For most of the week, the Toncoin (TON) price remained range-bound at $5. This movement contradicts previous signals that the altcoin’s value would trade much higher.

While TON still has the potential to go beyond the current levels, recent data shows that it could take some time as it could undergo a brief decline before that. Here is how.

Toncoin Flashes Bearish Signs

One key factor that could lead to a further decline in Toncoin’s price is the Daily Active Addresses (DAA) divergence. This metric tracks whether an asset’s price moves in tandem with user activity on its blockchain.

When both price and active addresses rise, it’s considered a buy signal, suggesting the cryptocurrency’s value may climb. Conversely, a drop in user interaction signals potential price weakness.

Data from Santiment shows that TON’s DAA has plummeted by 138.59% in the past 24 hours. This sharp drop suggests that many active users who traded the token yesterday have stepped back, signaling a bearish outlook for the price.

Read more: What Are Telegram Bot Coins?

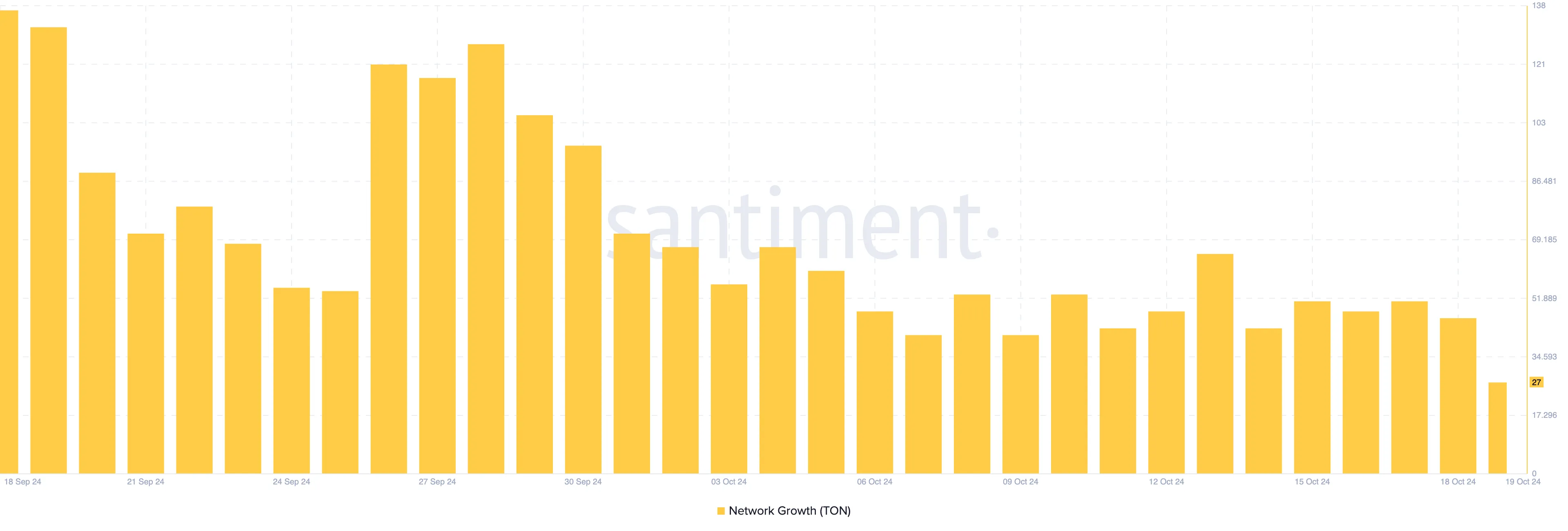

Another indicator contributing to this decline is Network Growth, which tracks the rate of new user adoption. When network growth increases, it signals a rise in the number of new addresses completing their first successful transactions, suggesting growing traction on the network. Conversely, a decline in network growth indicates a slowdown in this activity.

Regarding price movements, an increase in this metric can often precede a significant price surge. However, in TON’s case, the metric has declined, suggesting that TON may experience a short-term price dip.

TON Price Prediction: Run to $7 Delayed

An assessment of the TON/USD chart shows that the Chaikin Money Flow (CMF) has dropped significantly. The indicator’s primary purpose is to distinguish between periods of accumulation and distribution.

When the CMF is above the zero line, it indicates that the cryptocurrency is experiencing net accumulation. On the other hand, a reading below the zero signal indicates that the distribution is higher.

As seen below, the CMF is down to -0.22, suggesting that Toncoin is facing a high level of selling pressure. Should this continue, TON’s price might fall below the $5.05 support and hit $4.69.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Meanwhile, if bears halt their momentum, bulls could take advantage of the fatigue. In that scenario, buying pressure might become higher, and TON’s price could climb toward $6 or as high as $7.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.