The price of Toncoin (TON), the cryptocurrency linked to the popular messaging app Telegram, has maintained a downtrend in the past week.

Trading at $6.85 at press time, the altcoin currently sits at a weekly low, having declined by almost 10% in the past seven days.

Toncoin Continues to Witness Rising Selling Pressure

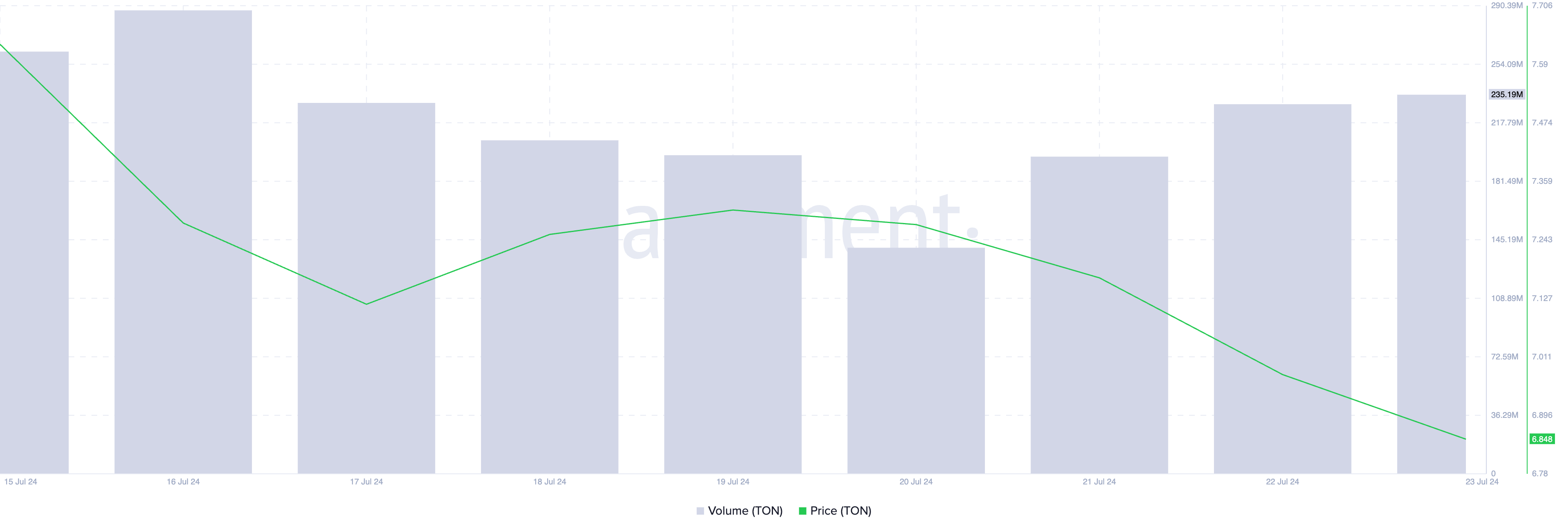

TON’s price has fallen by 3.19% in the past 24 hours, while its trading volume has risen by 6% during the same period. This creates a negative divergence, hinting at further price declines in the short term.

A price drop accompanied by a spike in trading volume is generally a bearish signal. It suggests that many investors are selling the asset, driving the price down.

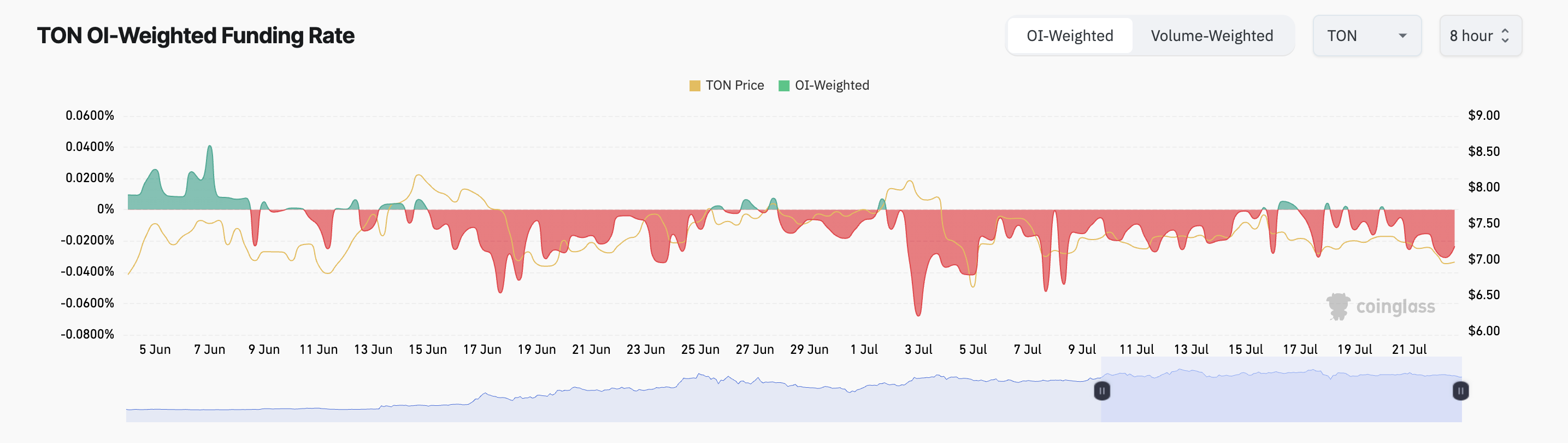

The steady fall in TON’s value during the week in review has caused many futures traders to go for short positions. This can be gleaned from the altcoin’s predominantly negative funding rate since the beginning of July. At press time, TON’s funding rate across cryptocurrency exchanges is -0.023%.

Read More: 6 Best Toncoin (TON) Wallets in 2024

Perpetual futures contracts use the funding rate to keep the contract price in line with the underlying asset price

When an asset’s funding rate is negative, it indicates more traders are taking short positions. This suggests that more traders anticipate a decline in the asset’s price compared to those buying it, hoping to sell at a higher price.

TON Price Prediction: The Altcoin is Primed For Further Devaluation

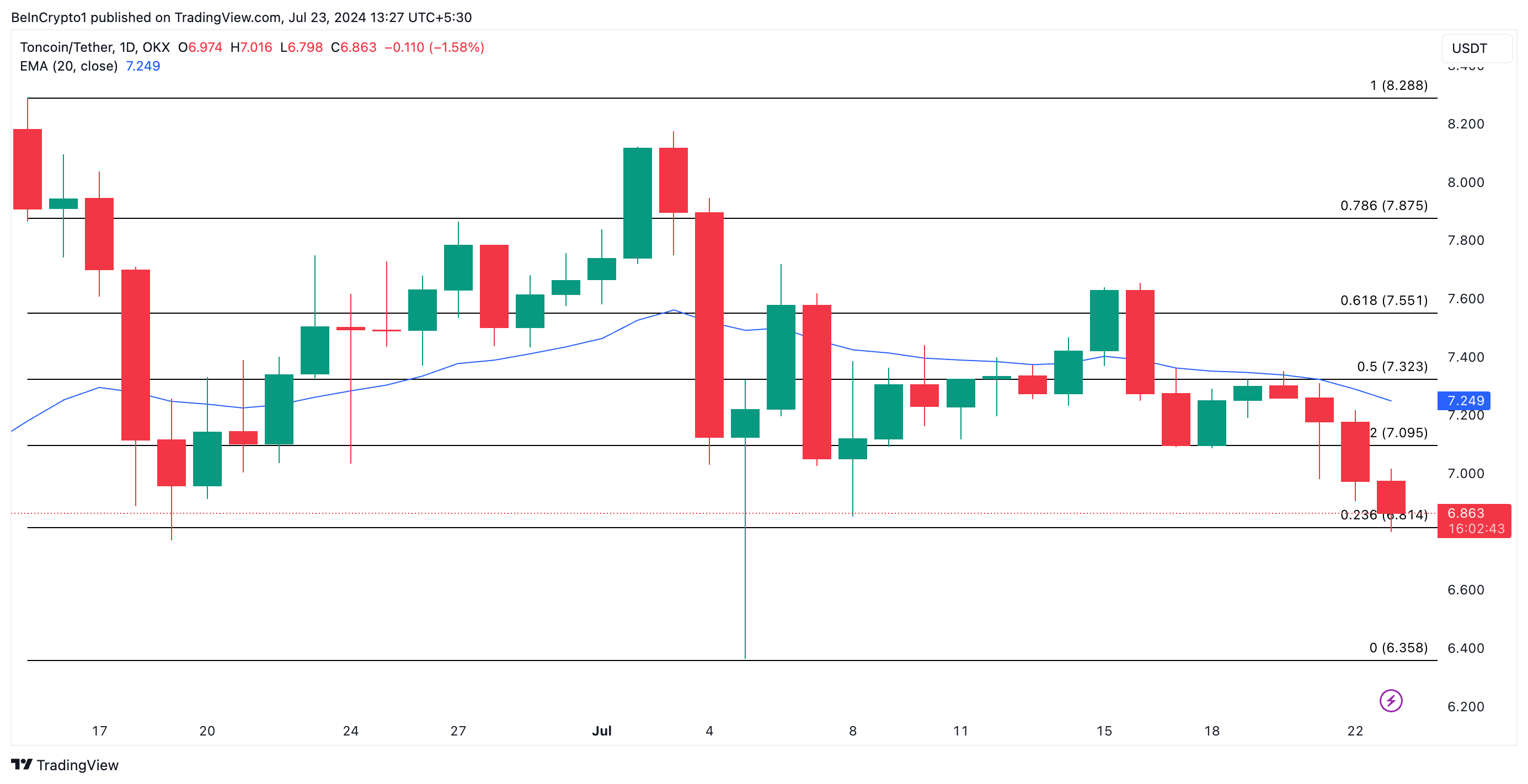

The steady decline in TON’s value in the past few days has pushed its price below its 20-day exponential moving average, which tracks its average price over the past 20 trading days.

When an asset’s price falls below its 20-day EMA, it often signals a potential bearish trend or short-term weakness. It suggests that the asset’s recent momentum is declining, and a downtrend might be starting or continuing.

If this downtrend continues, TON might fall to a monthly low of $6.35.

However, if the market trend shifts from bearish to bullish and the demand for the altcoin spikes, TON’s price may rally to $7.09, invalidating the bearish thesis above.