Solana (SOL) is currently caught between two opposing forces: whale wallets transferring large amounts of tokens to exchanges, and growing optimism surrounding the soon-to-launch SOL ETF.

The key question arises amid short-term sell pressure and improving macro sentiment: Can SOL hold the $190–200 support zone to ignite a new bullish wave?

Whale Sell-off or Portfolio Rebalancing?

Recent on-chain data shows notable movements in Solana holdings. Forward Industries reportedly transferred around $192 million worth of SOL to Coinbase, while Galaxy Digital moved 250,000 SOL (≈$50 million) to Binance. Such large deposits are often interpreted as potential selling signals from institutional or whale investors.

SponsoredHowever, optimism is building around the upcoming SOL ETF, which could counter selling pressure. 21Shares has filed a Form 8-A(12B) with the US SEC, the final step before the ETF can officially go live. If approved, this could channel new institutional inflows into Solana, helping absorb some of the market’s supply from whales.

Support Test, Price Gaps, and The Next Move for SOL

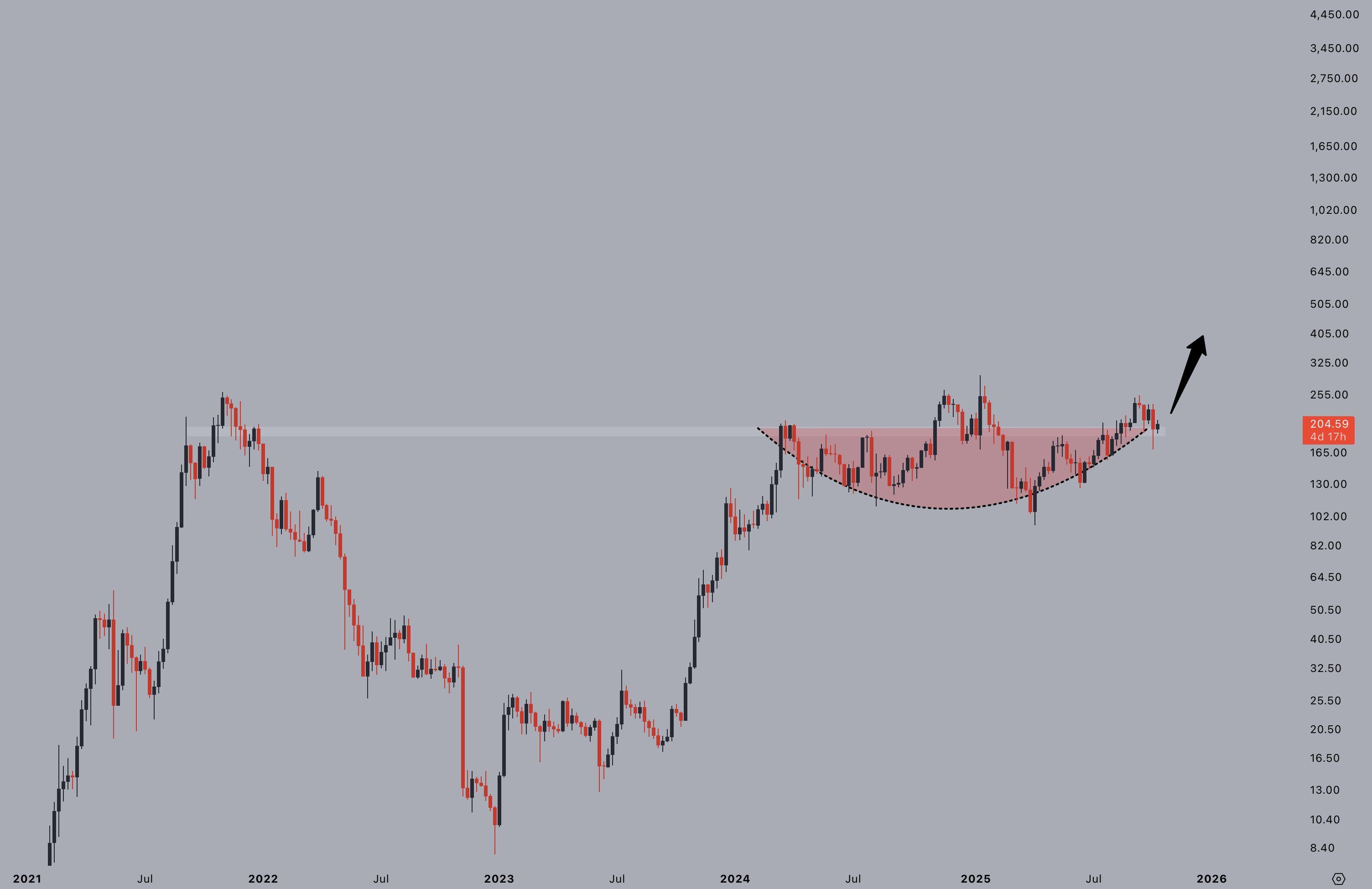

From a technical standpoint, SOL has broken out of an 18-month reaccumulation range, roughly $100–200 since mid-2023. It successfully retested $190 and now trades above $200. This lays the groundwork for a potential move toward higher resistance levels. Analyst Ali sees $260 as the next key target.

Applying Elliott Wave theory, another analyst interprets the recent pullback as a corrective wave 2, suggesting that wave three could soon follow with strong upside potential. The $190–200 range is an ideal entry zone for long-term accumulation. If SOL breaks above $287, it could confirm a breakout to $550 and above, extending Solana’s uptrend.

As noted by BeInCrypto, if SOL consolidates above $190 and builds strength within the $172–197 area, it could mark a promising accumulation phase. Still, traders must monitor the $215–224 zone, which is now acting as critical short-term resistance.

Another analyst’s contrasting view highlights something about ETH and SOL. While ETH has already filled its fair value gaps, signaling potential sideways movement, SOL still has an unfilled gap around $204–210. This positions SOL as a stronger short-term candidate.

“SOL, on the other hand, hasn’t filled the gap yet, making it likely a better bet than ETH for short-term trades,” the analyst commented.

In summary, the bullish scenario for SOL hinges on its ability to hold $190–200, fill the $204–210 gap, and break above $260, especially if ETF-driven institutional demand materializes. Conversely, if whales continue offloading positions, SOL could revisit the $100–150 accumulation range before mounting its next significant rally.