The US Securities and Exchange Commission (SEC) has collected a staggering $4.68 billion in fines from the crypto sector in 2024. This record amount marks a 3,018% increase compared to fines collected in 2023.

SEC claims that through these fines, it is ensuring transparency, protecting investors, and enforcing compliance across the crypto industry.

Terraform Labs Contributed Majorly to Crypto Fines

The bulk of these fines stem from a landmark case against Terraform Labs and its co-founder, Do Kwon. The $4.47 billion penalty was levied following the collapse of Terraform’s algorithmic stablecoin, TerraUSD, which resulted in substantial losses for investors.

In June 2024, Terraform Labs consented to a settlement with the SEC, which addressed allegations that the company misled investors about the stability and security of its digital assets.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

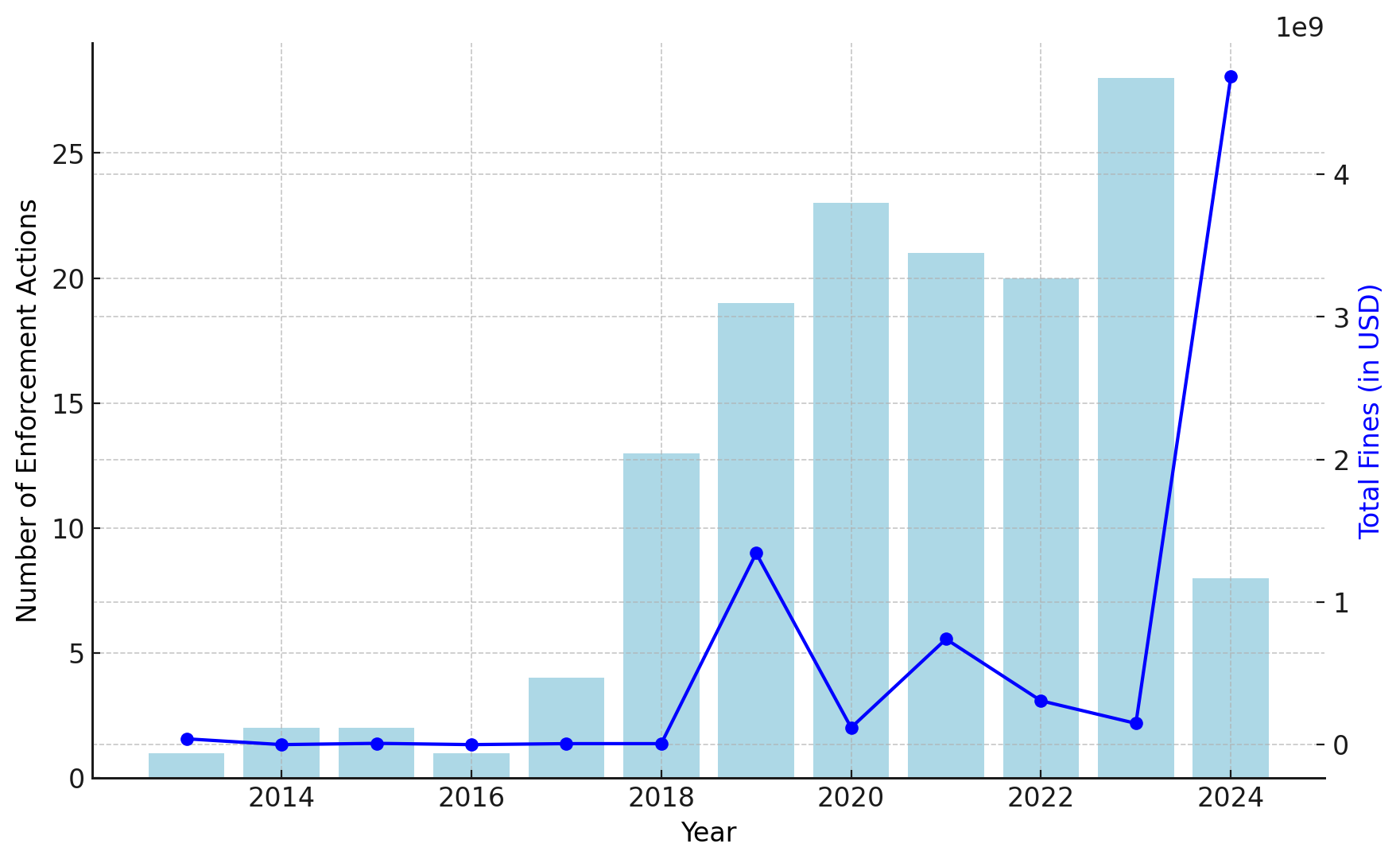

Despite undertaking fewer enforcement actions—11 in 2024 compared to 30 the previous year—the SEC has secured fines totaling over 30 times the amount collected in 2023. This dramatic increase from $150.3 million last year to billions this year illustrates a more focused strategy on high-profile cases.

Over the years, it has also targeted firms such as Ripple and Telegram for unregistered token sales and securities violations.

“This trend indicates a strategic shift by the SEC toward fewer but larger fines, with a focus on making high-impact enforcement actions that set precedents for the entire industry,” the Social Capital Markets said.

Analyzing the trend from 2019 to 2024, there is a clear trajectory of rising fine amounts. The average fine in 2018 was $3.39 million, which escalated to an average of $426 million in 2024, marking a growth of 12,466.37%.

The fines imposed encompass a variety of financial penalties, including forfeiture amounts, disgorgement, civil penalties, settlement sums, and prejudgment interest. These measures are part of the SEC’s comprehensive strategy to penalize and deter unlawful activities within the crypto market.

However, the SEC’s aggressive enforcement tactics have not been without criticism. The crypto community has expressed concerns that such stringent regulations may stifle innovation by imposing what some view as overly punitive measures.

“US SEC/Gary Gensler are literally acting like ransomware thugs They threaten so many crypto companies with phony lawsuits and then settle with a big fine,” an X user said.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

Moreover, the SEC’s handling of certain cases has come under legal scrutiny. Notably, in a case against D.E.B.T. Box, a federal judge criticized the SEC for “bad faith conduct” and ordered it to pay $1.8 million in legal costs. The judge also shed light on the issues with the agency’s approach to enforcement.