The Waves (WAVES) price is trading at a crucial resistance level, a breakout above which would go a long way in supporting the possibility of a bullish trend.

However, technical indicators are neutral, and the wave count suggests that the price is more likely to decline in the short-term.

Trading Range

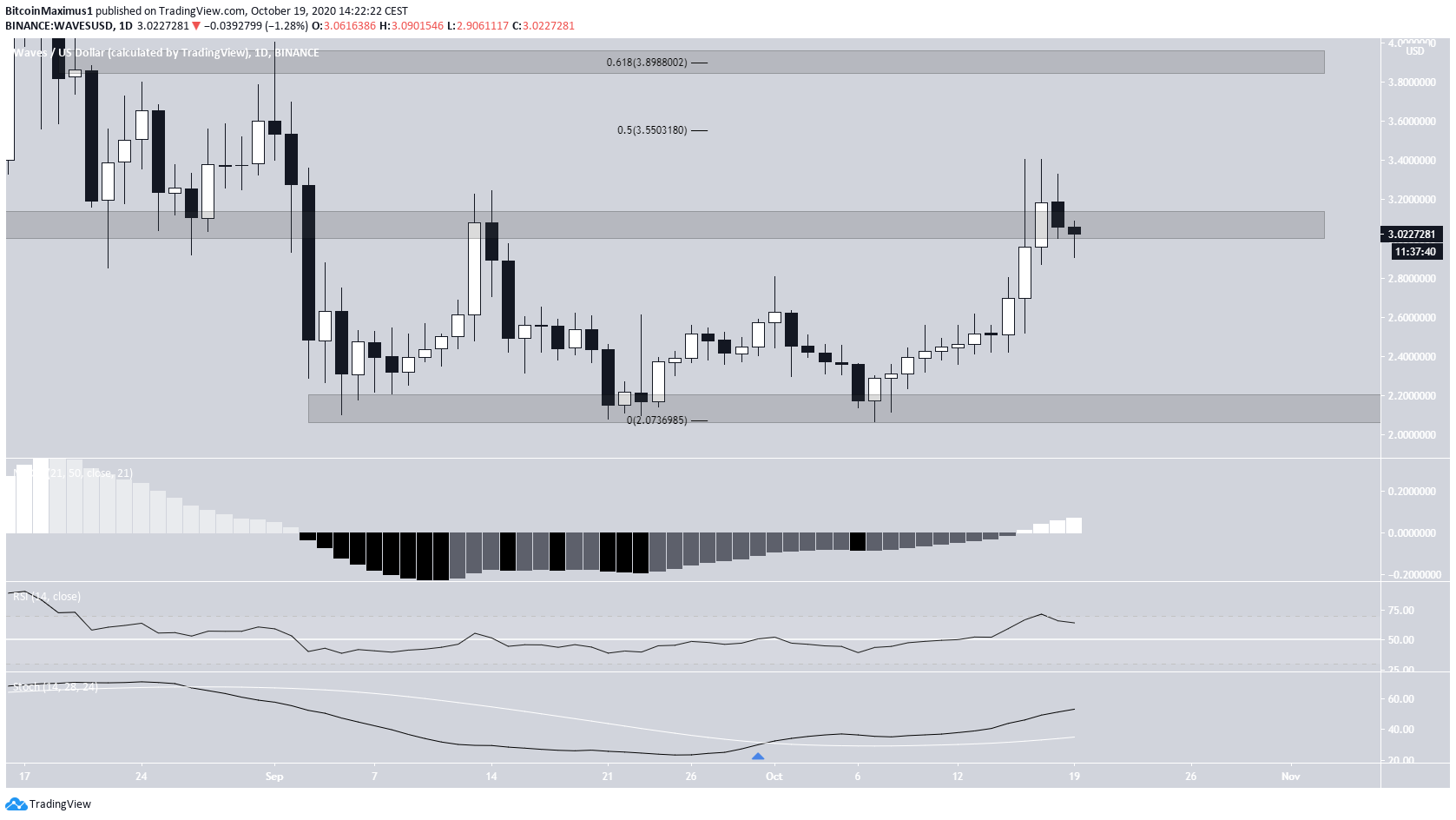

The WAVES price has been moving downwards since it reached a high of $5.02 on Aug 17. The decline continued until a low of $2.07 was reached on Sept 21, and the current bounce began. Currently, we can say that WAVES is trading in a range between $2.15 and $3.90, currently sitting in the middle of the range at $3.05. While the price moved above this level on Oct 17, it created a long upper wick and then fell. The fact that the price has not yet reached the 0.5 Fib level of the entire fall makes it likely that the current movement is corrective.

Future Move

Technical indicators on the daily time-frame are bullish. Both the RSI and the Stochastic Oscillator are increasing, the latter having made a bullish cross. Furthermore, the MACD has crossed into positive territory. The previous time this occurred, a very significant upward move followed. Therefore, these readings suggest that WAVES should rally towards the next resistance area at $3.90.

Wave Count

Since the previous Sept 21 low, the WAVES price seems to have completed an A-B-C corrective structure (shown in orange below). The structure gains more validity since the A:C wave ratio is 1:1.61 (common), and five subdivisions are clear (red) inside the C wave. If correct, what should follow is a price decline, fitting with the readings from short-term technical indicators. Therefore, WAVES is expected to fall towards $2.75 in the short-term. If the price manages to bounce at that level, it will allow for the possibility of another breakout attempt. However, until the price successfully breaks out above $3.05 and confirms the area as support, we cannot consider the trend bullish.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored