Trillioner (TLC) price recently formed a new all-time high, which brought the altcoin into the limelight; however, this might be short-lived.

The surge in outflows signals that enthusiasts who tried to make money off of its virality are moving on and out of the token.

Trillioner Coin Did Not Make a Single Trillionaire

The TLC price rose 45% in 48 hours in mid-June, making it a sensation overnight. In an era when people are looking for quick buck tokens, Trillioner checked all the boxes. However, what followed was not so great.

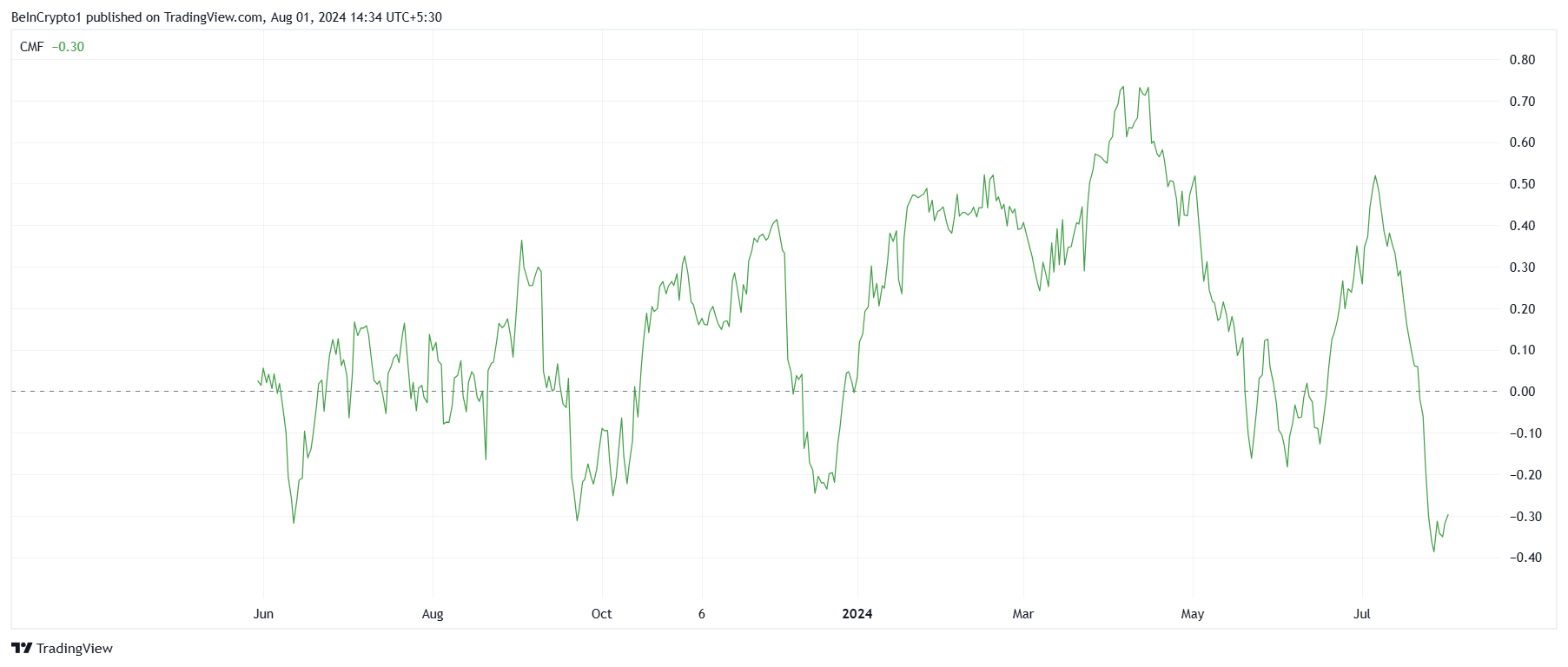

The crypto asset has shown barely any growth since mid-June, and now investors are realising the lack of value TLC holds. Due to this, outflows surrounding the altcoin have reached an all-time high, as noted in the Chaikin Money Flow (CMF).

The CMF is a technical analysis indicator used to measure the buying and selling pressure of an asset over a specific period. It combines price and volume data to indicate the strength of a trend and potential reversals.

Read More: A Guide to the Best AI Security Solutions in 2024

This significant outflow indicates that investors are losing confidence in the asset’s potential for future gains. As a result, many are choosing to sell off their holdings, further exacerbating the price decline.

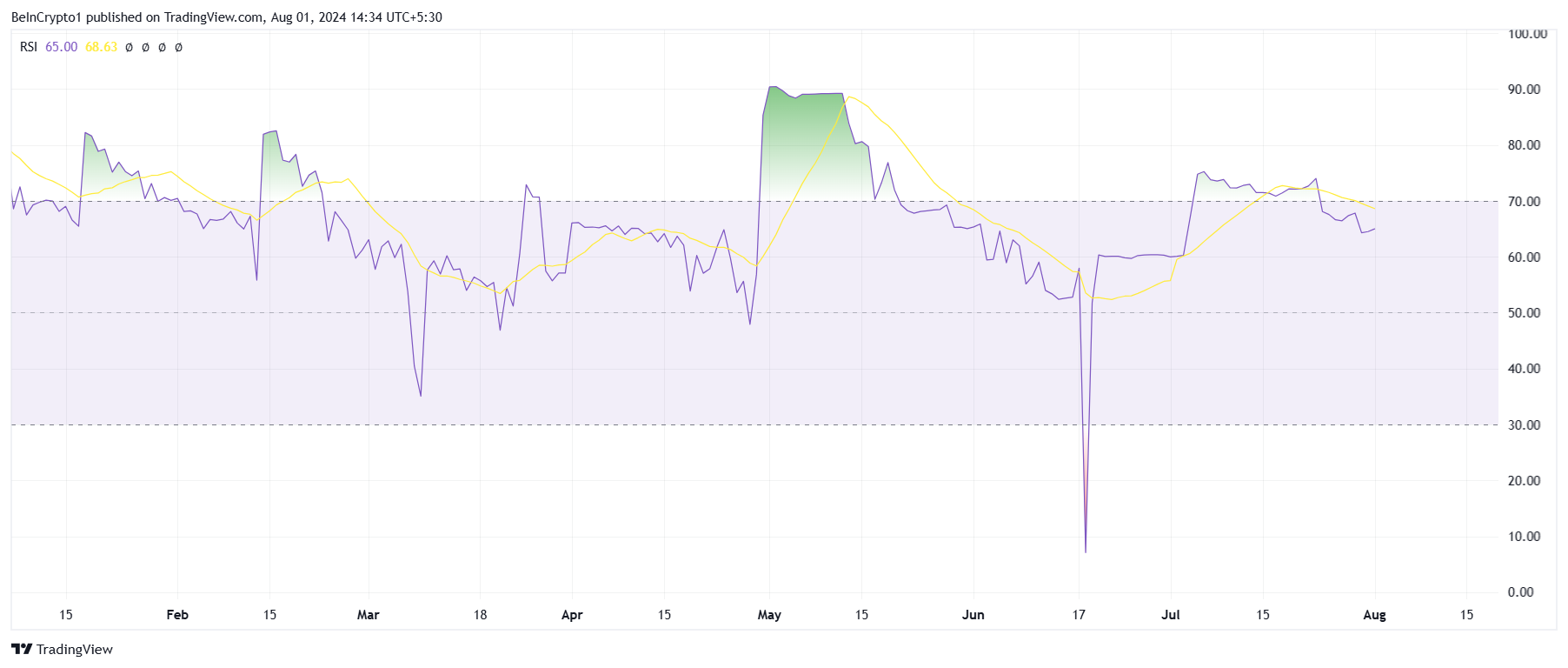

The Relative Strength Index (RSI) has revealed that the crypto asset was recently overbought. This overbought condition often serves as a precursor to a price correction, suggesting that the asset was trading at a higher price than its intrinsic value. Such a state typically prompts investors to reassess their positions, increasing selling pressure.

Thus, TLC seems to be experiencing significant volatility. Unless there is a notable positive change in the asset’s fundamentals, the high outflows and overbought conditions will likely continue driving the correction.

TLC Price Prediction: Consolidation Continues

TLC price has shown a tendency to continue sideways movement until a major development surrounds the altcoin. The mid-June rally enabled a rise, but the crypto asset could see some decline or sideways momentum going forward.

Read More: Top 9 Safest Crypto Exchanges in 2024

If the support at $77.89 is invalidated, the TLC price could observe a massive drawdown. If the all-time high of $79.02 is breached, a further rally could commence, invalidating the bearish thesis.