Ethereum co-founder Vitalik Buterin has outlined new methods to enhance transaction confirmation times on the Ethereum network.

In his latest blog post, Buterin proposes a novel approach in which each block is finalized before creating the next one, aiming to speed up transaction confirmations and user experience greatly.

Buterin Aims to Make Ethereum Transactions Faster

Historically, Ethereum has never led in transaction speeds among blockchain networks. Although, after the infamous Merge, transaction time has lowered to 5-20 seconds, other chains are twice as fast.

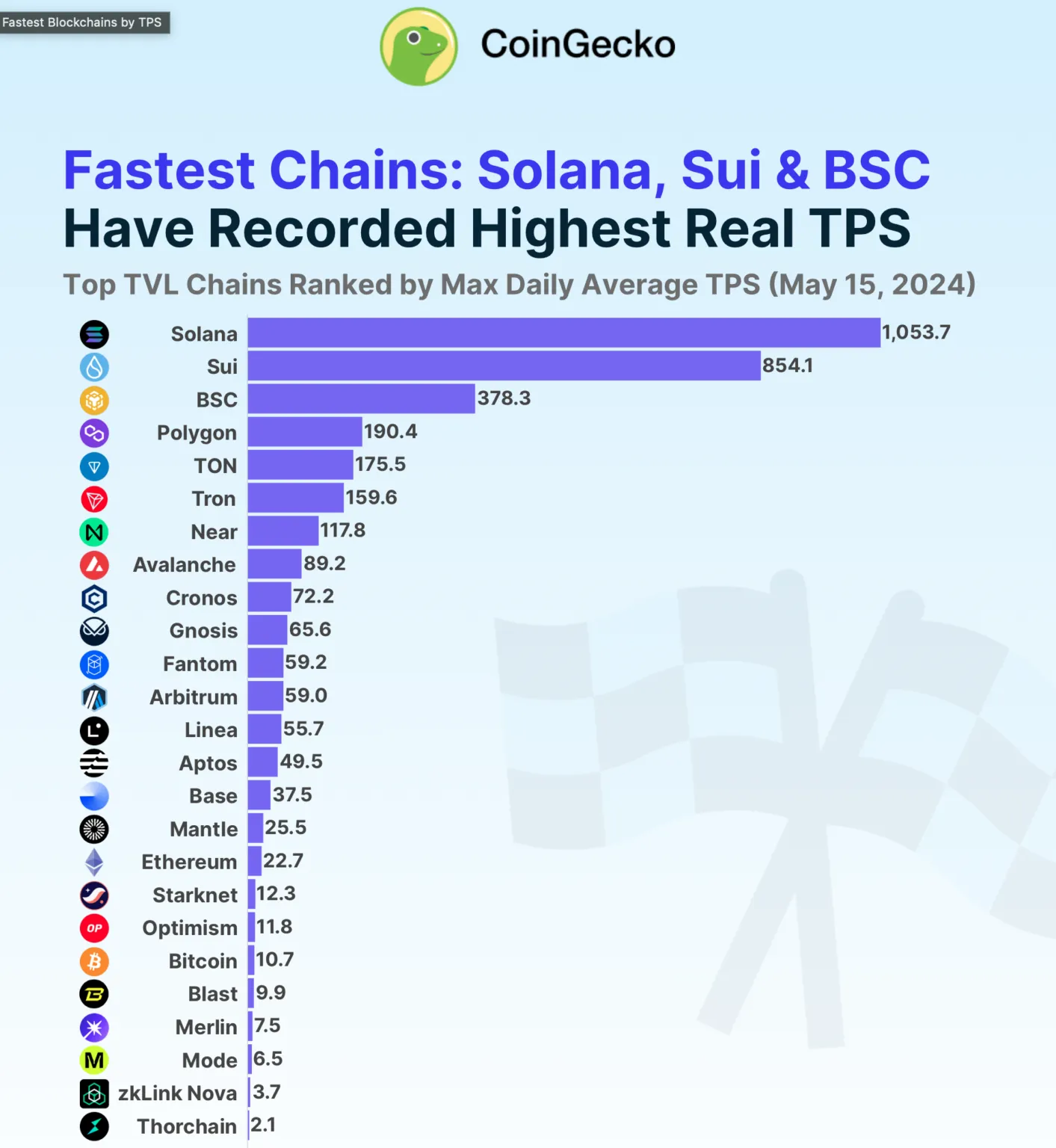

According to a report CoinGecko released in May 2024, Ethereum does not even rank on the top 10 for fastest chains. Solana, SUI, and Binance Smart Chain are currently leading the way.

Read more: Who Is Vitalik Buterin? An In-Depth Look at Ethereum’s Co-Founder

Now, Buterin suggests a new method called single-slot finality. Currently, Ethereum’s Gasper consensus takes about 12.8 minutes to finalize transactions. Single-slot finality would streamline this process, greatly reducing the waiting time.

“Over the last couple of years, we’ve become more and more uncomfortable with the current approach. The key reasons are that (i) it’s complicated, and there are many interaction bugs between the slot-by-slot voting mechanism and the epoch-by-epoch finality mechanism, and (ii) 12.8 minutes is way too long, and nobody cares to wait that long,” Buterin emphasized.

The need for improved transaction speed is crucial as the markets near Ethereum spot exchange-traded fund (ETF) approval in the US and investors are closely monitoring the cryptocurrency’s competitive market. Currently, Ethereum sits at $3,389, with a 1.24% increase over the previous 24 hours.

Buterin also focuses on using layer 2 solutions, or rollups preconfirmations, which process transactions faster using smaller groups of validators. As a result, this allows Ethereum’s main layer (L1) to focus on its core functions, like stability, resistance to censorship, and security. The job of layer-2 is to provide a better user experience, speed up transactions, and adapt to different needs.

However, because users still want faster transaction speeds, L2s will create their own systems to confirm transactions quickly. He notes that this process is complicated and is similar to building an entire blockchain layer.

Another proposal is to let users pay extra fees for immediate transaction confirmations. This system, called based confirmations, would use Ethereum proposers to guarantee transaction inclusion in the next block. If they fail, they face penalties, ensuring reliability.

Read more: Ethereum ETF Explained: What It Is and How It Works

Ultimately, Buterin sees these changes as achievable, but the concept remains an idea, with no news on its implementation or timelines.