In May 2021, TruePNL officially launched operations after raising a sizable $1.6 million in its then-recently concluded IDO. The company started with two product lines – a Robo-trading platform and a Launchpad for promising crypto-focused projects.

It didn’t take long from there for the TruePNL Launchpad to establish itself as the company’s flagship product.

Sure, it was not the first-of-its-kind platform targeted at crypto startups, but the company has always maintained that TruePNL Launchpad is a next-generation product that stands out in three key aspects as compared to the run-of-the-mill launchpads out there. These are:

- There are strict project selection criteria in place to ensure that only credible and high-quality projects are allowed on TruePNL Launchpad.

- The barrier to entry for investing in promising up-and-coming crypto projects has been significantly lowered for the average investor without a deep technical and investing background.

- A highly focused team comprising long-term crypto enthusiasts with an extended track record in blockchain development and marketing. The team is also backed by about a dozen global partners (so far) including the likes of Duck DAO, Gate.io Labs, Harmony, and X21, just to name a few.

So, without any further ado, let’s dive straightway into the key aspects that will eventually decide whether TruePNL Launchpad has what it takes to live up to the potential it has promised so far.

TruePNL Launchpad: An overview

The team

Let’s start with the team behind TruePNL. While we don’t have all the details about the full team, TruePNL does have two experienced leaders who have collectively spent more than a decade in establishing and heading multiple blockchain, marketing, and e-commerce businesses.

The presence of experienced leadership with a verifiable track record comes off as a big boost to TruePNL’s credibility.

TruePNL Launchpad in a nutshell

TruePNL Launchpad, the flagship product from TruePNL, is pitched as a fair and secure investment application.

The objective of the platform is to connect outstanding projects looking for a reliable and flexible launch platform with users who are in search of early investment opportunities in the next big blockchain/crypto projects.

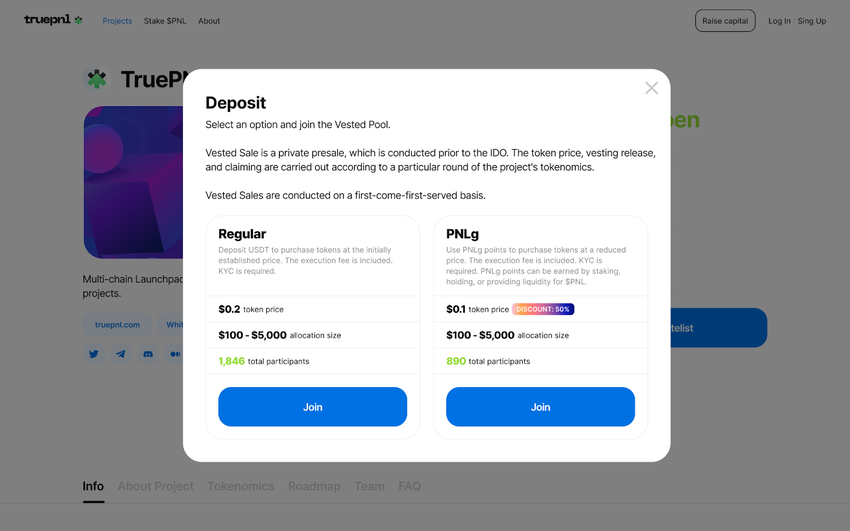

TruePNL allows KYC-verified registered users to buy tokens of promising crypto projects. Users can enter Lottery pools or take part in private (vested) sales to get sizable allocations in these up-and-coming projects just for USDT or with PNLg points.

Additionally, the launchpad offers more perks for users with PNLg, ergo, users who staked $PNL, $PNL holders, or LP providers on Uniswap/Pancakeswap.

With PNLg, any user can get a guaranteed allocation in public and vested sales, besides gaining access to exclusive private sales on the platform. Their contribution to the TruePNL ecosystem is also rewarded with a price reduction in vested sales and bigger shares in early-stage projects at lower costs.

TruePNL Launchpad: Under the hood

Here, we need to segregate the benefits promised by TruePNL Launchpad along two lines. Benefits for:

- Blockchain/crypto projects.

- Users who are interested in investing in these projects.

Basically, both projects and users get value out of it, because the goal of TruePNL is to boost the most promising ideas aimed at making the crypto world better and help them to raise funds and gain a community of loyal supporters.

Benefits for blockchain/crypto projects

Traditionally, blockchain startups with a minimum viable product (MVP) have three primary agendas — raising funds, building and nurturing a loyal community, and running promotional campaigns.

TruePNL Launchpad promises to take care of all of these three requirements by enabling blockchain projects to attract investors and raise funds by creating token exchange pools. These projects can then launch their own private and public sales using smart contracts on the Ethereum and Binance Smart Chain (BSC) networks.

At the heart of TruePNL Launchpad is a system of pools governed by smart contracts. Simply put, these pools represent various blockchain projects, each having its own unique set of rules for participation. Each pool accumulates the assets of users and in return, gives them an allocation of the newly issued tokens.

The TruePNL team claims that the launchpad they have designed guarantee the following advantages for blockchain projects:

- Safety: TruePNL launchpad promises a 100% safe and robust environment for fundraising. No upfront payments of any kind, no hidden costs, and a rigorous KYC procedure to ensure transparency.

- A fair distribution model: The main benefit from TruePNL pools is that it enables the fair allocation of tokens. The pool system, along with the robust KYC procedures ensures that bots and multi-accounts are kept out of the token allocation process. This results in a much higher probability of all interested users receiving their fair share of allocations.

- Bigger allocations: TruePNL promises significantly bigger allocations in private sales compared to most of its competitors.

Benefits for participants

The same TruePNL pool system that seems to work smoothly for up-and-coming blockchain projects works equally well for investors too. To understand how we first need to revisit the pain points that participants in most IDOs and launchpads typically suffer from.

- Complicated conditions for receiving allocations.

- Sniper bots jeopardize the impartiality of the whole allocation process by buying a sizable volume of tokens, only to sell them off soon afterward without caring two hoots about the project’s longevity or health.

- In most cases, whales or large-scale investors can throw in a lot of money to acquire a big chunk of the allocation. When that happens, the decentralization element of that particular project and the associated token starts eroding, leaving the whales with too much power to manipulate the token’s market price.

- The public sales hosted on centralized platforms (for example, IEOs) are very opaque and you’ll barely have any details about the actual participants. The centralized entity itself exclusively controls the entire allocation process.

TruePNL pools take care of these issues by using smart contracts that guarantee a transparent and secure token allocation process.

The best part is that it seems like anyone — even a relatively newbie without any deep technical/investment background can participate in the IDO rounds. In fact, they can also seamlessly participate in private vested presales, which is a key feature that allows getting much larger amounts of the project’s vested tokens at a presale price.

3 types of pools

There are three types of pools on the platform:

- PNLg pool

- Vested pool

- Lottery pool

The team regularly updates its sales regulations to extend the number of users who can join the sales. The goal here is to make the whole process easy, open to everyone, and without any complex tier systems.

While the other market players make the private sales exclusively open in exchange for substantial investments in their own product, e.g. staking a large number of native launchpad tokens, TruePNL currently offers allocations to all interested and eligible investors.

However, the Ecosystem contributors get more perks and benefits and use the internal off-chain token feature by the name of PNLg points to get discounts for allocations and increase the amount of investment.

BeInCrypto recently published an article that quickly explains how the TruePNL pool system and the allocation formula work — you might want to check it out for further details. Alternatively, you could also check out the TruePNL documentation for more details on pools.

TruePNL token ($PNL)

The PNL token is another crucial component of the broader TruePNL ecosystem. Users can use $PNL as a mode of payment in the collateral commission pool and also while participating in public sales hosted on the launchpad.

Built on Web 3.0 utilizing the Polkadot substrate, $PNL will also allow liquidity staking in DeFi products, among other usages.

$PNL staking

By staking your $PNL stash, you stand a chance to win pretty useful and possibly substantial rewards in PNLg points. You can use the PNLg points thus earned to purchase allocation in any sale hosted on the launchpad.

Since the launch of the staking feature in December 2021, TruePNL users have reportedly put around 5.5 million $PNL tokens for staking to receive PNLg points.

Depending on your preference, you may stake $PNL for 3, 6,12, or 24 months. The PNLg points you earn will be determined by the amount you stake, as well as the token lock-up period. Of course, the bigger the amount, the larger will be your PNLg rewards.

To get started, you must stake a minimum of 1000 $PNL, which amounts to $60 (approx) at the time of writing. The in-built calculator shows the PNLg reward, including the PNLg boost percentage for 12 and 24 months staking.

Additionally, you will also be receiving from 2% to 6% APY, paid in $PNL, at the end of the staking period.

For more info on $PNL staking, hop over to the staking guide on the TruePNL website.

Currently, the system allows affordable rates to enter: even the minimum staking amount is enough for a threshold required to get a share in a Public Sale, which is divided for PNLg pool and the Lottery pool, the second being the easiest way to get an allocation. However, a great amount of pure luck is needed to win any lottery so the Lottery pool is based on the random selection of users who end up getting a share of tokens

The project is also in the process of delivering a new utility feature to PLNg, which is to provide a fee reduction in Vested Sales of the platform: there will be two options to get the presale tokens, and by using PNLg points users will get their allocations at the lower price.

The update went live on March 11 and it will be applied to all upcoming private sales.

Other important aspects of the TruePNL ecosystem

A new DeFi index protocol

While quickly reaching a series of milestones, growing the number of launches, and expanding the community, the team has kickstarted another product within the ecosystem – Merged Finance, a multichain DeFi index protocol. The beta of the protocol is expected to go live by the end of Q1 2022.

With 1,000 waitlist subscribers already on board, Merged Finance has bagged a grant worth $50,000 from Harmony. The team overseeing the project now plans on integrating the Harmony blockchain in the foreseeable future.

Check out this space for more details.

Increasing focus on P2E, metaverse, and NFT-related projects

The TruePNL team is always keeping a close tab on emerging new trends and ideas such as play-to-earn titles, NFT gaming, metaverses, DeFi farming aggregators, and so on.

Current sales and projects USPs overview

We skimmed through some of TruePNL’s current launch selections and found the following high-potential projects plus current sales that are worth looking at:

Project type: P2E Games

- Nomad Exiles – a Play-to-Earn RPG game with integrated DeFi farming, NFTs, and free-to-play mechanics. The project is approved by numerous top-ranking launching platforms besides TruePNL.

- Wizardia – a Play-to-Earn online role-playing strategy game with unique NFTs at its core.

- Degen Gang – this title offers a more elaborate play-to-earn gameplay metaverse with two separate token utility implications. Degen Gang is about getting exclusive entry to the virtual Degen Bar by owning the project’s NFTs, which allows taking part in Bar Fights and Poker Games, enjoying Live music and events, buying items in the Shop, and more.

Project type: DeFi

- Lyber – first European neo-bank specializing in digital assets allowing its users to invest, send and spend their assets easily.

- DeFiYield an accessible DeFi yield farming ecosystem and cross-chain investment protocol designed as a single place for anyone to participate in DeFi created to provide safety in investing for those wishing to engage in and succeed in the new finance revolution.

- UNO Farm – a cross-chain auto-farming solution with transparent automated strategies and analytics. Users can easily enter the best DeFi yield opportunities and leave their farms for several months, without the need to do re-compounding manually.

Check out the Launches section on the app for a comprehensive list of projects launched by TruePNL Launchpad.

Before moving on, it is worth mentioning here that the way TruePNL has handled the Plutonians vested sale demonstrates its flexibility and ability to quickly accommodate changing market dynamics.

To quickly elaborate, as sluggish market conditions made everyone act more cautiously, TruePNL first tried a new approach of getting smaller private allocations for its community. However, in the case of the Plutonians vested sale, the platform decided to follow the current demand and ended up quickly increasing the vested pool 3x because every new batch was otherwise getting swept away almost immediately.

Final remarks

Overall, although the project is still at an early stage, TruePNL has so far shown some serious potential given that the demand for convenient and profitable DeFi solutions is constantly on the rise. On that count, it is worth considering the project as a viable investment option in the long run. As always, we plan on keeping a close eye on the TruePNL ecosystem to get you all the info you could use before making that decision.

Meanwhile, you might want to follow TruePNL on social media for regular updates: