Gabor Gurbacs, an advisor at VanEck, commented the evolving narrative of the blockchain industry in 2024, noting significant changes resulting from recent developments in the crypto space.

“I believe efforts today are meaningfully differentiated from old “blockchain this blockchain that” stories,” he noted.

VanEck’s Gurbac Highlights Underestimation of the Blockchain

On X (formerly Twitter), Gabor Gurbacs argues that individuals commonly underestimate the crypto industry’s potential and investments, drawing parallels to past misguided doubts.

“People also laughed at ETFs. Now it’s a $9 Trillion industry.”

Introduced in 1993, the first exchange-traded fund (ETF), SPY, made history as the inaugural ETF listed on a national stock exchange. Today, it remains one of the world’s most actively traded ETFs.

However, he argues this is what it is starting to look like for the crypto industry going forward, especially with the recent approval of 11 spot Bitcoin ETF applications by the US Securities and Exchange Commission.

“Serious efforts and capital are starting to flow in this space. It’s less so about blockchains than rethinking and remaking capital markets,” he states. He indicates that the news coverage has evolved from simply pointing to stories about the capability of the blockchain:

“I believe efforts today are meaningfully differentiated from old “blockchain this blockchain that” stories.”

It’s only the beginning for firms looking to introduce Bitcoin products to the market. On January 12, BeInCrypto reported that Grayscale Investments will be filing for a covered call Bitcoin ETF, which will allow investors to generate income from options on its Grayscale Bitcoin Trust (GBTC).

However, Gurbacs further argues against those who challenged recent statements by BlackRock CEO Larry Fink regarding tokenization.

“97% of people who laugh at Larry Fink, & his comments on tokenization being his next focus area, don’t understand how broken capital markets are.”

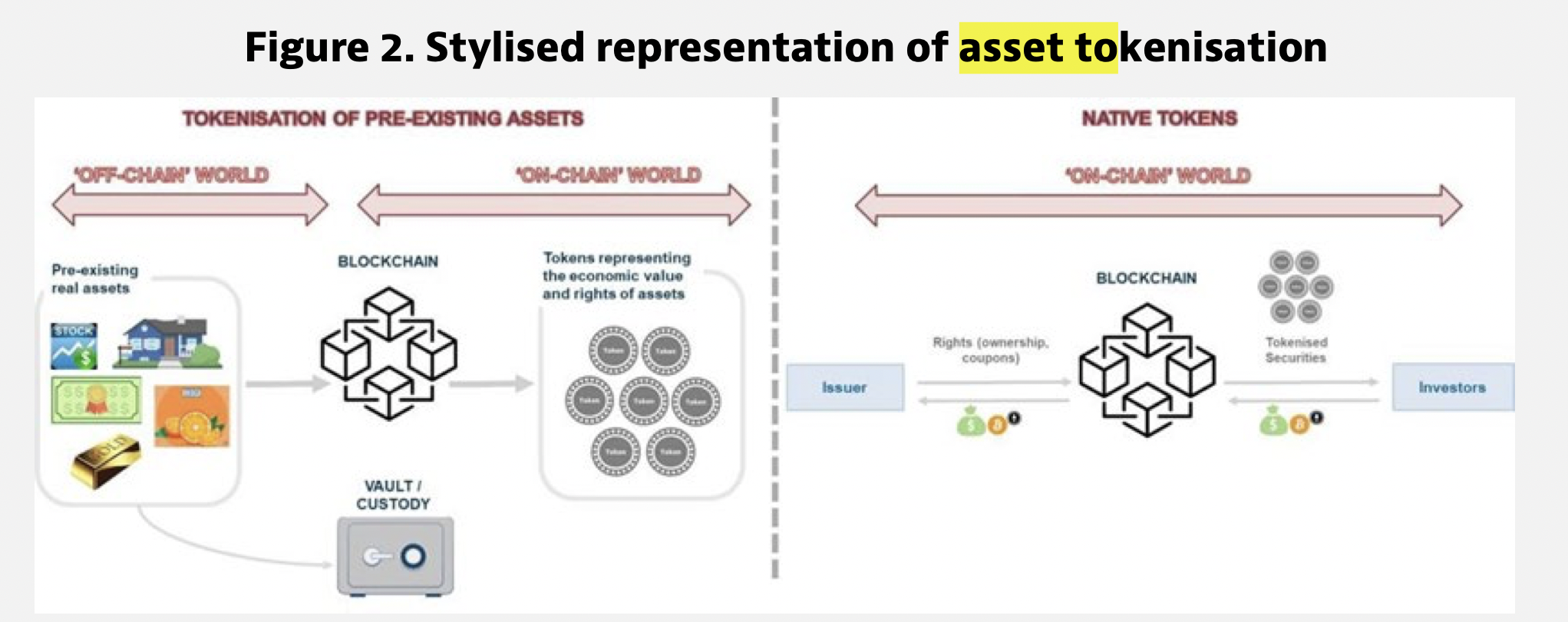

The tokenisation of assets is the digital representation of physical assets on the blockchain. It offers advantages like enhanced increased transparency. Furthermore, a simplified access to fractionalized assets by enabling ownership splitting on the blockchain.

This follows BeInCrypto’s recent reporting that Fink’s vision extends to the idea that ETFs will eventually transform every asset class. Furthermore, the ultimate step being the tokenization of assets.

Read more: What is a Layer-1 Blockchain?

Gurbacs Highlights Overlooked Modern Capital Markets Vision

Yet, Gurbacs argues that recent contentment with capital markets may be disrupted by the evolution of spot Bitcoin ETFs and the potential for others in the future.

“People haven’t given a serious thought on what modern capital markets should look like for decades,” he states.

Many in the industry speculate over which narrative will be next in the crypto world.

Until last year, AI-focused crypto didn’t receive much attention. However, in 2023, the spotlight shifted, especially with the emergence of generative AI chatbots like OpenAI’s ChatGPT and Google’s Bard.

Furthermore, Binance recently commented on the success of AI crypto tokens in 2023.

“Interest in artificial intelligence (“AI”) has experienced an upswing in the last few months, as evident by Google search trends and soaring AI-related token prices.”

Read more: Crypto Trading During the Holidays: 5 Key Historical Trends