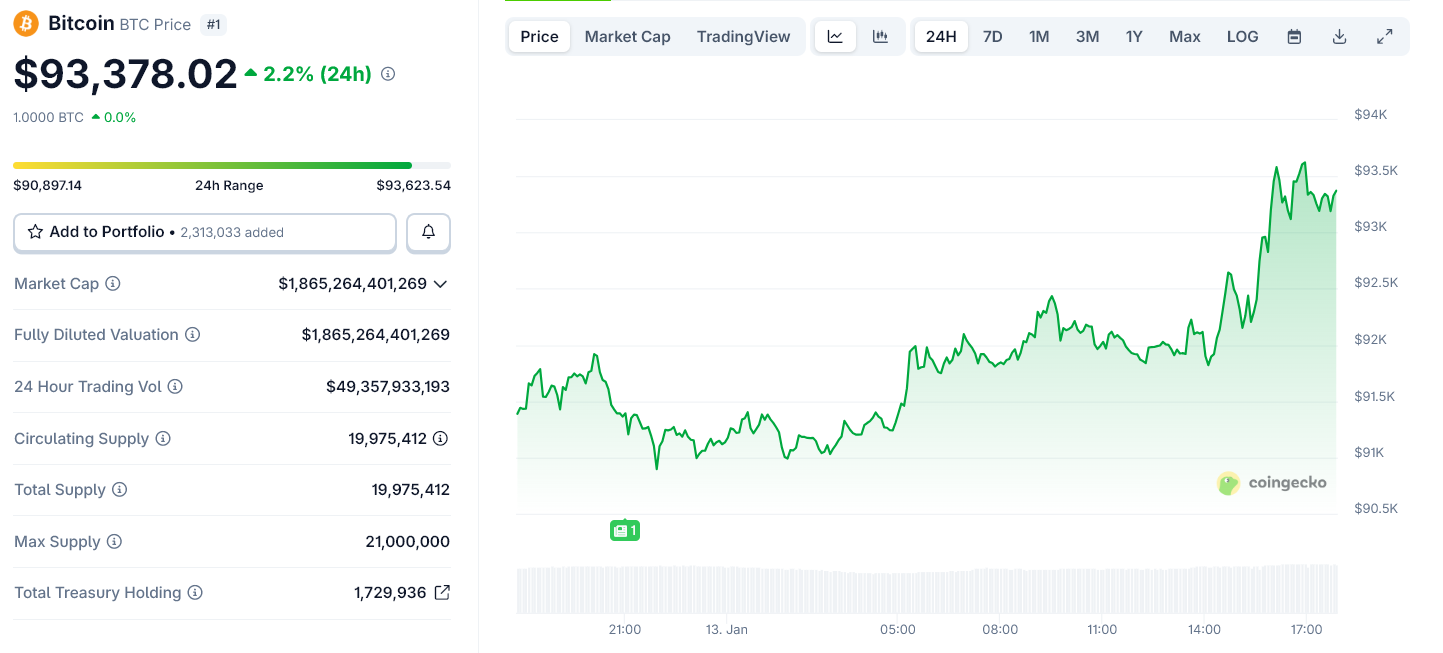

Bitcoin climbed back above $93,000 on Monday after the latest US inflation data showed price pressures remain under control. The move suggests risk appetite is returning after weeks of ETF-driven selling.

The Consumer Price Index showed inflation rising at a steady but moderate pace. Prices are no longer surging, and they are not collapsing either. That balance reduces the risk of new interest rate hikes and supports assets that benefit from stable liquidity, including Bitcoin.

US CPI Data Calms Markets and Supports Risk Assets

The CPI report showed inflation running near 2.7% year over year. That means prices are still rising, but much more slowly than during the inflation shock of 2022 and 2023.

For households, this means living costs remain high but are no longer rising rapidly.

For markets, it signals that the Federal Reserve can afford to keep rates steady rather than tighten further.

This environment tends to support risk assets. When inflation is neither accelerating nor collapsing, investors feel more comfortable holding assets like stocks and crypto.

Bitcoin reacted quickly. After trading near $90,000 earlier in the day, the price pushed higher as CPI removed fears of renewed monetary tightening.

Bitcoin’s Rebound Reflects More than Macro Relief

The CPI boost did not happen in isolation. It came as Bitcoin was already stabilizing after a sharp ETF-driven reset.

Earlier in January, more than $6 billion exited US spot Bitcoin ETFs. That selling came from investors who bought near October’s peak and were forced out when price fell.

However, those outflows have slowed. Bitcoin is now trading close to the ETF average cost basis near $86,000. That level often acts as support once weak hands have exited.

US buying, measured by the Coinbase Premium Index, remains soft. That shows institutions stepped back after the ETF flush.

Yet Bitcoin has held its range despite heavy supply hitting exchanges. This means global buyers are absorbing what ETFs release.

Path Back to $100,000 Soon?

Bitcoin is now building support between $88,000 and $92,000. The CPI data removes a major macro risk, while on-chain and ETF data show the reset phase is already well advanced.

If ETF flows stabilize and US buyers return, Bitcoin could reclaim $95,000 in the near term. A move back toward $100,000 becomes more likely later in the quarter if demand improves.

For now, today’s CPI report strengthens the case that Bitcoin is in a pause before the next leg higher, not the start of a new bear market.