Lookonchain reports that whales are scooping Aethir (ATH) tokens, suggesting it is the new gold rush amid soaring demand for GPUs.

Decentralized Physical Infrastructure Networks (DePin) continue to be a growing narrative, transforming the tech sector. They enable decentralized projects in real-world infrastructure.

Whales Flock to DePin Token ATH

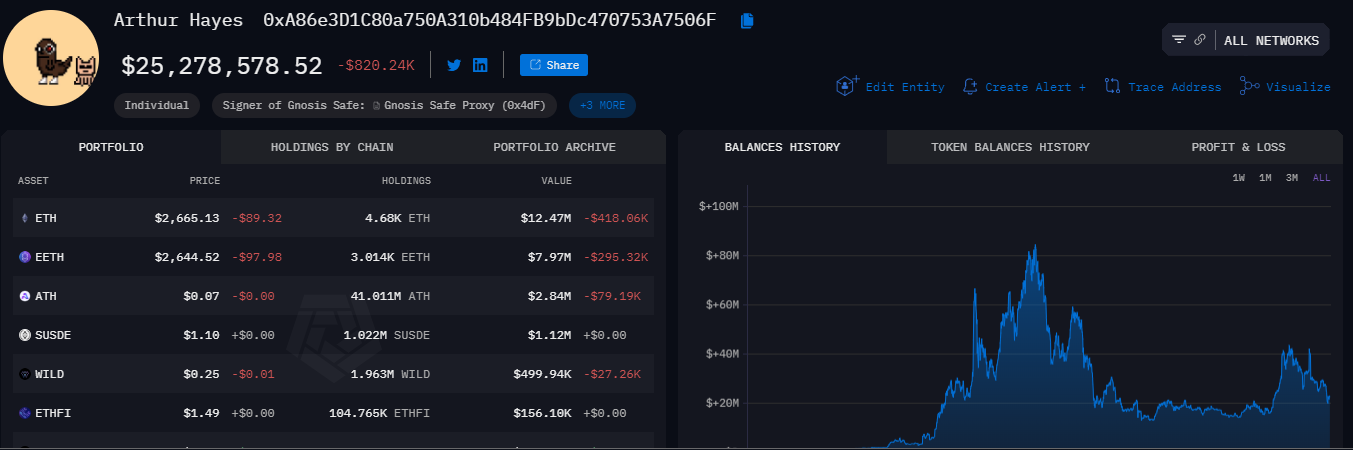

On Thursday, Arthur Hayes reportedly purchased 11.4 million ATH tokens worth approximately $800,000 from OKX, according to Lookonchain. The BitMEX founder also received 29.611 million ATH tokens from multiple exchanges, including KuCoin, Bybit, and HTX, as highlighted by Arkham.

Meanwhile, WuBlockchain indicates that Hayes holds 41.011 million ATH, worth about $2.84 million, with this being his third largest position on-chain. Reportedly, Arthur Hayes’ family office is also an Aethir investor.

In a separate Lookonchain report, another whale purchased 28.87 million ATH tokens valued at $1.95 million across Bybit, KuCoin, and OKX exchanges.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Aethir is gaining attention as a key player in decentralized cloud infrastructure for gaming and AI. AltcoinDaily, a prominent crypto analyst, notes that Aethir is emerging as a leader in the DePin space, thanks to its potential to build scalable, decentralized solutions. The ATH token underpins the Aethir ecosystem, serving as a medium for staking and governance — real-world use cases that enhance the project’s credibility.

The token’s integration across exchanges drives the surge in interest, boosting platform appeal and meeting the rising demand for advanced blockchain solutions. Positioned as a GPU marketplace, Aethir seizes the opportunity presented by the AI sector’s growing need for computing power.

This demand also benefits other DePin projects like Helium (HNT), Storj (STORJ), and StorX Network (SRX), which offer cost-efficient, decentralized infrastructure.

Aethir, the Nvidia of Crypto

Crypto researcher Alex Wacy refers to Aethir as the “Nvidia of crypto” due to its impressive arsenal of 43,000 enterprise-grade GPUs, including 3,000 Nvidia H100s. These high-performance GPUs are crucial for AI training, and Aethir’s network holds the largest collection of H100s among all Web3 companies. By clustering these GPUs within the same data center, Aethir significantly enhances AI training efficiency.

Wacy also highlights that Aethir’s exclusive use of enterprise-grade GPUs guarantees superior service quality and 99.99% uptime. This commitment to top-tier performance positions ATH as a dominant player in the cloud gaming and AI training sectors.h this, they conclude that ATH is well-positioned to dominate the cloud gaming and AI training market.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

As the DePin narrative gains traction and more users enter the market, sector tokens are expected to attract even more attention. With an expanding range of options, some analysts argue that all DePin projects present compelling investment opportunities.

“The entire DePIN (and decentralized computing in particular) is a Web3 gold mine. I would not be able to pick one project over another for now, though,” another researcher noted.

As BeInCrypto reported, the DePin narrative has recorded parabolic growth since inception, soaring 400% to $20 billion as of August 8. This shows growing interest in decentralized infrastructure. Nevertheless, revenue generation remains a major challenge, with firms leaning toward DePin projects that focus on profitable markets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.