Following the US GENIUS Act, capital is pouring into yield-bearing stablecoins, with Ethena’s USDe leading the charge.

However, with explosive growth comes rising concern, with overhanging fears about whether this may be the next breakthrough or the next UST.

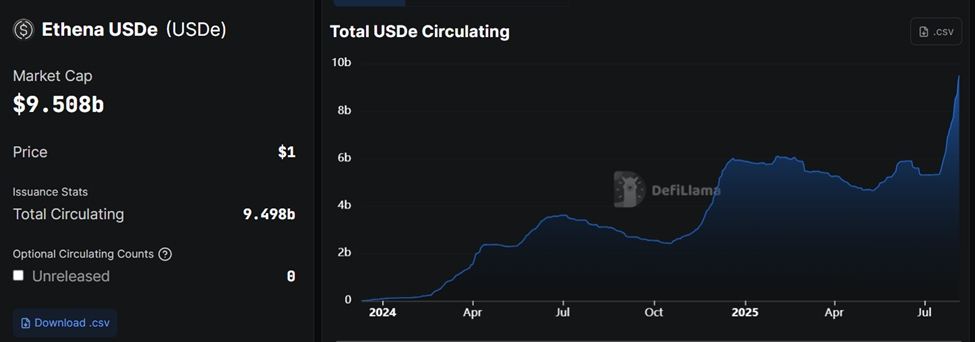

USDe Supply Surges to $9.5 Billion, Now Third-Largest Stablecoin

Ethena’s USDe stablecoin is on an unprecedented growth streak. Over the past month, its circulating supply has jumped by 75%, reaching approximately $9.5 billion, according to DefiLlama.

This dramatic expansion makes USDe the third-largest stablecoin by market cap, trailing only Tether’s USDT and Circle’s USDC.

Tom Wan, Head of Data at Entropy Advisors, noted that the combined market cap of USDe and USDtb has surpassed $10 billion. This puts Ethena among the top five DeFi protocols by TVL.

“Excluding the double count, Ethena still has $9.4B TVL, and will soon become one of only five DeFi protocols with $10B+,” Wan stated.

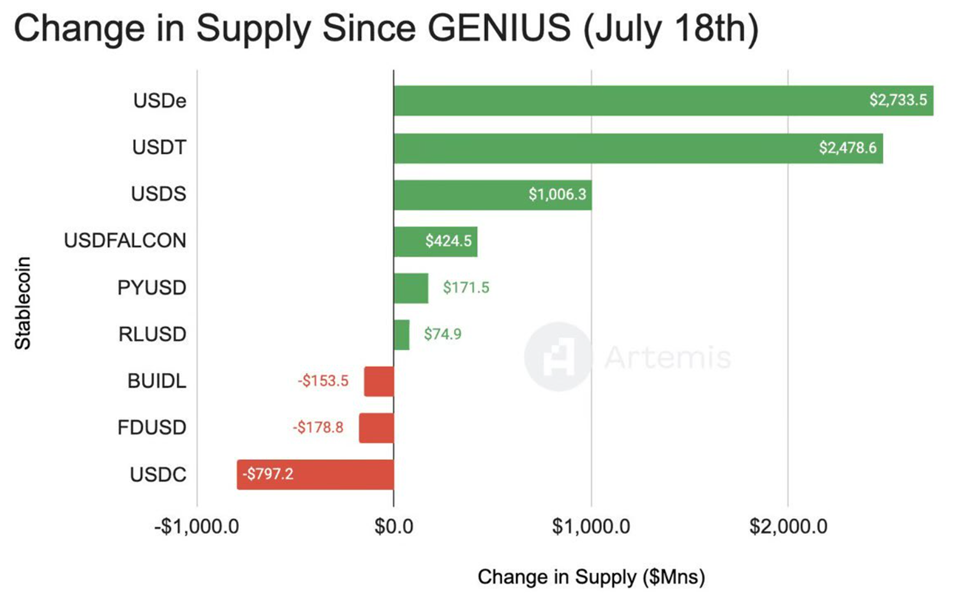

The rise comes after the GENIUS Act passed on July 18, catalyzing capital inflows into yield-bearing stablecoins.

According to David Arnal, a researcher at Sentora (formerly IntoTheBlock), USDe added $2.7 billion in net new supply, the most among all stablecoins post-GENIUS.

Tether also saw strong inflows of $2.4 billion, while USDC experienced outflows of nearly $800 million, suggesting shifting market confidence.

“…yield-generating stablecoins are no longer just a trend but a new structural element of DeFi,” Arnal observed.

Analysts Warn USDe Growth Could Be Fragile

While the numbers are impressive, not everyone is convinced USDe is on solid ground. Crypto analyst Duo Nine warns that USDe is still untested in a true bear market.

“This basis trade synthetic token remains unvalidated. Until it passes a proper bear market, it’s just a concept. Its ballooning market cap increases risk when bears return,” he cautioned.

Echoing that concern, another analyst, Alan the Yield Farmer, drew a sharp parallel to the infamous UST-LUNA collapse, calling Ethena’s USDe and ENA the potential UST/LUNA of this crypto cycle.

He pointed out that USDe offers a relatively modest 3.5% APY, while alternatives like USDS and USDY yield over 4.5%. That could pressure Ethena’s AUM, especially in volatile markets.

However, others argue this comparison is overblown. On-chain analyst Yuki highlighted that USDe successfully challenged USDT and USDC dominance without the de-peggable mechanics that doomed Terra’s UST.

Meanwhile, Bunjil emphasized a crucial difference: USDe is backed by staked ETH and short hedges, not a hyperinflationary token like LUNA.

“If they started collateralizing with $ENA, I’d run,” Bunjil warned, clarifying that Ethena has avoided that mistake.

Ethena Labs Founder Reveals Risk Controls and DeFi Integration

To address de-peg concerns, Guy Young, founder of Ethena Labs, pointed to key integrations that mitigate liquidation risks.

“…Important to note USDe oracle on Aave now set to USDT removing liquidation risk for any temporary USDe deviation from $1.00 50% APY on USD with multi-billions of capacity Only possible in DeFi, and only possible with Aavethena,” Young stated.

Yield-bearing stablecoins go beyond being just a trend and are shaping up to be a structural pillar of the next phase of DeFi.

However, as USDe approaches the $10 billion milestone, questions remain. Can Ethena’s synthetic stablecoin weather a full market cycle without unraveling? Or will history rhyme with a different stablecoin—and a familiar disaster?