Crypto markets have several US economic indicators to monitor this week that could influence their portfolios.

This comes amid the growing influence of US economic data on Bitcoin (BTC), making it vital that traders and investors brace for impact.

US Economic Data to Watch

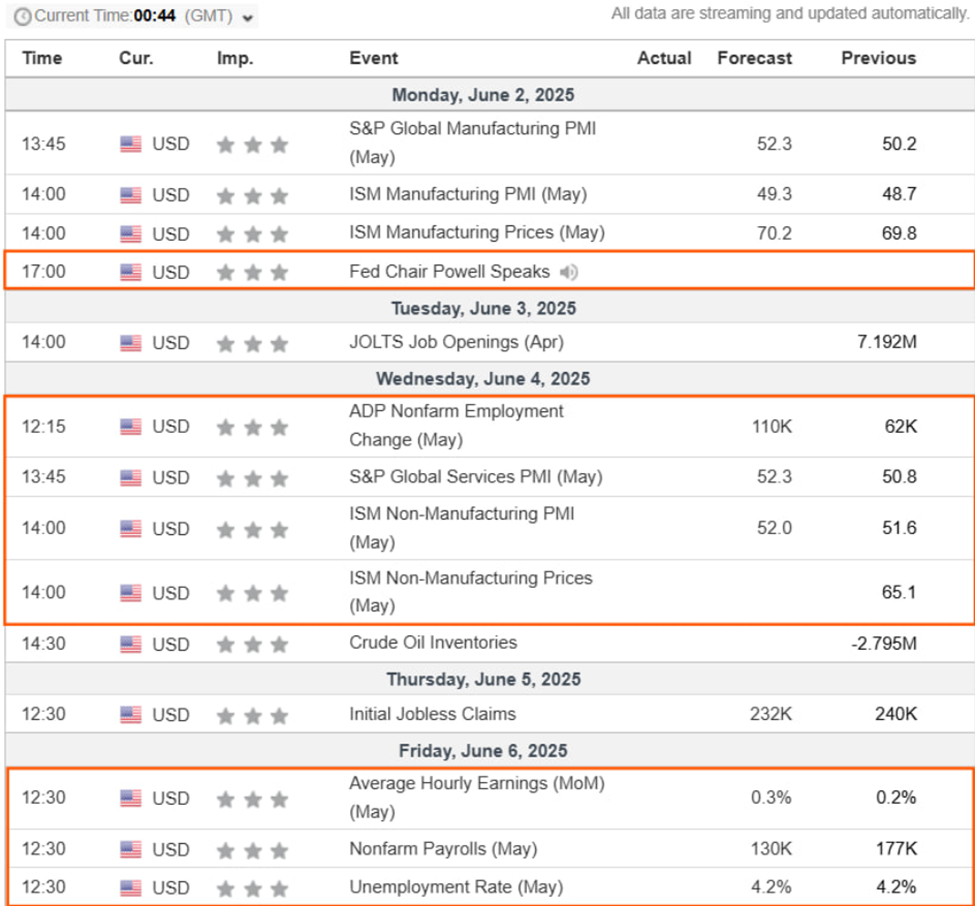

Investors looking to capitalize on the potential volatility can trade around the following US economic data points this week.

US Job Openings (JOLTS)

The Job Openings and Labor Turnover Survey (JOLTS) for April 2025 is set to be released on June 3. In March, job openings fell to 7.192 million, marking the lowest level since September 2024 and falling below market expectations of 7.48 million.

This decline occurred before the full impact of the Trump administration’s new tariffs. According to Bloomberg analysts, the economic policies have depressed hiring.

“…employers focusing on containing costs as households become a bit more guarded and businesses reconsidered investment plans against a backdrop of shifting trade policy,” Bloomberg stated.

As this US economic indicator approaches, Bitcoin traders should brace for impact. A continued decrease in job openings may signal a cooling labor market, potentially prompting the Federal Reserve (Fed) to consider easing monetary policy.

Such a shift could weaken the US dollar, making Bitcoin more attractive as an alternative asset. Conversely, if job openings stabilize or increase, it may reinforce expectations of continued monetary tightening, possibly dampening Bitcoin’s appeal.

ADP Employment

Another US economic indicator to watch this week is the ADP Employment report for May 2025, due on Wednesday, June 4. In April, private-sector employment increased by 62,000 jobs, a significant slowdown from March’s revised gain of 147,000.

For now, however, economists see a median forecast of 112,000. A lower-than-expected job growth figure could signal economic cooling, potentially prompting the Fed to consider easing monetary policy.

Such a shift might weaken the US dollar, making Bitcoin more attractive as a hedge against currency depreciation.

Conversely, a stronger-than-expected report could reinforce expectations of continued monetary tightening, possibly dampening Bitcoin’s appeal.

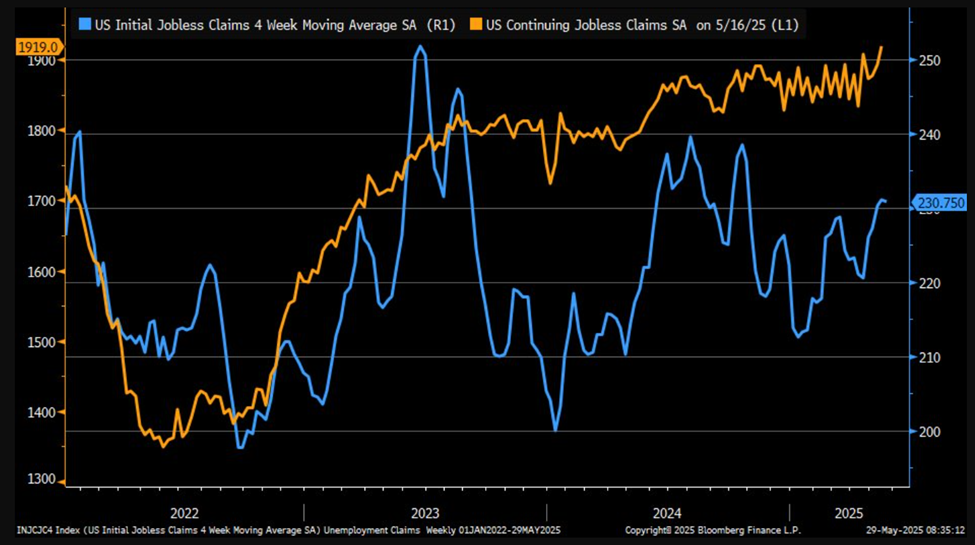

Initial Jobless Claims

Initial jobless claims for the week ending May 24 rose to 240,000, up from 226,000 the previous week and exceeding the forecast of 229,000. This marked the highest level since November 2021, indicating potential softening in the labor market.

As part of the US economic indicators to watch this week, markets will see how many people filed for unemployment insurance for the week ending May 31.

With a median forecast of 232,000, an uptick in jobless claims may signal economic weakness. This would increase the likelihood of the Fed adopting a more accommodative monetary stance.

Such a shift could lead to a weaker dollar, enhancing Bitcoin’s attractiveness as an alternative asset. However, if the rise in claims is viewed as a temporary fluctuation, the impact on Bitcoin may be limited.

“Initial jobless claims continue to steadily, but slowly, increase,” observed Eric Basmajian, a business cycle analyst.

Non-Farm Payrolls

The US Employment report, or Non-Farm Payrolls (NFP) for May 2025, is scheduled for release on June 6. In April, the economy added 177,000 jobs, surpassing expectations, while the unemployment rate remained steady at 4.2%.

“Economists see payrolls rising by 125,000 after job growth in March and April exceeded projections, based on the median of a Bloomberg survey. That would leave the average over the past three months tracking a still-solid 162,000. The unemployment rate is seen holding at 4.2%,” Bloomberg analysts noted.

Economists anticipate a slowdown in job growth to 130,000 in May, reflecting potential economic impacts from President Trump’s tariffs.

Strong job growth may lead the Fed to maintain its current monetary policy stance or even consider tightening, which could strengthen the US dollar and potentially suppress Bitcoin prices.

However, if underlying economic concerns prompt the Fed to adopt a more dovish approach, Bitcoin could benefit as investors seek alternative stores of value.

Analysts say tough employment conditions in the US come as employers seeking clarity around the White House’s trade policy progressively have to deal with frequent adjustments to timelines and schedules.

“Increased volatility is expected—prepare your risk management and wait for confirmations before entering trades,” MrD Indicators cautioned.

As of this writing, Bitcoin traded for $104,858, after rising 0.17% in the last 24 hours.