For some institutional investors, trading ETH below $2,000 represents an opportunity rather than a risk, despite growing concerns about expanding unrealized losses.

ETH has now entered its sixth consecutive month of decline. This marks the longest losing streak since the 2018 downtrend.

Tom Lee and K3 Capital Boost ETH Holdings as Staking Ratio Hits Record High

According to Lookonchain, Tom Lee — founder of Fundstrat and head of Bitmine — executed large ETH purchases during the third week of February.

On February 18 alone, Bitmine acquired an additional 35,000 ETH worth approximately $69.37 million. The purchase included 20,000 ETH, valued at $39.8 million, from BitGo, and 15,000 ETH, valued at $29.57 million, from FalconX.

K3 Capital also made a significant move. Data from OnchainLens shows that a wallet linked to the investment fund purchased 20,000 ETH worth $40.08 million from Binance.

These sizable transactions reflect strong long-term conviction in ETH, even as the asset trades below $2,000.

Data from CryptoRank indicates that long-term investors have increased Ethereum accumulation during the current downturn.

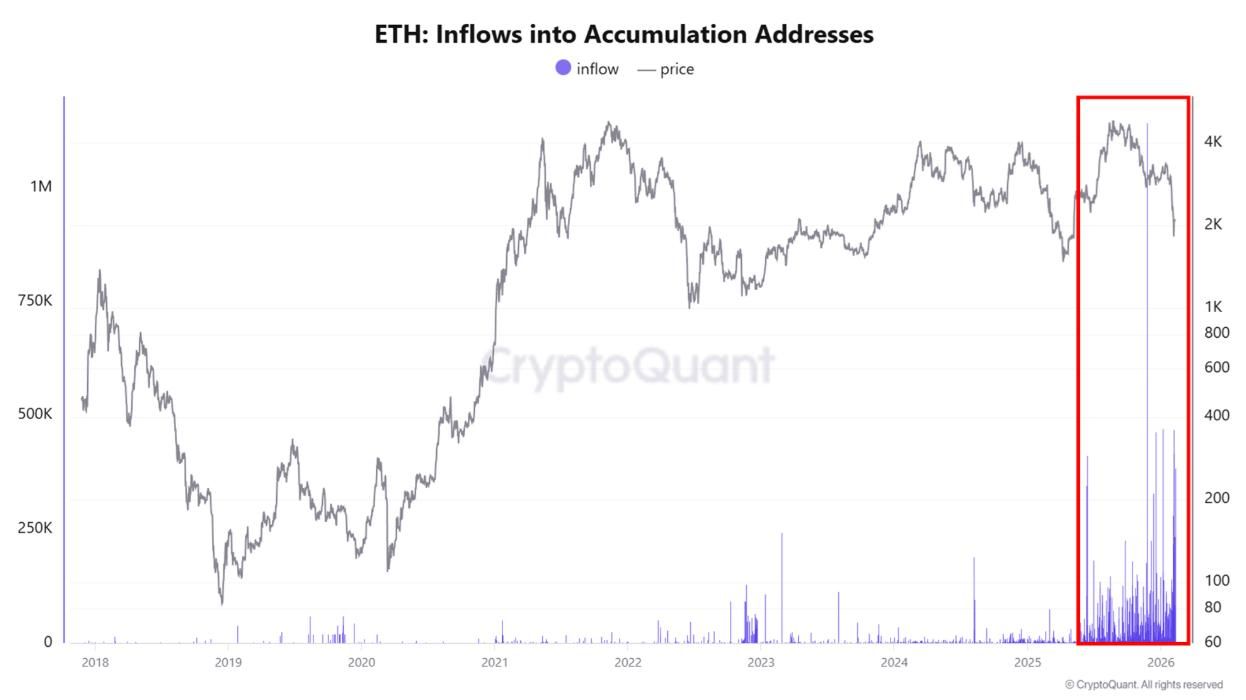

Meanwhile, data from CryptoQuant shows that inflows into ETH accumulation addresses over the past six months have reached the most active period in history. History shows that in 2018, ETH experienced seven consecutive months of decline before recovering.

“The whales and the largest banks are buying and building on ETH. These are the highest inflows into whale‑accumulation wallets we’ve seen. Meanwhile, retail has abandoned it and is calling for its failure. They’re tired and exhausted after watching the price chop inside this massive range for five years.” – Crypto investor Seth commented.

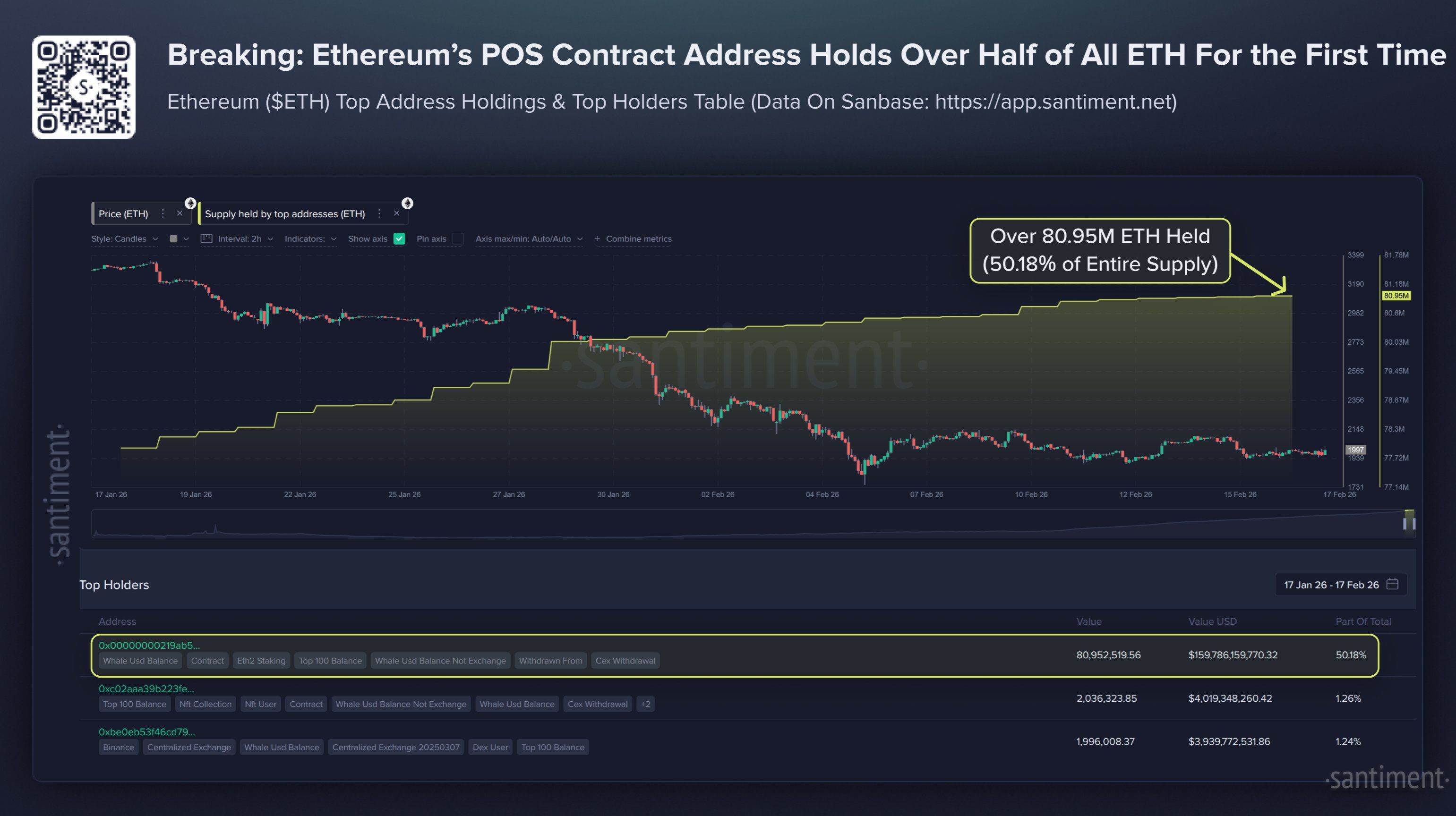

Another key milestone has emerged. For the first time in Ethereum’s 11-year history, more than half of the total ETH supply has been staked.

On-chain data platform Santiment reports that over 50% of the ETH supply now resides in the Proof-of-Stake (PoS) contract.

This contract functions as a one-way vault. Investors deposit ETH into staking to secure the network. Staked coins temporarily leave circulation and cannot be traded.

Staking activity has continued to rise, particularly during bearish cycles. As more ETH becomes locked, the liquid supply declines.

“When over 50% of the supply is locked in staking, liquid supply shrinks. Fewer coins are available for trading. That reduces sell pressure and makes the market more sensitive to new demand.” Validator Everstake stated.

Everstake clarified that 50.18% represents the total ETH held by the Ethereum PoS contract address, while the remaining 30% is active stake.

However, recent analysis by BeInCrypto does not rule out the possibility that ETH could decline further to $1,385 in the short term, amid the most negative market sentiment seen in years.

Even if that scenario unfolds, on-chain data suggests that large investors and institutions continue to position for a long-term recovery.