TRUMP, the meme coin that gained attention after the much-discussed TRUMP dinner, has been facing difficult price action in recent days. The token has lost traction, with its price slipping and bearish sentiment creeping into the market.

As the price continues to struggle, the likelihood of a further decline now outweighs any potential recovery, leaving traders in a precarious position.

TRUMP Traders Face Losses

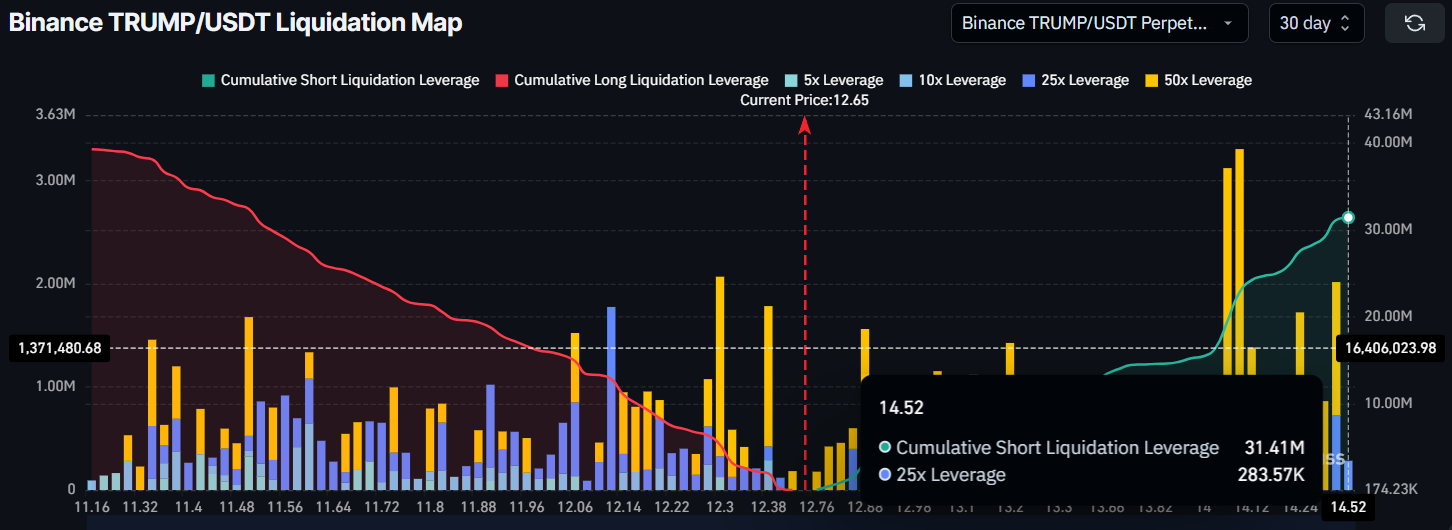

The liquidation map for TRUMP reveals data concerning traders. Approximately $31 million worth of short contracts are at risk of liquidation if the price of TRUMP rises to $14.52. This is a critical threshold for shorts, as their positions would be liquidated if the price surges beyond this point.

The demand for a price drop signals that many investors no longer believe in the potential for further gains. Instead, they are positioning themselves for a fall in price, suggesting waning optimism in the short-term outlook for TRUMP.

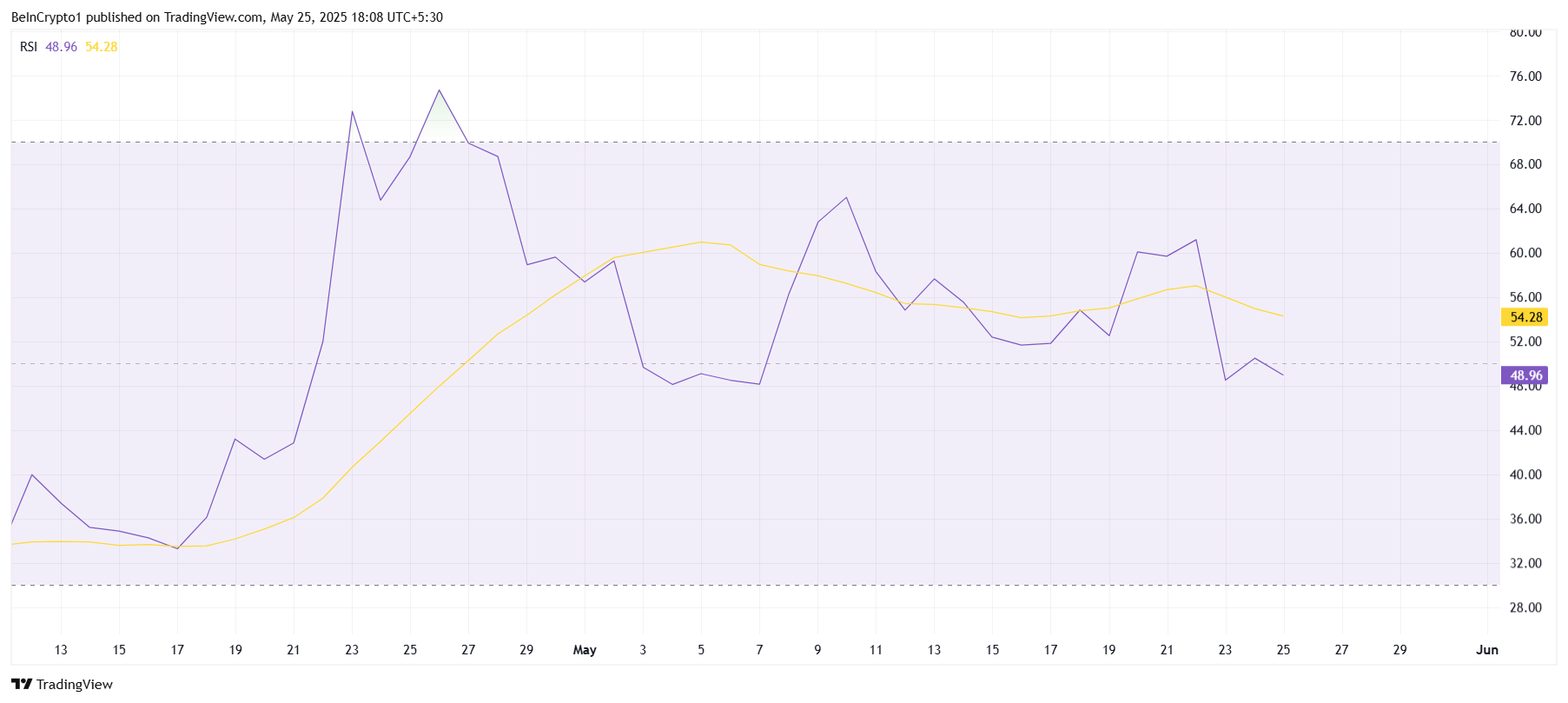

On the macro level, technical indicators paint a bearish picture for TRUMP. The Relative Strength Index (RSI) has recently slipped below the neutral 50 mark, signaling a shift into the bearish zone. This decline in the RSI indicates that the price of TRUMP is vulnerable to further downward pressure if the negative momentum strengthens.

As the RSI continues to trend lower, TRUMP is increasingly susceptible to price declines. The inability to regain bullish momentum leaves the token in a precarious state, with the potential for further losses if the current trend persists.

TRUMP Price Awaits Recovery

At $12.65, TRUMP is currently grappling with a lack of bullish momentum. Despite the hype surrounding the TRUMP dinner, the token has fallen by nearly 15% since the event, indicating that the market has failed to sustain its earlier enthusiasm.

This decline reflects broader skepticism about the token’s future performance.

For TRUMP to recover, it would need to see a significant rally, requiring a nearly 15% increase to reach $14.53. However, given the current market conditions and broader sentiment, this level seems difficult to achieve.

Instead, it is more likely that TRUMP could break through its current support at $12.18, leading to a further drop to $10.97.

That said, if there is a sudden shift in demand driven by new investors, TRUMP could see a surge. A strong push past $13.36 could set the stage for a rise to $14.53, triggering a liquidation of $31 million worth of short positions.

Such a move would cause significant volatility in the market, potentially providing a sharp rebound for the altcoin.