Recent research from Solidus Trade Surveillance has unmasked a startling $2 billion in deceptive crypto transactions in the murky decentralized finance (DeFi) sector.

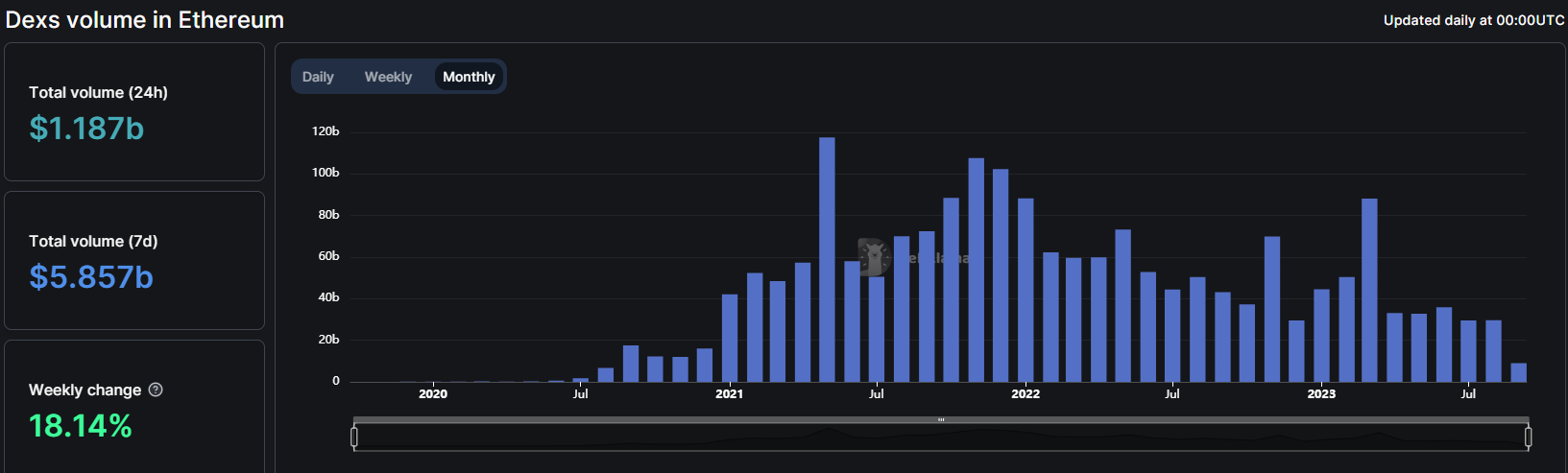

According to the report, Ethereum-based decentralized exchanges (DEXs) have been the stage for a significant volume of wash trading since September 2020.

Wash Trading on Decentralized Exchanges Becoming the Norm

Wash trading is a form of market manipulation where an entity buys and sells the same asset simultaneously. This deceptive practice creates a mirage of market activity while the beneficial ownership of the asset remains unaltered.

The Solidus report reveals that in DeFi, 67% of nearly 30,000 DEX liquidity pools have executed wash trades, making up 13% of total trading volumes.

According to current DeFiLlama data, Ethereum-based DEXs did around $5.86 billion in volume over the past week.

Smaller and fragmented crypto markets are most susceptible to manipulation, and wash trading is a common tool. Exchange and marketplace operators, crypto market makers, individual speculators, and token deployers have been known to execute wash trades for various reasons.

Read more: What Is an Automated MarketMaker (AMM)?

These include inflating trading volumes, hitting order-to-trade ratio requirements, topping activity leaderboards, and misleading investors about the health of their projects.

Notable Examples

The Solidus report further delves into the mechanics of DEX-based wash trading. The research identified two primary typologies: A-A wash trading and multi-party wash trading. A-A wash trading involves a single cryptocurrency address acting both as the dominant liquidity provider and the swapper.

This results in no change in beneficial ownership but manipulates the less-established token’s price and volume, creating a false market signal. The report identified $960 million worth of A-A wash trades since September 2020.

Read more: How To Evaluate DEXs With On-Chain Analytics

In contrast, multi-party wash trading involves different addresses for the liquidity provider and swapper, controlled by the same entity. This method, which the report found accounted for approximately $1.1 billion in wash trades, is preferred by those seeking to avoid detection and inflate the number of investors appearing to buy or sell the token.

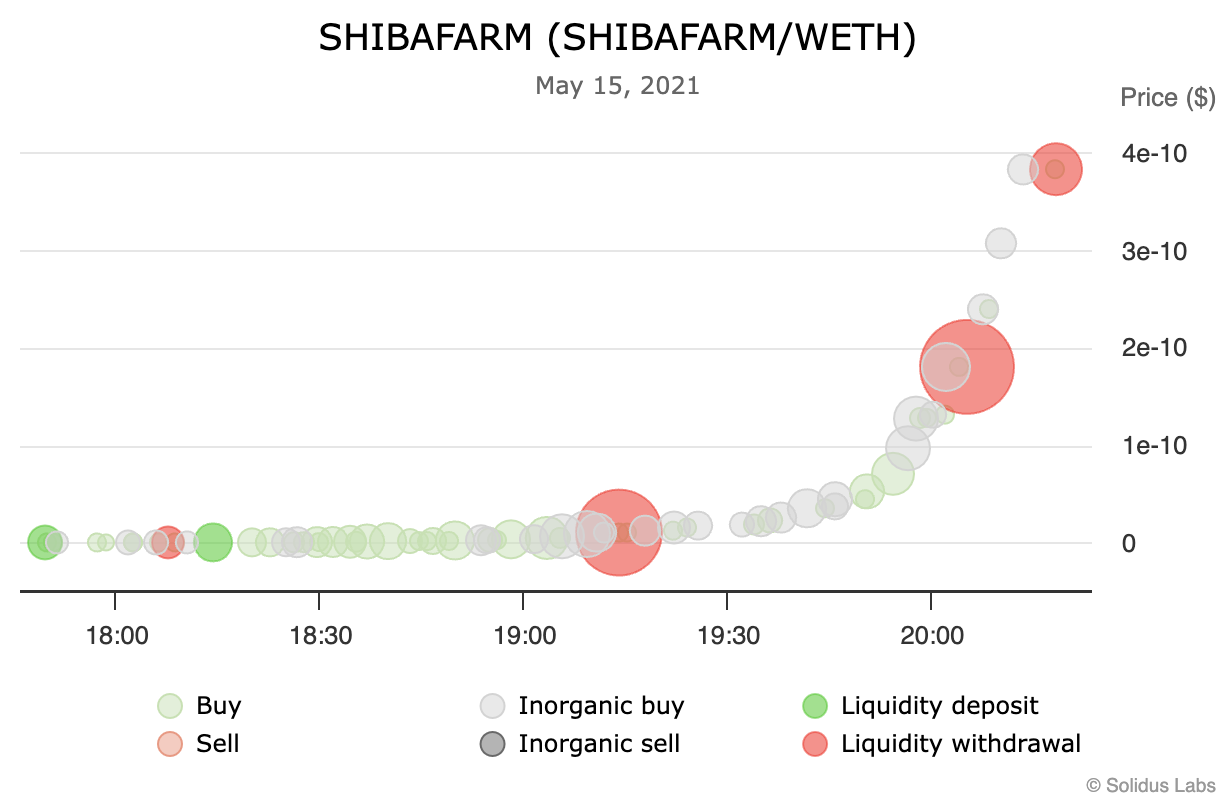

The report also highlights the case of SHIBAFARM, a token that used deceptive techniques, including a “chained” multi-party wash trading strategy, to manipulate its price and volume. This resulted in profits of approximately $2 million for the deployer within just two hours.

The question of responsibility for wash trading prevention and detection in DeFi still remains open. However, the Solidus report emphasizes that fairer markets are essential for sustainable growth. Timothy Cradle, Director of regulatory affairs at Blockchain Intelligence Group, agrees that having fair and transparent markets is a must:

“There’s competition in every industry. That’s not an excuse to go out and do wash trading and try to make your exchange look more liquid than it actually is, especially when you’re dealing with cryptocurrency.”