Uptober is just one day away, and optimism is running high for Bitcoin (BTC) and the broader crypto market.

As the industry enters the tenth month of the year, the alignment of 10 key internal, macro, technical, and on-chain signals suggests that the crypto market could be primed for significant upside in October.

Will October Live Up to ‘Uptober’? 10 Signals Suggest a Rally Ahead

The first promising signs are emerging from market signals, where liquidity, sentiment, and seasonality trends are aligning in favor of the bulls.

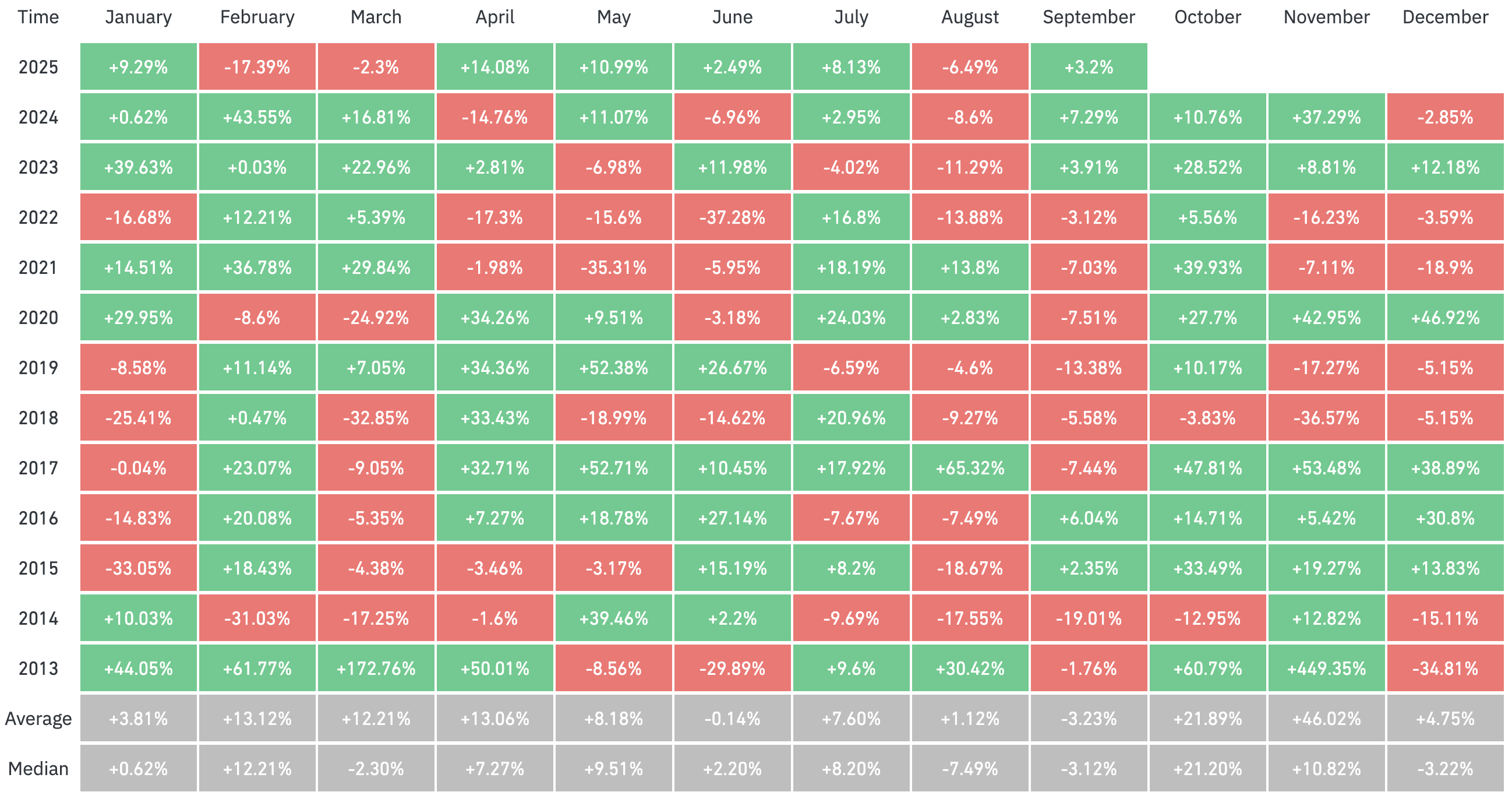

1. Bitcoin’s Historical October Patterns

From a seasonal perspective, October has been a bullish month for Bitcoin. The largest cryptocurrency has posted an average return of 21.89%, closing the month in green 10 times over the past 12 years.

What’s worth noting is that this time, several signs are emerging that could mean that this bullish trend could extend to the broader market.

2. SEC’s ETF Deadlines

In October, the SEC has to decide on multiple altcoin exchange-traded funds (ETFs), which could serve as major catalysts for market sentiment.

“Enormous next few weeks for spot crypto ETFs. SEC final deadlines approaching on numerous filings.Starts this week with deadline on Canary spot ltc ETF. Will be followed by decisions on SOL, DOGE, XRP, ADA, & HBAR ETFs (though SEC can approve any or all of these whenever),” Nate Geraci posted.

Approvals could likely inject fresh capital into the market, triggering possible price rallies. Despite historical bearish seasonality for some altcoins like XRP, these catalysts may override past trends.

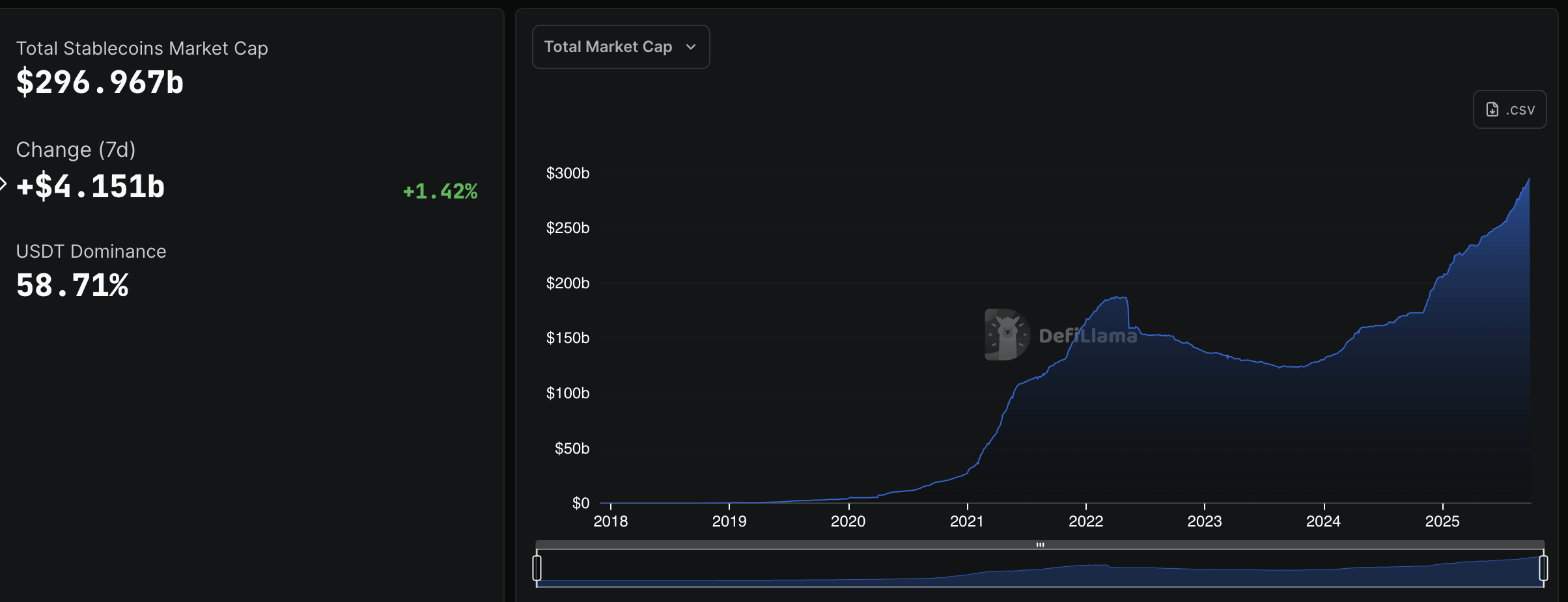

3. Stablecoin Supply Surges to Record Highs

In addition, DefiLama data showed that the total stablecoin market capitalization has reached a new all-time high of nearly $297 billion. This milestone reflects increasing liquidity in the ecosystem, as stablecoins often serve as on-ramps for crypto investments. Higher supply typically correlates with market expansion, positioning October for potential inflows.

4. Fading Retail Hype

Beyond liquidity, sentiment indicators add a contrarian bullish twist. Search interest for terms like ‘crypto,’ ‘altcoin,’ and ‘Bitcoin’ is declining, reflecting low public attention. Low social interest at this stage is seen as bullish, suggesting the market is still early in its cycle, before mainstream investors return.

“Our data shows the same pattern over and over: impulsive investors always arrive too late. They start researching exchanges, coins, or even ‘Who is Satoshi Nakamoto?’ only after the big moves — then they cry about manipulation, losses, and claim the market ruined them. But the truth is very different,” Joao Wedson, founder of Alphractal, said.

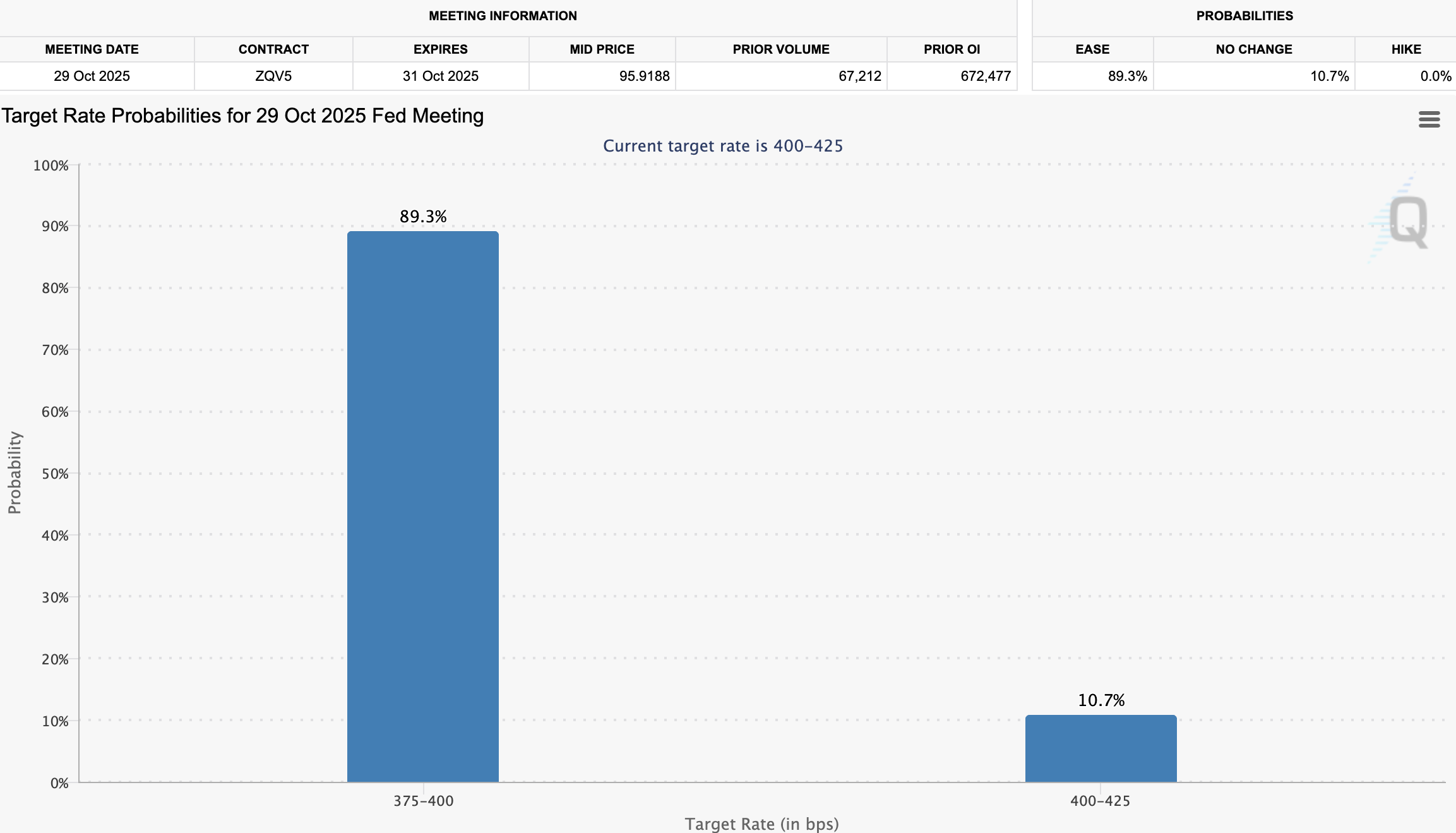

5. Fed Rate Cut Expectations

Macroeconomic conditions are also appearing favorable for the crypto market in the upcoming month. According to the CME FedWatch Tool, markets are pricing in a 89.3% probability that the Fed will cut rates at its October meeting after recently slashing them in September.

For crypto, the high probability of another Fed rate cut is a bullish macro signal. Lower interest rates reduce the appeal of traditional safe assets like bonds and increase demand for risk assets, including Bitcoin and altcoins.

Cheaper borrowing also boosts liquidity in financial markets, which often translates into more capital flowing into crypto.

6. Resumption of Global M2 Correlation

Furthermore, Raoul Pal, founder and CEO of Global Macro Investor, noted that Bitcoin has previously tracked the global M2 money supply with a 12-week lag. However, this correlation broke on July 16.

This happened because the US Treasury drained liquidity by issuing $500 billion in bonds to rebuild its Treasury General Account. Pal suggested that the account is now sufficiently ‘topped up.’

Thus, he expects the liquidity drain to fade. This, in turn, could allow Bitcoin to follow M2 again.

7. Bitcoin’s RSI Signals

From a technical perspective, Joe Consorti observed that Bitcoin’s 30-day Relative Strength Index (RSI) is approaching levels seen at the April 2025 bottom and September 2024’s pre-Q4 low. This oversold condition signals gathering momentum.

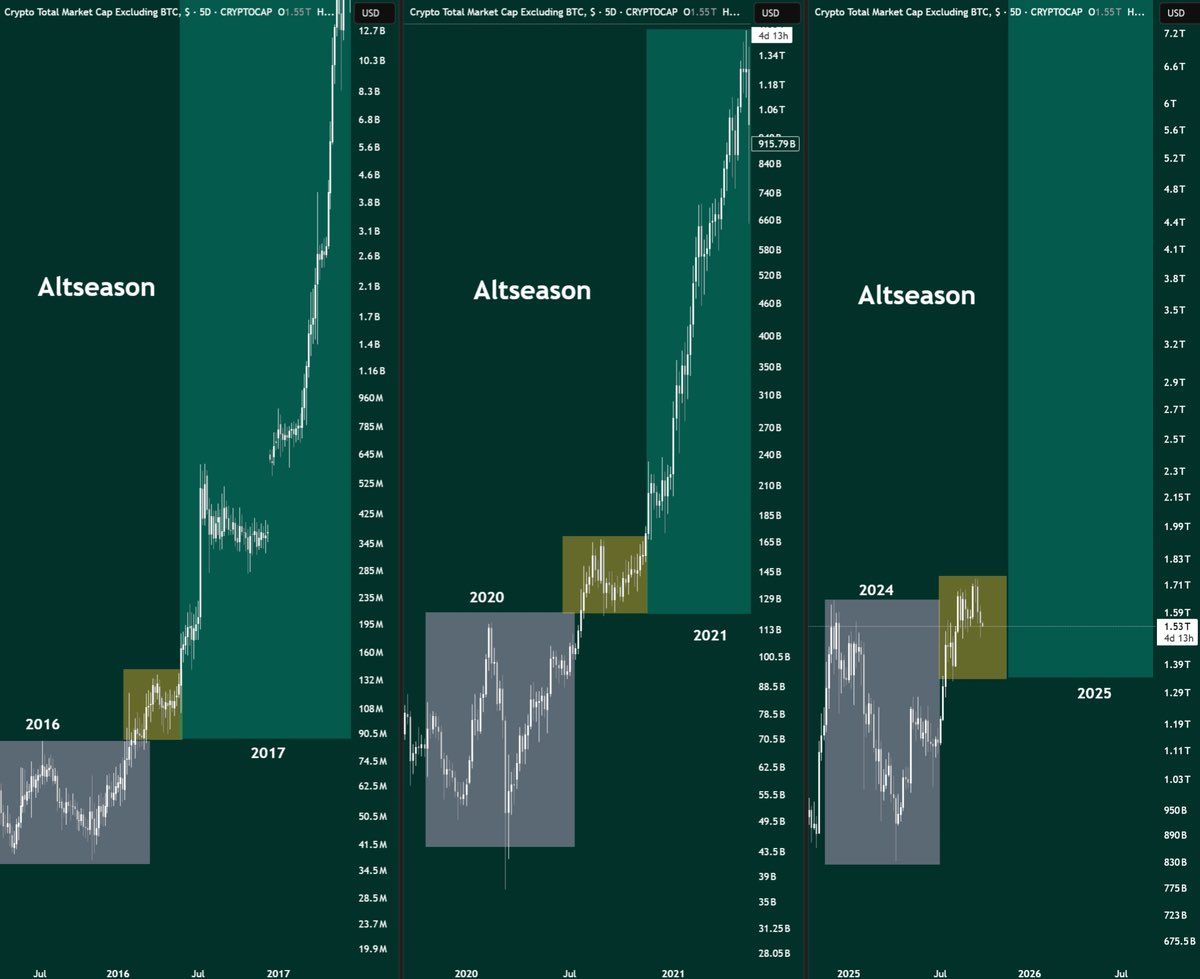

8. Altcoin Market Bullish Structures

For altcoins, analysts are drawing parallels between the current market structure and the patterns seen in 2017 and 2021, both of which led to massive rallies.

“Altseason WILL happen in Q4. Get ready for Uptober, Moonvember, and Pumpcember,” analyst Gordon predicted.

Moreover, Merlijn The Trader noted that altcoins have just formed a ‘cup and handle’ pattern. In technical analysis, this pattern is considered a bullish continuation setup. Once the handle is completed, it often signals the end of the consolidation phase and the potential for a significant upward breakout.

“What comes after? Parabolic mania. Multi-trillion cap is the destiny,” he remarked.

9. On-Chain Signals Highlight Holder Conviction

Lastly, on-chain signals fuel further optimism for a Uptober rally. Analyst Darkfost revealed that wholecoiners’ exchange inflows have hit cycle lows.

This metric, which tracks addresses holding at least one full Bitcoin, suggests that holders are retaining their coins.

“On Binance, after peaking in November 2023 with average annual inflows of nearly 11,500 BTC, the figure has now fallen to around 7,000 BTC, marking a new cycle low. The same trend is visible across all exchanges where average annual wholecoiner deposits have declined from 45,000 BTC in May 2024 to about 30,000 BTC today. A drop in exchange deposits suggests stronger conviction to hold, which mechanically reduces selling pressure,” Darkfost posted.

In addition, profit-taking among long-term investors has diminished, with holders refraining from sales. On-chain data, including Coin Days Destroyed (CDD) and Spent Output Profit Ratio (SOPR), shows cooling activity and declining sell pressure. This reinforces the bull market’s integrity and points to further upside.

10. MVRV Ratio Drops to Neutral Zone

Finally, the MVRV (Market Value to Realized Value) ratio, which compares Bitcoin’s market value to realized value, has retreated toward 2.0.

“Historically, this zone reflects neither panic nor euphoria: investors are still sitting on healthy gains, yet the market has cooled from overheated conditions. Each past cycle has shown that when MVRV consolidates around this range after an early surge, the trend often resets before entering its strongest expansion phase,” an analyst claimed.

Taken together, these signals suggest that conviction among holders is strengthening, sell pressure is declining, and the crypto market is positioning itself for further upside in October. Still, risks such as regulatory setbacks or macroeconomic shocks remain important factors to watch.