The United States and China have agreed to temporarily reduce tariffs on each other’s goods for 90 days. This marks a potential thaw in the ongoing trade war between the world’s two largest economies.

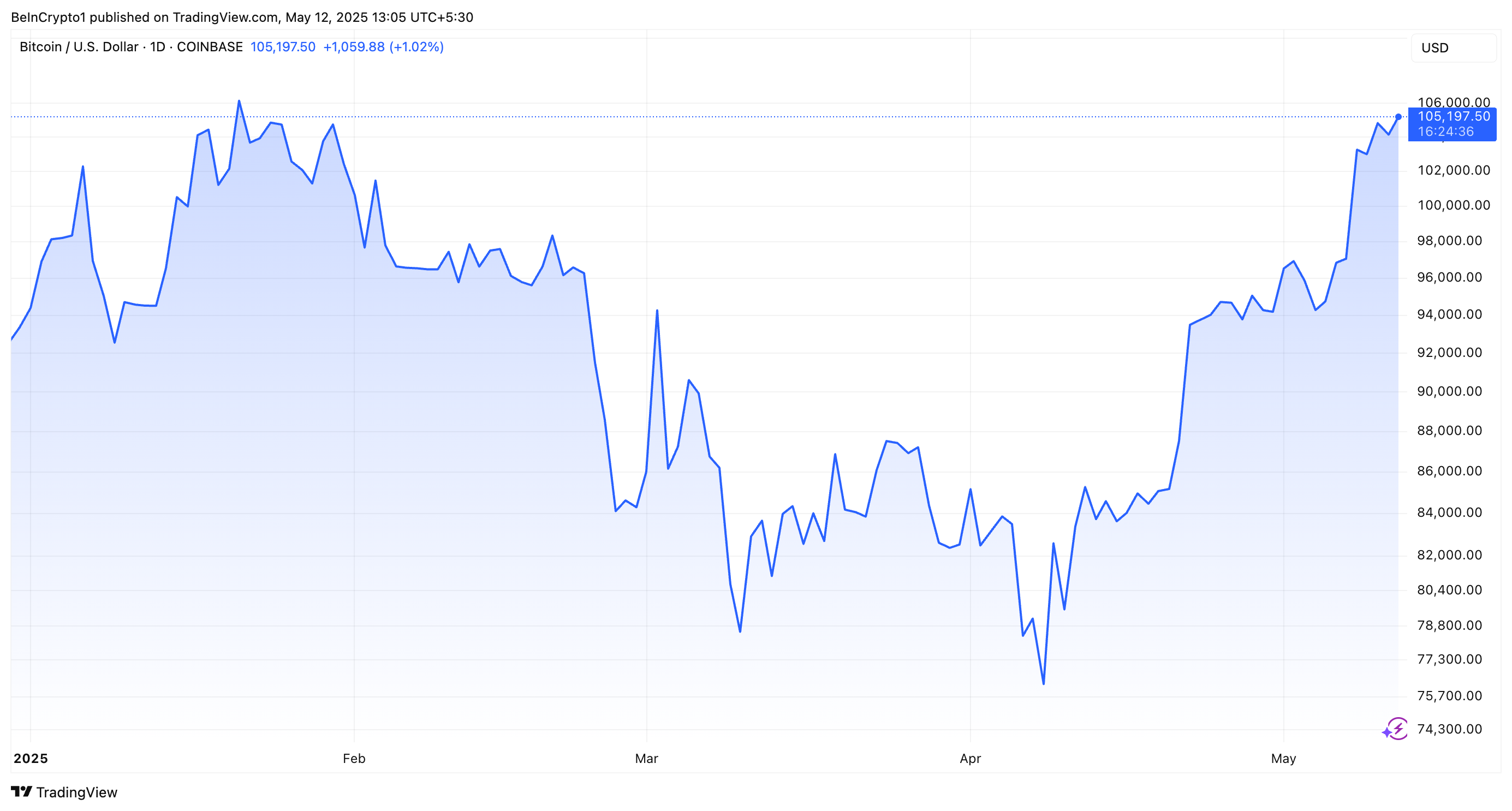

The move has triggered a price rise in Bitcoin, propelling it to highs last seen on January 31.

US-China Tariff Deal Sparks Bitcoin Rally

The White House released a joint statement confirming the agreement. Under it, the US will lower its tariffs on Chinese imports from 145% to 30%.

Meanwhile, China will reduce its tariffs on American goods from 125% to 10%. Both measures will take effect on May 14 and last for 90 days. These steps reflect a collaborative approach to address mutual concerns and strengthen the trade relationship.

“After taking the aforementioned actions, the Parties will establish a mechanism to continue discussions about economic and trade relations,” the statement read.

The decision follows two days of intensive talks between top US and Chinese officials, hosted by the Swiss government in Geneva. The discussion aimed at de-escalating tensions that have disrupted global markets and strained economic relations.

“It’s important to understand how quickly we were able to come to agreement, which reflects that perhaps the differences were not so large as maybe thought. The United States has a massive $1.2 trillion trade deficit, so the President declared a national emergency and imposed tariffs, and we’re confident that the deal we struck with our Chinese partners will help us to work toward resolving that national emergency,” Jamieson Greer, US Trade Representative Ambassador, said.

Notably, the market’s reaction to the announcement was swift, catalysing a price rise in Bitcoin. After the news, the largest cryptocurrency surged approximately 1.25%.

At press time, Bitcoin traded at $105,197, reflecting its highest levels in over three months. With this latest pump, BTC remains just 3.4% below its all-time high (ATH).

The rise wasn’t limited to BTC. S&P 500 futures increased by 2.5% and Dow Jones rose by 2.2%. Nasdaq futures have also surged, experiencing a 3.1% gain.

Moreover, Asian markets saw gains, with Hong Kong’s Hang Seng index rising by over 3%. Nonetheless, gold prices have dipped 2.5%.

For now, the temporary tariff cuts offer a brief reprieve, but the outcome of the ongoing tariff talks between the US and China remains uncertain. The long-term impact of these negotiations will likely continue to influence global markets, including the cryptocurrency space.