A transaction from a wallet holding almost $1 billion in Bitcoin has attracted the attention of crypto enthusiasts.

The anonymous owner with 31,010 BTC is regarded as one of the wealthiest holders of the pioneer cryptocurrency.

Trackers Spot Bitcoin Whale

According to the blockchain monitoring tool, Bitcoin Block Bot, the BTC was transferred from an unidentified wallet. This address had no link to any known platform or exchange.

A closer look at the wallet reveals that it had made a total of 35 transactions since it was created.

The owner drained the wallet’s contents, leaving a final balance of about 0.0043 BTC (~$139 at current price).

Historical records from BitInfoCharts shows that the whale has been a long term “Hodler.” The wallet has always maintained a balance of 31,010.01 BTC since it was funded on Oct. 26, 2018. The total amount was worth around $202,000 at that time.

This mammoth BTC chunk was transferred to two different addresses with a transaction fee of just 0.00015 BTC worth approximately $5.

Given that these bitcoins were not sent to any known exchange, it could be surmised that the whale was attempting to reduce risk. Sharing the wallet’s content could reduce the chance of losing the entire stash in case of any eventuality.

The BTC owned by this anonymous owner accounts for approximately 0.17% of Bitcoin’s total supply.

Shrinking Whale Population

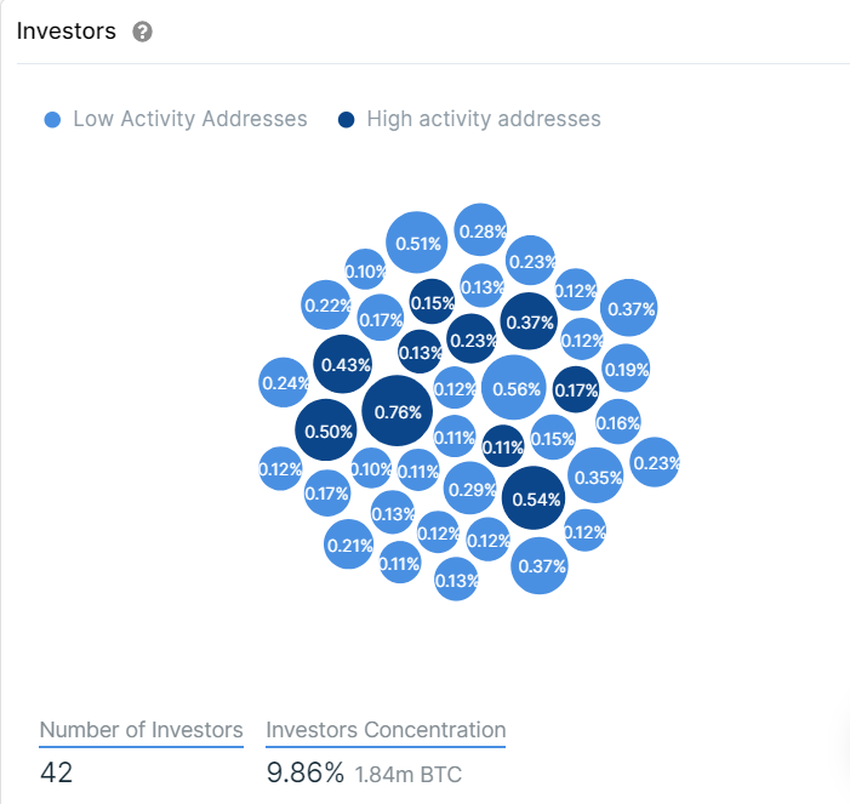

Statistics from data aggregator, IntoTheBlock, shows an existing scarcity for large holders of Bitcoin. No single wallet holds 1% of the circulating supply of Bitcoin. Moreover, just four wallet addresses hold ≥ 0.5% of the minted coins.

Only 42 wallets hold ≥ 0.1% of the circulating supply. These whales cumulatively control 9.86% of all mined coins amounting to 1.84 million BTC.

Interestingly, the bubble chart further highlights the level of activity from each wallet. Activity, in this case, refers to the frequency of transactions recorded from these addresses.

The darker bubbles represent the wallets with over 300 transactions, while the lighter colors have recorded below this figure since their creation. The information gathered from this tool distinguishes long-term holders from other investors.

This indicates a decline in long-term holders. With the increasing supply shock on Bitcoin, this pool may continue to shrink.