Welcome to the Asia Pacific Morning Brief—your essential digest of overnight crypto developments shaping regional markets and global sentiment.

Grab a green tea and watch this space. Trump administration officials hold more than $193 million in crypto stakes. House crypto bills drive record stock highs. Korea’s Upbit faces a potential $137 billion penalty for 9.57 million violations.

Trump Officials Hold Millions in Crypto

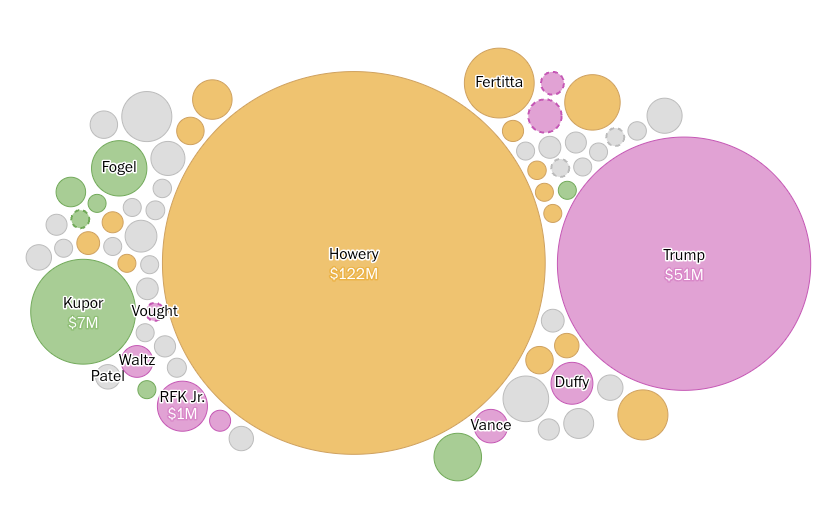

Nearly 70 Trump officials hold cryptocurrency stakes worth millions, according to a report by The Washington Post. President Trump himself holds at least $51 million in digital assets. Vice President Vance commands bitcoin reserves worth up to half a million dollars.

Seven Cabinet members maintain crypto wallets with significant holdings. Health Secretary Kennedy leads with five million in cryptocurrency investments. Justice Department prosecutors have reduced their pursuit of cryptocurrency crimes.

Tech executives like Scott Kupor and David Fogel joined the administration ranks. Ambassadors including Ken Howery and Tilman Fertitta, possess substantial portfolios. PayPal founder Howery holds a minimum of $122 million.

Biden administration officials reported zero cryptocurrency holdings in contrast. Trump’s era marks cryptocurrency achieving unprecedented governmental legitimacy. Digital asset values have doubled recently across markets.

Crypto Stocks and Digital Assets Rise on Bills

House passes crypto bills sparking massive stock surge. Coinbase climbs 3.15% to $410.75, hitting fresh record highs. Circle Internet Group gains 0.81% reaching three-week peaks.

Robinhood Markets jumps 2.13% above $105 breaking previous records. Galaxy Digital Holdings soars 7.38% as investors celebrate regulatory clarity. PayPal Holdings adds 1.22% benefiting from crypto momentum.

| Ticker | Company | Price | Change |

|---|---|---|---|

| MSTR | Strategy, Inc. | $451.34 | -1% |

| COIN | Coinbase Global, Inc. | $410.75 | 3.15% |

| HOOD | Robinhood Markets, Inc. | $105.45 | 2.13% |

| PYPL | PayPal Holdings, Inc. | $73.86 | 1.22% |

| CRCL | Circle Internet Group, Inc. | $235.08 | 0.81% |

| XYZ | Block, Inc. | $70.73 | 2.46% |

| NTHOL | Net Holding A.S. | $46.92 | 3.12% |

| GLXY | Galaxy Digital Holdings | $35.79 | 7.38% |

| MARA | Marathon Digital Holdings, Inc. | $19.97 | 2.73% |

| MTPLF | Metaplanet | $9.29 | 1.2% |

| RIOT | Riot Platforms, Inc. | $13.33 | 6.05% |

CLARITY Act targets crypto market structure oversight framework. GENIUS Act creates comprehensive stablecoin regulation guidelines nationwide. The Senate already cleared the stablecoin bill last month.

Bitcoin hovers around $119,000, showing minimal daily movement. Ethereum remains stable at $3,480 despite equity optimism. XRP surges 15% approaching its 2018 record high.

Market capitalization exceeds $100 billion for leading exchanges. Digital asset investment firms benefit from legislative progress. Regulatory clarity drives unprecedented stock market performance.

Upbit Could Face $137 Billion Fine

South Korean Lawmaker Min Byung-duk revealed that Upbit could face maximum penalty. South Korea’s largest crypto exchange violated regulations 9.57 million times. Financial Intelligence Unit found ten different violation categories previously.

Know Your Customer violations reached 9.34 million cases alone. Upbit reused old identification images instead of collecting new ones. This basic compliance failure occurred nine million separate times.

Current sanctions include a three-month partial business suspension only. Ten executives and employees received disciplinary actions recently. However, financial penalties have not been imposed yet.

Agricultural Bank received 129.6 million KRW fine for twelve violations. IM Bank paid 4.5 million KRW for single regulatory breach. Upbit’s violations dwarf traditional banking institution cases significantly.

Maximum penalties could reach 183 trillion KRW, equivalent to $137 billion, under current law. This amount exceeds most national government budgets worldwide.

Paul Kim and Shigeki Mori contributed.