The collapse of the FTX exchange has set a contagion effect within the entire market, the US authorities are going after the founder Sam Bankman-Fried.

The FTX collapse has set a ripple effect in the market. The collapse of once the second-largest exchange in the world has been like a tumbling of a huge building that brings down all the other smaller buildings in the nearby vicinity.

Sam Bankman-Fried going to prison?

The community demands to send Sam Bankman-Fried (SBF) to prison while the American and Bahamian authorities discuss the possibility of bringing him to the United States for questioning.

According to a Bloomberg report, three people familiar with the matter state that SBF has been cooperating with Bahamian authorities while they investigate his role in the FTX episode. Bahamian police interviewed him on Saturday.

The Australian Securities and Investment Commission (ASIC) has suspended the financial service license of FTX Australia.

Genesis halts withdrawals due to FTX Contagion

The lending entity Genesis Global Capitals has announced that it temporarily suspends redemptions and new loan originations. The reason mentioned is that the recent event around FTX has created market turmoil due to which there are “abnormal withdrawal requests” exceeding its current liquidity.

According to Mint, Genesis’ derivative business had $175 million locked in the FTX trading account. However, the firm’s spot and derivative business remain fully operational. There was already a massive dent in the firm’s liquidity due to the default of 3AC.

It is worth noting that Genesis’s parent company, the Digital Currency Group controls one of the largest investment vehicles, The GrayScale Bitcoin Trust (GBTC). GBTC gives institutional investors exposure to Bitcoin; it has over $10.7 billion in assets under management.

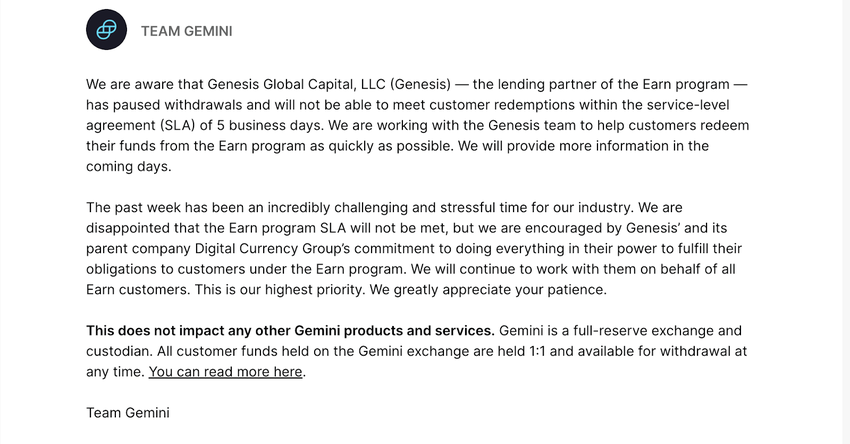

Gemini halts withdrawals

Another domino to collapse is the earn program of Gemini. Gemini earn had partnered with Genesis Global Limited to give yields to customers. Since Genesis paused redemptions, Gemini could not provide yields to its client, forcing it to halt the withdrawals.

The famous personalities who had ties with SBF or FTX are reportedly trying to erase it. A Twitter user mentioned that other accounts are deleting their tweets related to SBF/FTX. The NFL player Tom Brady, who owned equity in FTX, deleted all the tweets associated with the bankrupt exchange.

Got something to say about FTX contagion or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here