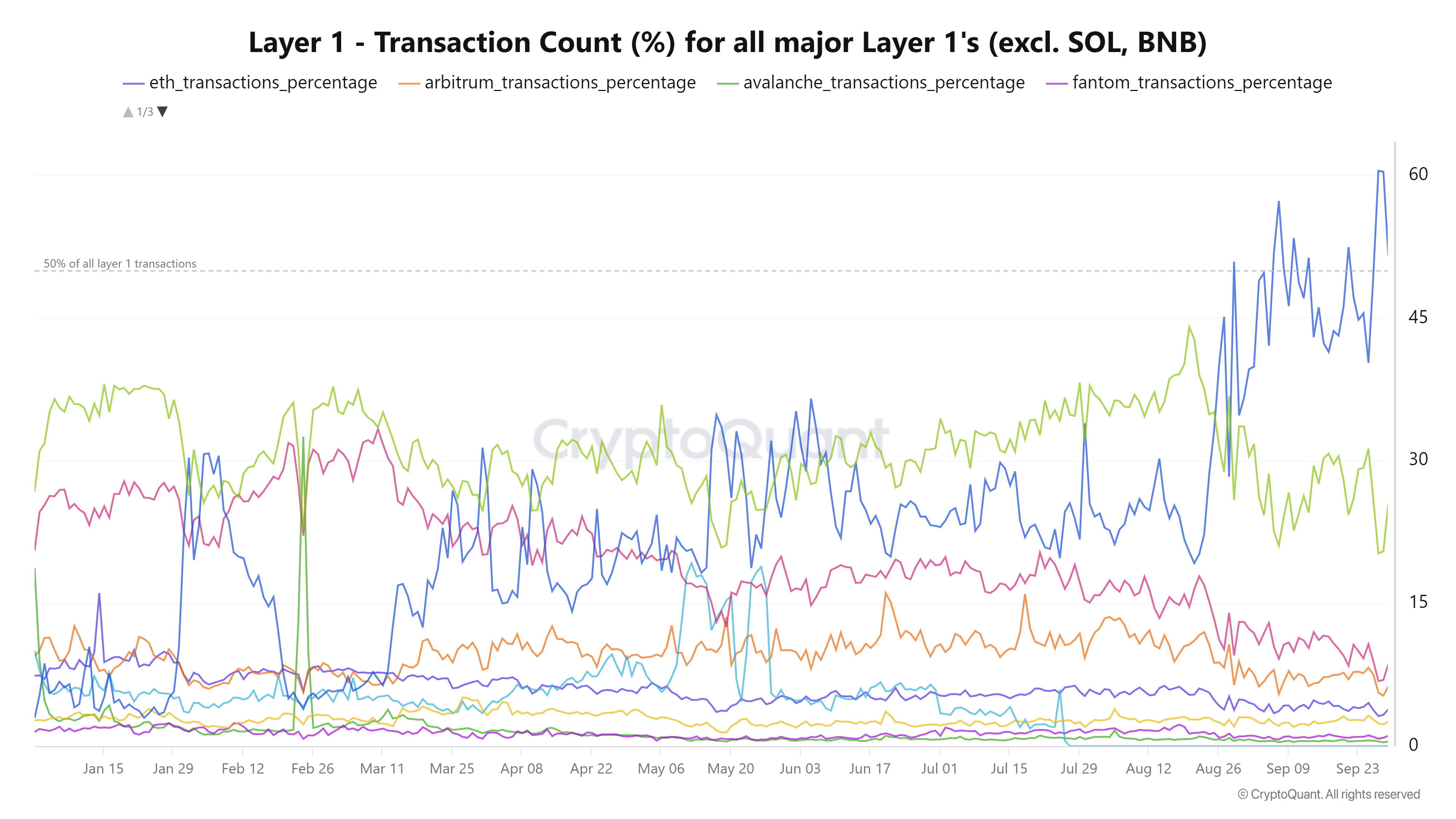

The Open Network (TON) emerges as a leader among Layer-1 networks, accounting for a significant proportion of transactions in the L1 space in September.

TON blockchain gained mainstream attention in 2024, ascribed to a series of Telegram-related projects launched atop its network.

TON Blockchain Leads L1 Transactions in September

CryptoQuant data shows TON is the most popular L1 on transaction volume metrics, accounting for 50% of the market in the last month. The report ascribes this traction to major token launches atop its network, including viral tap-to-earn games Hamster Kombat and Catizen and other projects like DOGS and Watbird.

Indeed, these clicker games have been instrumental in the growth of TON ecosystem. As BeInCrypto reported, the DOGS meme coin reached 17 million token claims shortly after its launch on The Open Network.

It also achieved 28 million monthly active users (MAU) in August and surpassed 5 million unique wallets, effectively becoming one of the most popular meme coins by holder count. Its utility within the Telegram ecosystem boosts engagement and sets it apart from other meme coins.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

Similarly, Hamster Kombat recorded a meteoric rise. It climbed to the third-fastest app in history to reach 150 million users shortly after launch. In late July, the game reported upwards of 300 million users, marking a remarkable record in Web3 game development since its March debut.

Likewise, Catizen has been instrumental in the success of TON blockchain. Amid its soaring popularity, Binance and Coinbase exchanges adopted its native token, CATI. The individual and joint successes of these projects, among others, have seen TON blockchain dominate L1 transaction volume.

In a recent podcast, Collin Wu and WuliGy compared TON and other projects to help clarify strengths and weaknesses. According to them, TON leads in GameFi, enticing users to participate more with unpredictable rewards.

“The ecosystems behind these tokens have huge potential, especially in regions like CIS, South Asia, and areas where credit cards are less common. As they gradually embrace Web3 and crypto payments, the growth potential is immense,” Collin Wu and WuliGy said.

Read more: What Are Telegram Bot Coins?

With TON dominating the gaming space, total value locked (TVL) on the blockchain is up by almost 40% in September, moving from $311.66 million to $431.98 between August 27 and September 30, DefiLlama data shows.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.