The TRUMP cryptocurrency has plummeted to new lows, erasing most of its value within a month. This drawdown is the result of the ongoing tariff wars waged by the US President.

Bearish market conditions have intensified the downturn, preventing any meaningful rebound. As a result, traders are shifting their stance, now favoring short positions over long bets.

TRUMP Is Losing Traders’ Favor

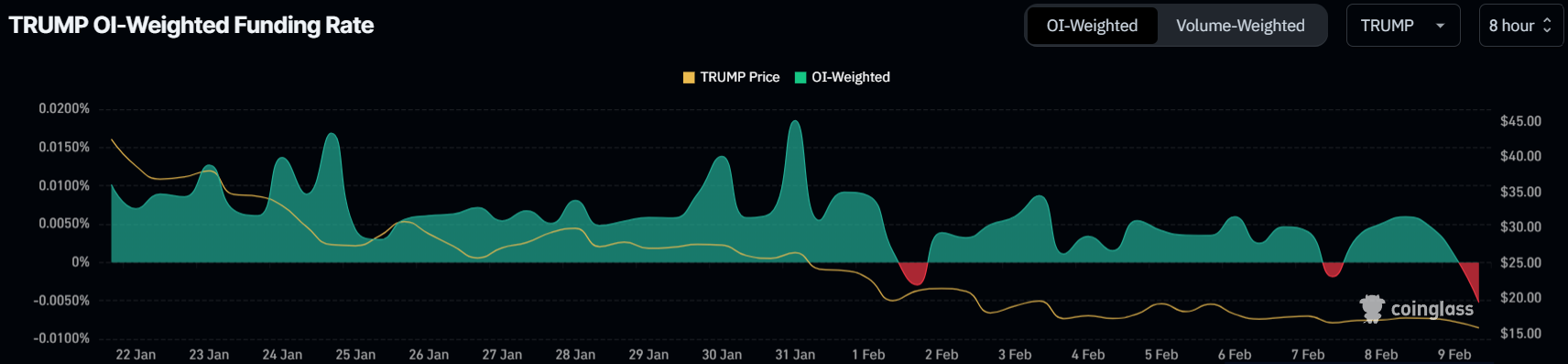

Funding rates for TRUMP have dropped to their lowest levels since mid-January, signaling a surge in short contracts. This shift suggests that traders are betting on further losses rather than a potential rebound. With fewer investors willing to enter long positions, selling pressure continues to dominate.

The lack of price stability has fueled bearish sentiment across the market. Traders are now capitalizing on the downtrend rather than waiting for a reversal. Without a change in market conditions, this negative outlook is likely to persist, keeping TRUMP’s price under pressure.

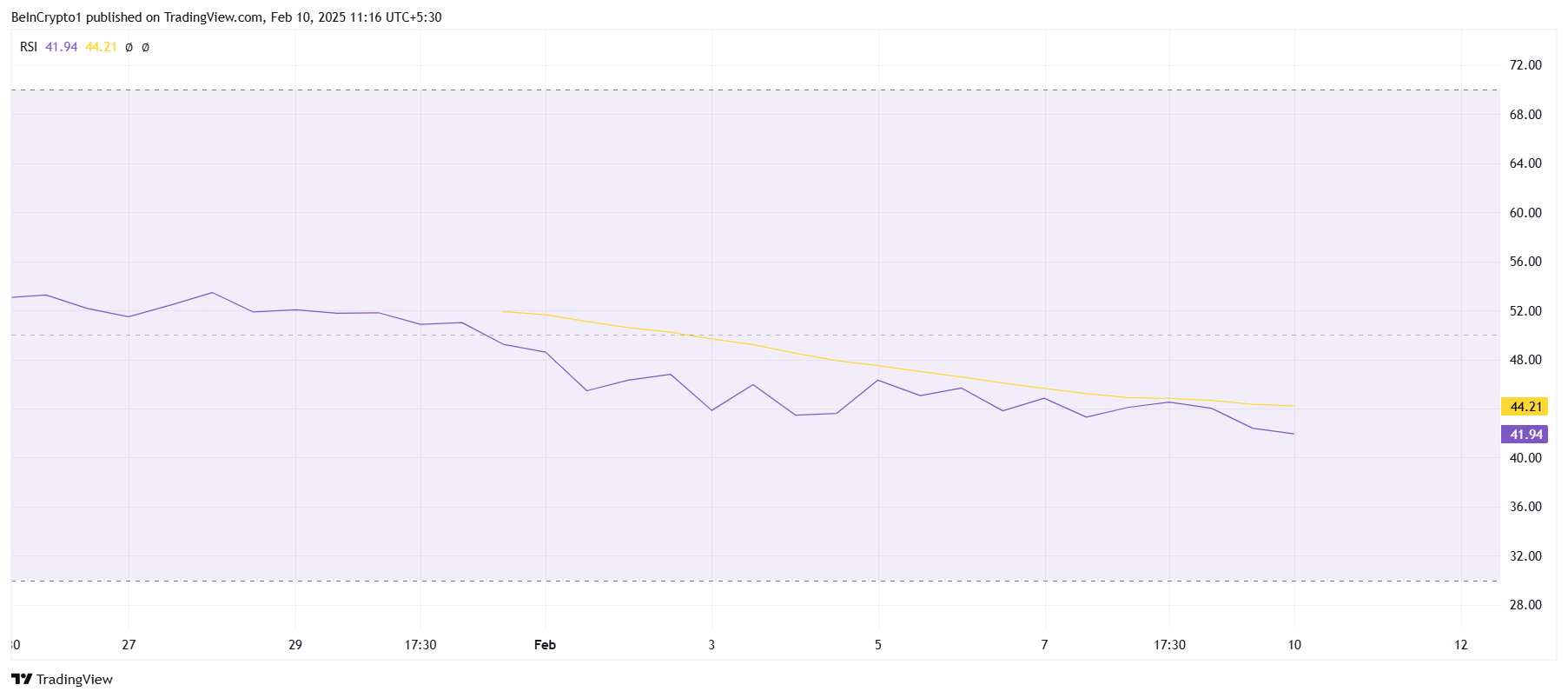

Technical indicators reflect the weakening momentum in TRUMP’s price action. The Relative Strength Index (RSI) has remained below the neutral 50.0 mark since early February, signaling continued bearish pressure. A deepening RSI suggests increasing selling activity with no immediate signs of relief.

A prolonged stay in the bearish zone often leads to extended downturns. TRUMP’s current trajectory shows no divergence, meaning the selling trend remains intact. Until the RSI moves above neutral territory, the probability of recovery remains low, and further declines could be expected.

TRUMP Price Prediction: New Lows Ahead

TRUMP’s price hit a new all-time low (ATL) of $14.29 today, marking an 11% drop in the last 24 hours. The sharp decline was triggered by the loss of $16.00 as support, which acted as a crucial level for maintaining stability. Without a swift recovery, further downside remains possible.

If TRUMP continues its downward trend, the price could soon slip below the $10 mark. A break under this psychological level would erase almost all of its value since its listing day. Such a move could intensify liquidation risks, pushing the price further into uncharted territory.

The only way to invalidate the bearish thesis is for TRUMP to reclaim the $19.58 support level. If buyers return, the price could rise toward $26, partially recovering recent losses. However, given the current sentiment, a strong, bullish reversal appears unlikely without a major shift in market conditions.