s Resilience Is Key

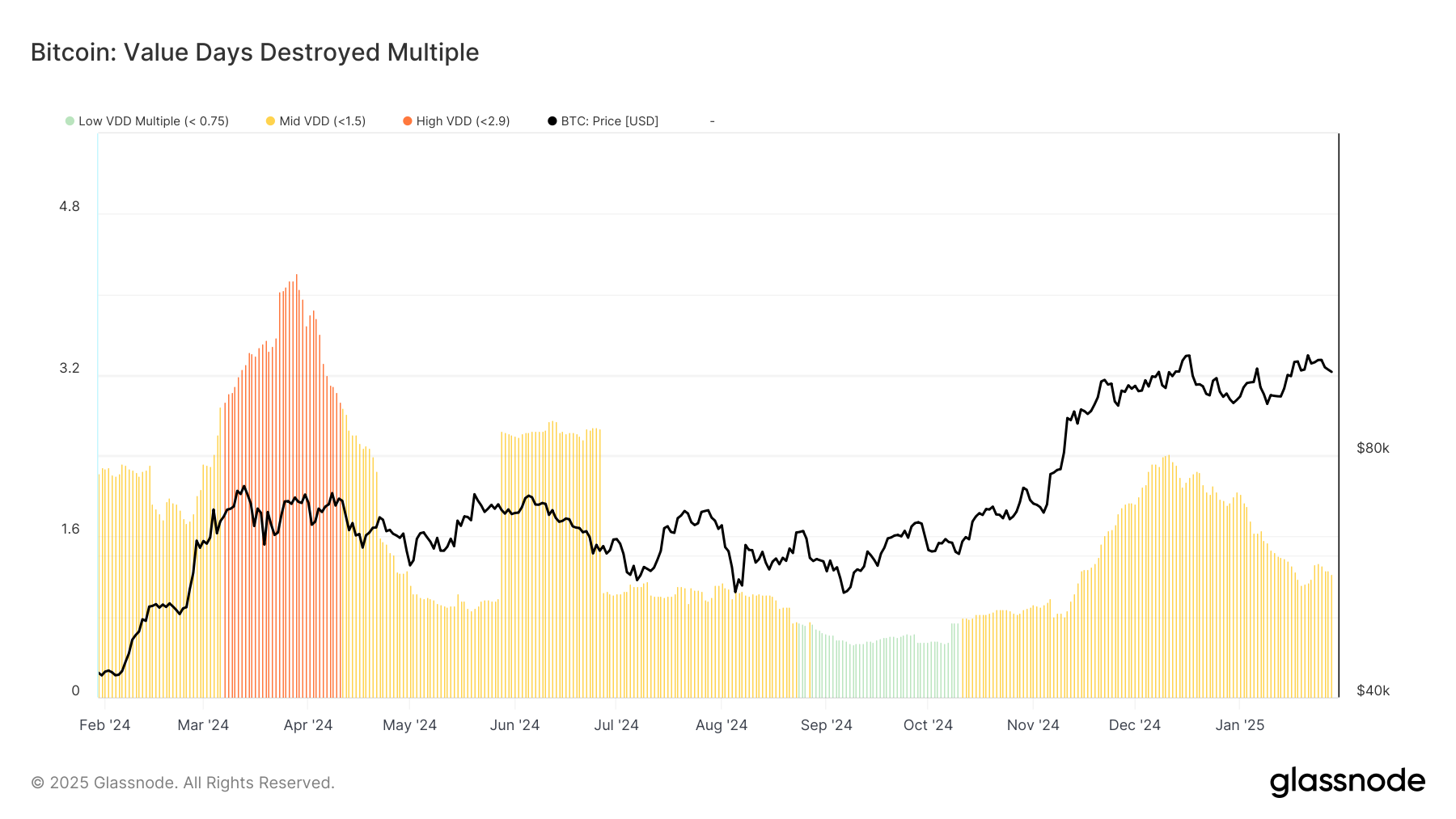

The Value Days Destroyed Multiple (VDDM) is a crucial indicator for tracking Bitcoin’s market trends. It compares short-term spending to yearly averages, with high values (above 1.4) indicating a heating market. Extreme values (over 2.9) have historically marked cycle peaks, signaling potential corrections.

Currently, VDDM sits at 1.22, suggesting a different market structure than previous cycles.

Unlike past bull runs, Bitcoin’s spent coin volume remains relatively controlled despite reaching new all-time highs (ATHs). This signals a more sustainable rally, reducing the risk of sudden sell-offs. With no extreme spikes in VDDM, Bitcoin has room for further growth, supporting the argument for a continued uptrend in the near future.

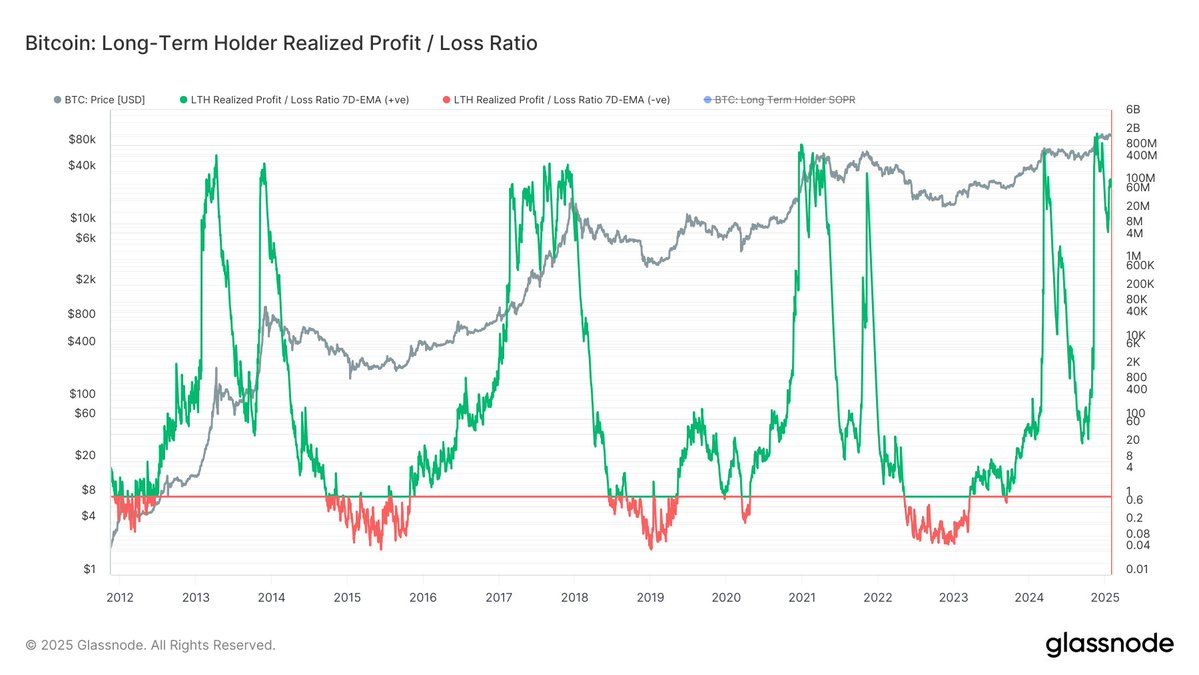

Bitcoin’s long-term holder profit and loss volumes provide another key insight into market momentum. The ratio between these two metrics remains significantly elevated, indicating that most LTHs are in profit. This pattern is characteristic of bull market phases, where minimal supply is held at a loss, reinforcing the ongoing accumulation trend.

As long-term holders continue to retain their BTC, selling pressure remains low. This behavior supports Bitcoin’s ability to maintain its bullish trajectory without major drawdowns. With limited LTH supply at a loss, the cryptocurrency is positioned for sustainable gains, increasing the likelihood of an extended upward move.

BTC Price Prediction: New High Ahead

Bitcoin’s price is currently setting up a Parabolic Curve pattern, a structure that historically precedes major rallies. Over the past year, BTC has established three bases, a key characteristic of this setup. The next phase of this formation suggests an impending breakout, which could drive the cryptocurrency significantly higher.

For confirmation, Bitcoin must close above $110,000, which would establish a new ATH. The Parabolic Curve pattern indicates a potential rally similar to previous base breaks, which theoretically could push BTC toward $185,661. However, a more practical and realistic target places BTC on track to reach $120,000 in the near term.

Currently, Bitcoin’s critical support level stands at $92,324, a price it has tested multiple times since mid-November 2024. Losing this support is unlikely unless selling pressure intensifies. However, if BTC breaks below this threshold, it could fall toward $85,000, invalidating the bullish outlook and delaying further gains.