Just slightly ahead of Curve Finance, Uniswap holds the number one position as the most popular decentralized exchange. Uniswap V3 upgrade should boost this precarious lead even further.

By pioneering automated market makers (AMMs) in November 2018, Uniswap cleared the way for the decentralized future of finance. One without the influence of hedge funds as market makers, exchanges, and clearing houses, all in one corruptive package.

When JP Morgan talks of ethereum eventually outperforming bitcoin, DeFi protocols like Uniswap will drive its value. The Uniswap team teased us with a V3 upgrade just a month ago, promising the long-anticipated layer 2 scaling. Such an upgrade couldn’t come sooner, given the breakneck pace at which DeFi traffic flows into Binance Smart Chain (BSC).

BSC’s equivalent to Uniswap — PancakeSwap — reached over 2 million transactions this month, outpacing the entire Ethereum space. This is completely understandable as people flee enormous transaction fees, unbefitting of the vision of decentralized finance. As of press time, the average Uniswap Swap fee is at $50.81, according to the Etherscan gas tracker.

Let’s take a look at key Uniswap V3 features that will alleviate Ethereum’s gas crisis.

Uniswap V3 gives liquidity providers greater control

Since the May 2020 launch of V2, the pioneering DEX accounted for $135 billion in trading volume. Most of the features revolved around improving the user experience, fixing exploits, and optimizing the protocol. However, Uniswap V3 represents a true milestone thanks to the following upgrades:

Concentrated liquidity

During V2, liquidity providers (LPs) had to adjust the price of their assets across an x*y=k price curve. This made the assets reserved for the entire price range — from 0 to infinity — despite most pools not using such liquidity. When you take into account that LPs tend to earn fees on a small percentage of their assets, in addition to high slippage, such a system discourages staking.

Uniswap V3 overhauls this by giving LPs the tools to customize the price ranges of their assets instead of distributing them evenly. Therefore, each LP can create its own price curve. This has the effect of generating concentrated liquidity, rendering LP positions non-fungible.

For instance, LPs can have an ETH/USDT pairing in a single liquidity pool, setting its liquidity usage only between $2,000–$2,700. By the same token pair, a different price range could be set for the same pool. If the ETH price happens to be outside the designated range, the LP receives no fee.

Uniswap V3 will use ticks to keep the liquidity within a certain price range to facilitate concentrated liquidity. These ticks have their own LPs.

Multi-tiered fees

Under the current V2 system, Uniswap gives LPs 0.3% for each transaction, dependent on their pool share. This is in addition to the fee protocol of 0.05% on transactions, lowering LP yields from 0.3% to 0.25%, subject to governance change by vote.

Uniswap V3 makes the LPs’ fees more flexible by introducing multi-tiered fee brackets:

- 0.05%

- 0.30%

- 1%

Through governance voting, between 10% to 25% of LP fees can then be allocated to token stakers per pool. This should produce the effect of stable pools generating smaller fees than volatile pools, aligning with LPs risk.

Likewise, a greater emphasis is placed on governance voting to determine fees. Only time will tell if this will be a superior model to Kyber’s approach of providing dynamic fees.

Capital efficiency

Departing from V2, Uniswap V3 will make it possible that 100% of your asset deposit will be employed for yield farming.

Whether in stablecoin pools, or for more volatile token pairs, even if trades occur outside your set price range, when they do occur, you would be earning more from the 100% utilization of your assets.

As you can see, capital efficiency directly results from concentrated liquidity, making more fees from less. Speaking of liquidity, if a trade happens outside your set price range, your liquidity will be turned inactive. Meaning it will no longer generate fees from active liquidity.

Therefore, when we combine concentrated liquidity with capital efficiency, Uniswap parties will have to choose wisely between these approaches:

- Very high capital efficiency but very high risk.

- Wide price range but low capital efficiency.

- Several price ranges within a single pool.

Of course, to leverage active liquidity, you can use the third option and set range orders.

With the provided example, if DAI goes under $1.001 USDC, you could start your position by providing $1M DAI into the pool at the 1.001–1.002 price range. When DAI goes above $1.001 USDC, your fees start to generate. If DAI goes even further up, above $1.002, your pool converts into USDC, which you can withdraw with the accumulated fees.

BSL 1.1 license

As the king of Ethereum’s ecosystem, Uniswap’s code is often copied to repeat its success under a different team. Sushiswap is the best example of this. As a compromise between staying open-source and reducing Sushiswap-like scenarios, V3 introduces Business Source License (BSL) 1.1 for its code.

Such a license should prevent unauthorized use, making other protocols unable to use Uniswap’s code for commercial use. Following the period of two years, the code then reverts to an open-source GPL license. One could see that the very deployment of the BSL 1.1 license would be sufficient to scare off investors from tapping into competitive protocols accused of unauthorized use.

The future is bright for Uniswap

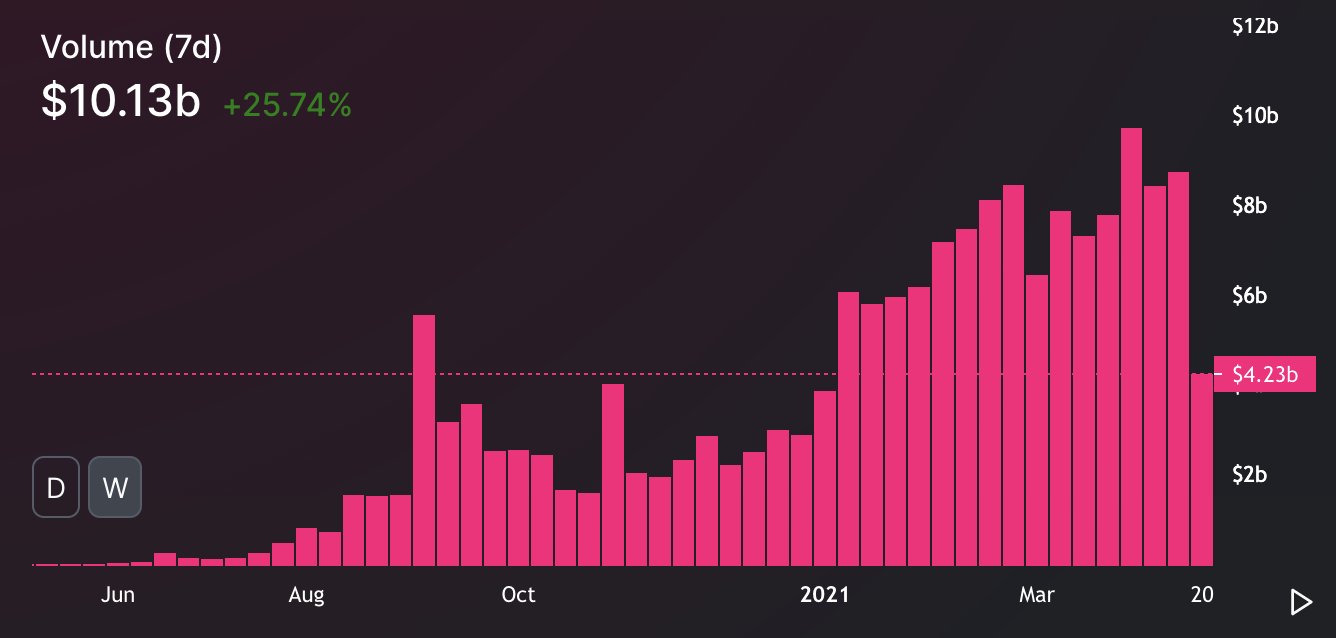

As Uniswap’s weekly trading volume surpassed $10 billion this month, there is little doubt that the protocol will become a major DeFi player in the near future. Its V3 upgrade overhauls much of the fee structure and incentives, giving LPs new tools to fine-tune their gains.

However, they will also require greater engagement. Uniswap V3 is scheduled to launch on May 5, followed suit by Optimism’s roll-out.