While major cryptocurrencies like Bitcoin maintain dominance, stablecoins seem to be gaining ground. So much so that they are seeing more transaction volume on major blockchains.

There are thousands of cryptocurrencies in existence but some are undoubtedly more popular than others. Bitcoin, for example, is the world’s most sought after crypto and has maintained that position for years.

However, a series of July 20, 2020 tweets from Messari researcher, Ryan Watkins, suggests that this dominance may be under threat.

Move Over Bitcoin?

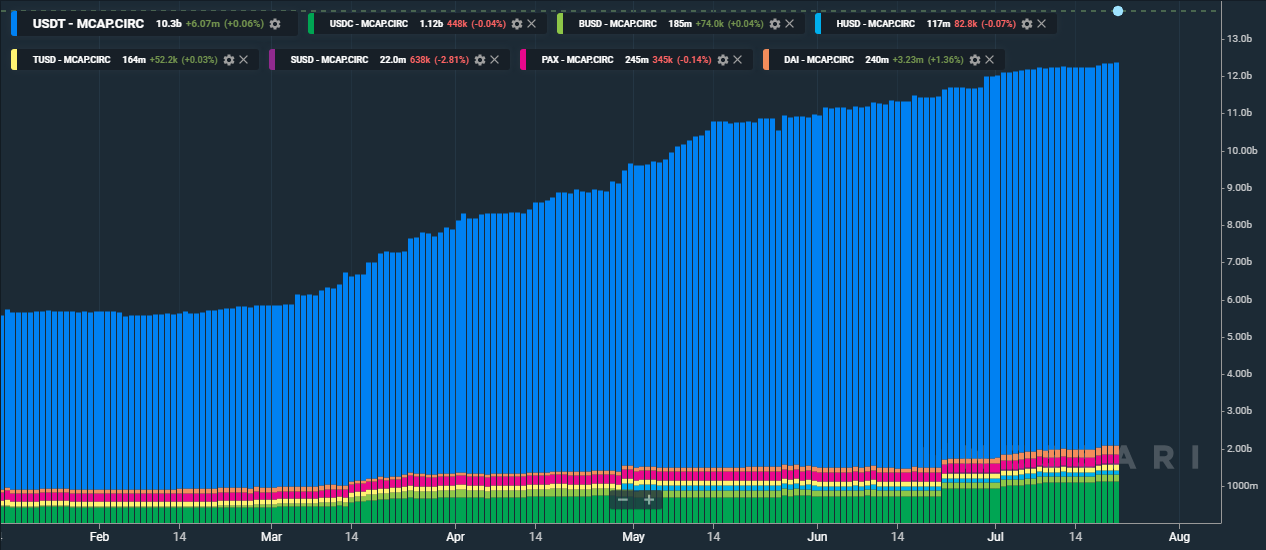

According to Watkins, Bitcoin is witnessing some stiff competition from Tether (USDT), a popular stablecoin. USDT has surpassed Bitcoin as the top cryptocurrency on public blockchains. This is based on recent data from both the DeFi boom and the second quarter of 2020.

Blockchains and Stablecoins

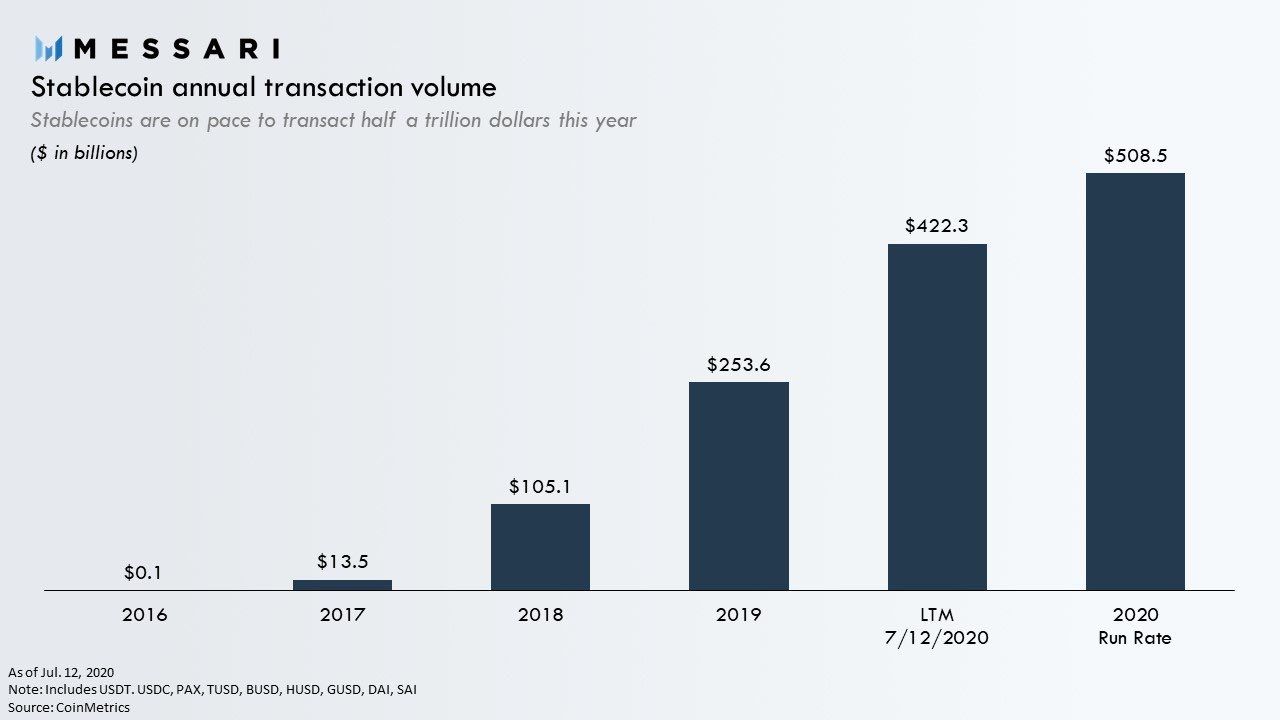

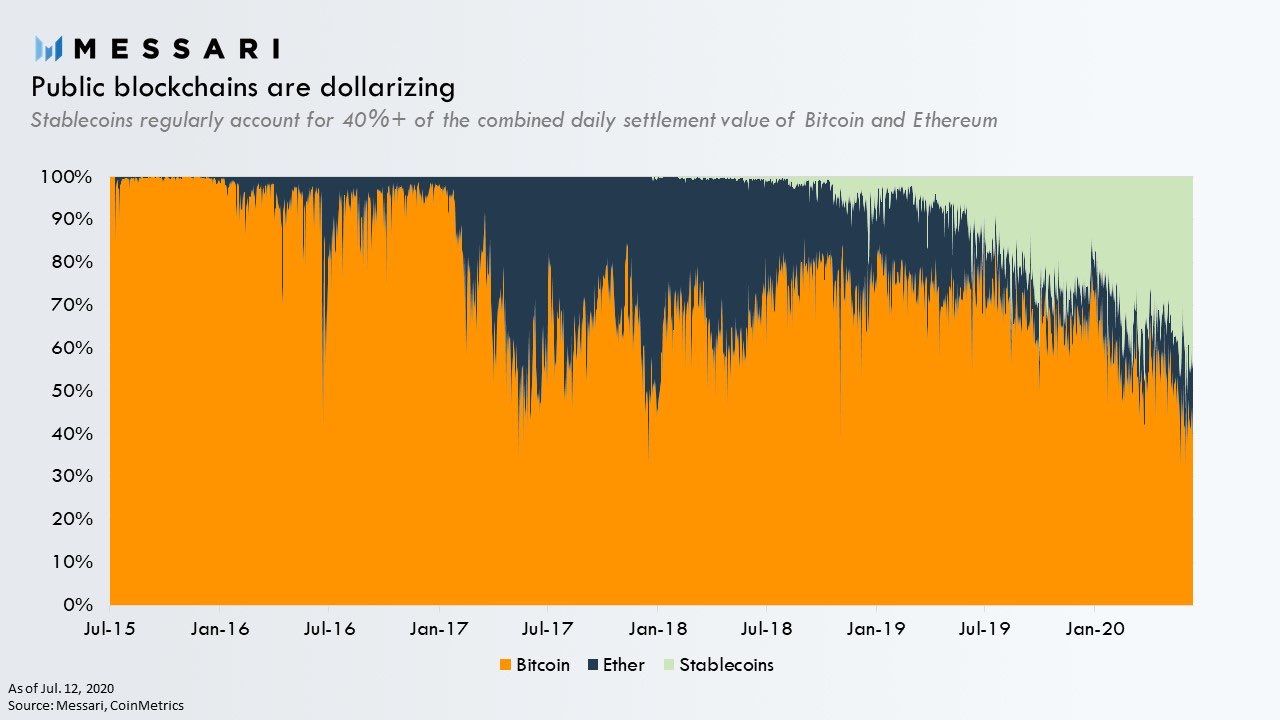

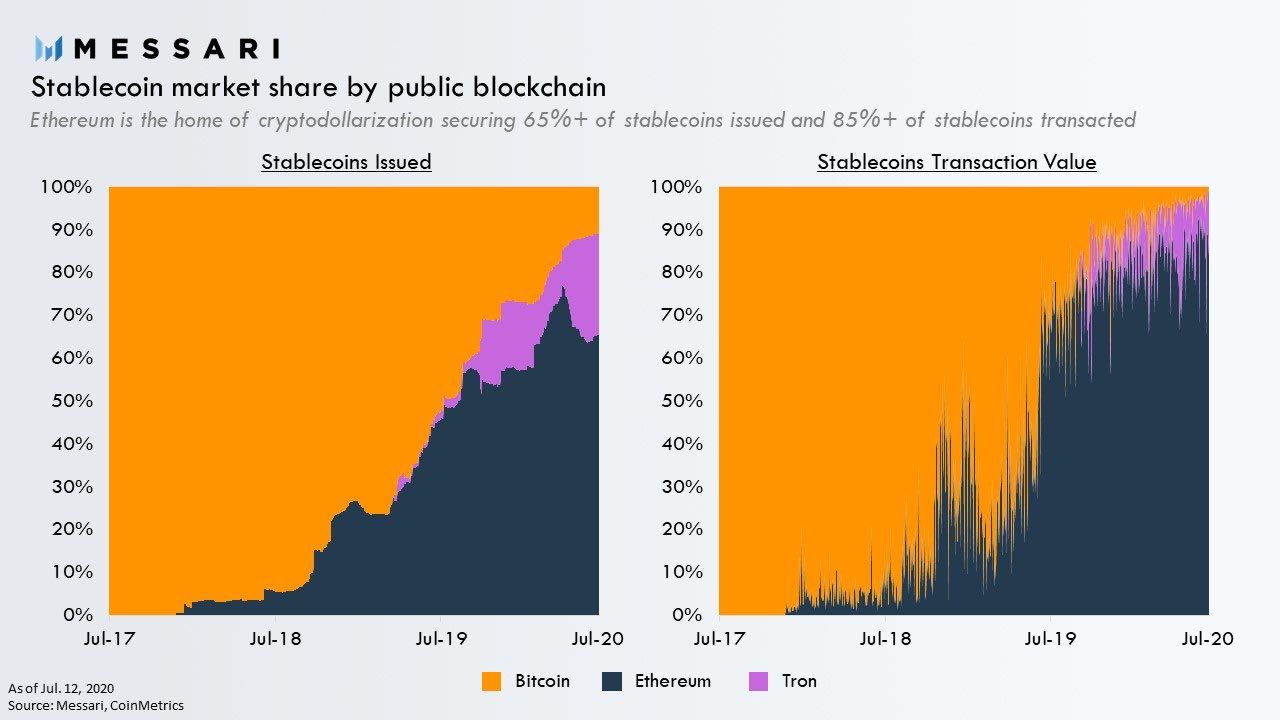

Stablecoins represent a transaction volume of about $508 billion so far in 2020. The fiat alternatives are even catching up with some industry heavyweights. In recent months, stablecoin transactions regularly constituted over 40% of the combined daily settlement value for Bitcoin and Ethereum.

Ethereum on the Rise

Challenges So Far

Despite all of this, it hasn’t been all smooth sailing. A July 7, 2020, FATF report outlines new standards that will apply to various stablecoins. The report implies that there is a need for a centralized version. Stablecoins have been a source of much controversy within the industry as some purists insist they aren’t valid due to their respective fiat currency pegs. Watkins’ thread, however, shows that they are growing in popularity nonetheless.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored