Toncoin’s (TON) price has seen relative stability in recent price action, holding firmly above the $5.49 support level. However, for true recovery and significant growth, TON needs to flip the $5.96 resistance into support.

Only after crossing this threshold can TON unlock its potential to deliver substantial profits to investors.

Toncoin Has a Challenge

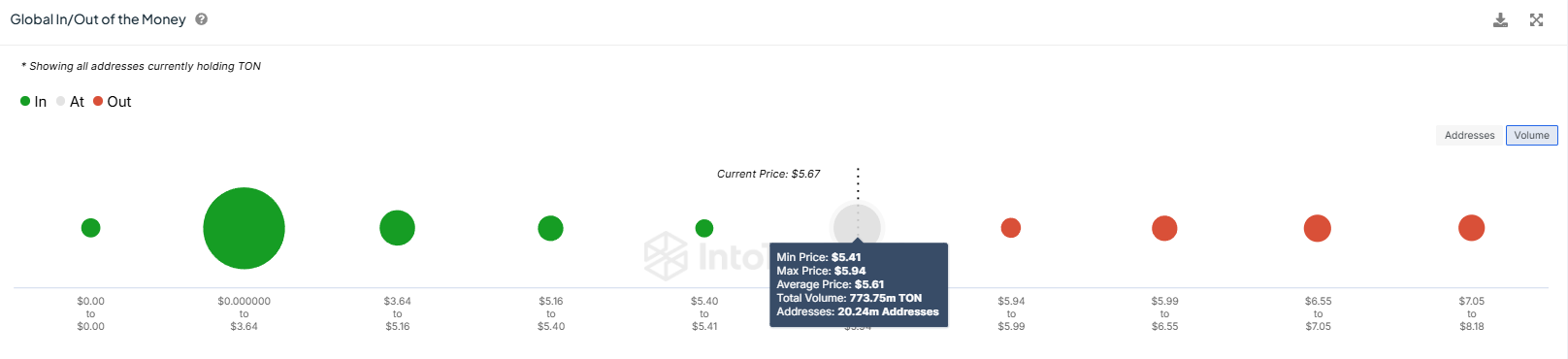

Toncoin is on the verge of a major profit breakthrough, potentially bringing billions of dollars into the market. Data from the Global In/Out of the Money (GIOM) indicator reveals that around 773 million TON tokens, worth approximately $4.2 billion, were purchased between the price levels of $5.41 and $5.94. If TON manages to break past the $5.96 mark, the entire supply purchased within this range would turn profitable.

This surge in profitability could lead to increased bullish sentiment, as investors who have been holding Toncoin for an extended period would be incentivized to maintain their positions. This scenario could further drive up demand, pushing Toncoin’s price higher as more investors enter the market to capitalize on potential gains.

Read more: What Are Telegram Bot Coins?

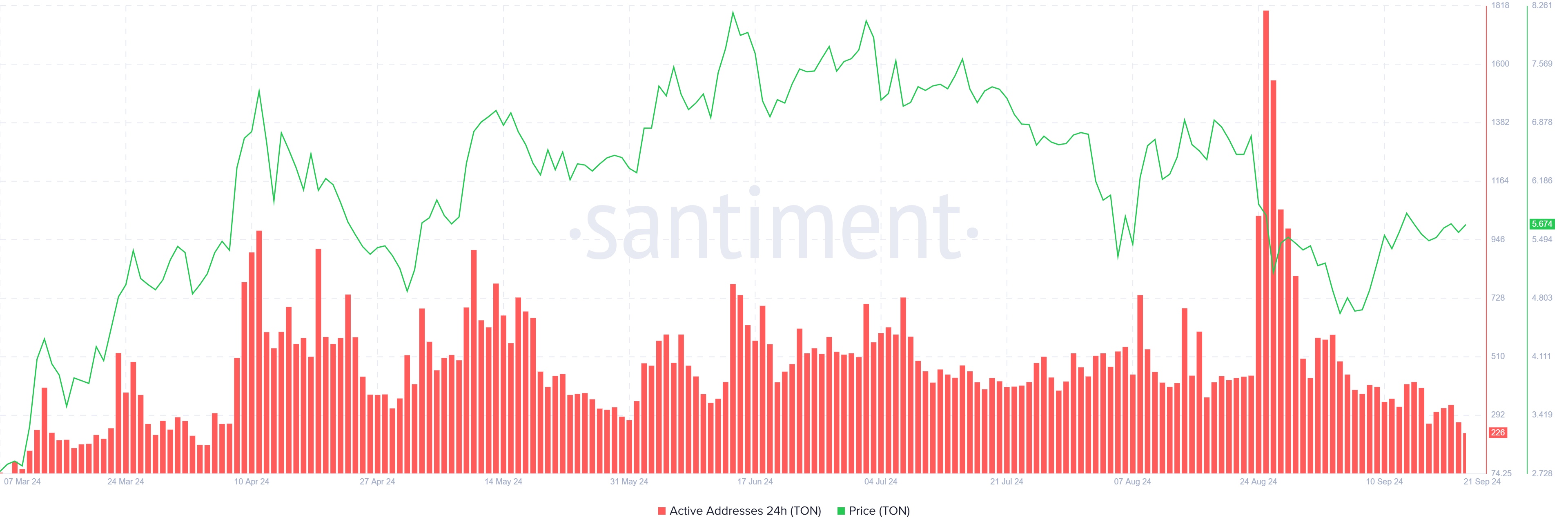

However, despite this promising outlook, Toncoin is facing some challenges in its macro momentum. Active addresses on the Toncoin network have dropped to a five-month low, indicating a lack of investor participation. This decline in active addresses points to uncertainty among traders, who may be cautious about the token’s future potential.

For Toncoin to regain its momentum and see stronger upward movement, it will need to attract renewed interest from both retail and institutional investors.

TON Price Prediction: Consolidation Ahead

Toncoin is currently trading at $5.61, hovering just above the critical support level of $5.49. While this suggests that TON is holding steady, the mixed signals from the market point towards a bearish-neutral outlook. Investors remain cautious, making a significant price surge less likely in the immediate term.

Given the current sentiment, Toncoin is expected to continue consolidating between $5.49 and $5.96. This sideways movement will likely delay any breakout above the upper limit, potentially keeping the token in its current range for a while.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

However, if bullish momentum overtakes bearish sentiment, Toncoin could breach the $5.96 barrier. This move would trigger profits for holders of the $4 billion worth of TON supply bought between $5.41 and $5.94, thus invalidating the bearish-neutral outlook and setting the stage for further gains.