The TrueUSD (TUSD) stablecoin surged to to $1.20 a few days ago on the Binance exchange. A SUI farming pool on Binance is the likely reason behind the 20% surge in price.

The TrueUSD (TUSD) stablecoin has depegged on several exchanges, including Binance. Unusually, the token depegged to over $1.20 in relation to USDT on the exchange. Binance is one of the more popular exchanges for TrueUSD, with the trading platform promoting it as a zero-fee pair.

Aave and Compound Triggered the Depeg

The reason for the roughly 20% increase in price could be because of the high demand for the token, with liquidity being unable to keep up. Kaiko reported on the development, saying, “TUSD liquidity has not kept pace with its volumes, making a depegging like this more likely.”

Kaiko also noted that users on Aave and Compound began to borrow large sums of the token as the depegging began. Regarding the trading strategy employed, Kaiko stated:

“Most of these transactions appear to be organic rather than bot-driven. The most common strategy was borrowing TUSD and swapping for USDC, effectively shorting TUSD from its elevated price. However, neither Aave nor Compound have a large supply of TUSD, which meant that borrowing rates quickly surged, hitting over 100% APR on both protocols.”

What Is TrueUSD (TUSD)?

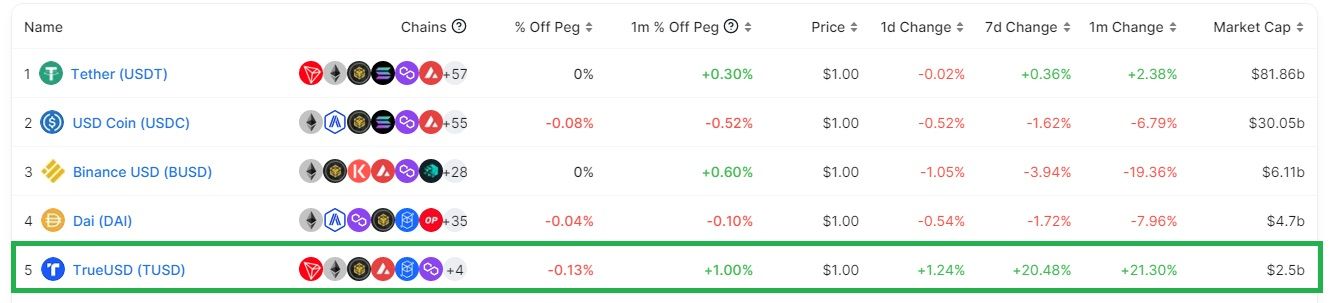

TruseUSD (TUSD) is an ERC-20 stablecoin pegged to the U.S. dollar. It has surged in market cap, becoming the fifth largest stablecoin, according to DeFiLlama. It currently has a market cap of $2.5 billion, with a 20% increase in market cap over the past week.

The reason for the increase might be the SUI farming pools on Binance. Sui is a layer-1 blockchain network, and users can stake BNB and TUSD to farm the token.

There was also some controversy after TRON founder Justin Sun sent $50 million of TUSD to Binance. The speculation was that Sun was trying to farm the SUI liquidity pools on Binance. Changpeng Zhao tweeted that Binance would take action against any farming action done. Sun reversed the transfer.

Stablecoin Supply Thinning Out

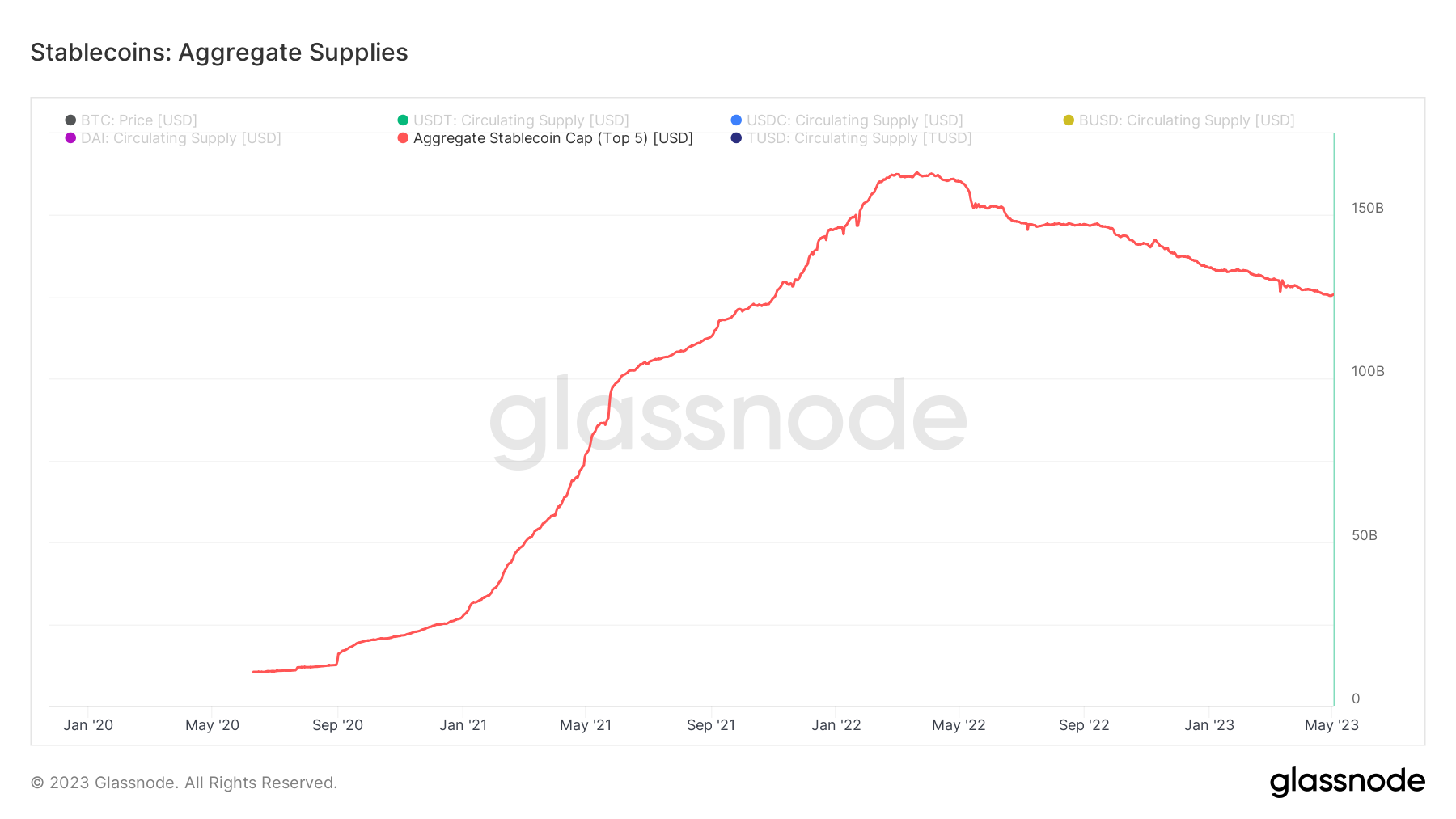

The stablecoin market has had an eventful 2023, though recent days have not been quite as optimistic. The aggregate supply of the top 5 stablecoins has dropped by around 23% this year, according to data from Glassnode.

Tether (USDT) continues to dominate the stablecoin market, with its market share rising to a 15-month high in March. Other stablecoins have taken a hit, like USDC, which saw billions in outflows a few months ago. It remains the second largest stablecoin at $30 billion, considerably behind Tether’s $82 billion.