NFTs belonging to the bankrupt crypto hedge fund Three Arrows Capital (3AC) have been sold by Sotheby’s in New York.

In an auction on Friday, the first lot of 3AC NFTs sold for a total of over 2,482,850 USD. The funds will be used to help repay the company’s creditors.

Cryptopunks and BAYC NFTs Among Three Arrows Collection

Prior to filing for bankruptcy in July 2022, 3AC had amassed an impressive collection of NFTs.

In February, the insolvent fund’s liquidator, Teneo, published a full list of the non-fungible tokens that it intends to sell. Items the fund held include rare digital artworks by Joshua Bagley, Dmitri Cherniak, and Tyler Hobbs. It also owned several Cryptopunks, a Cryptokitty, and a Bored Ape Yacht Club (BAYC) NFT.

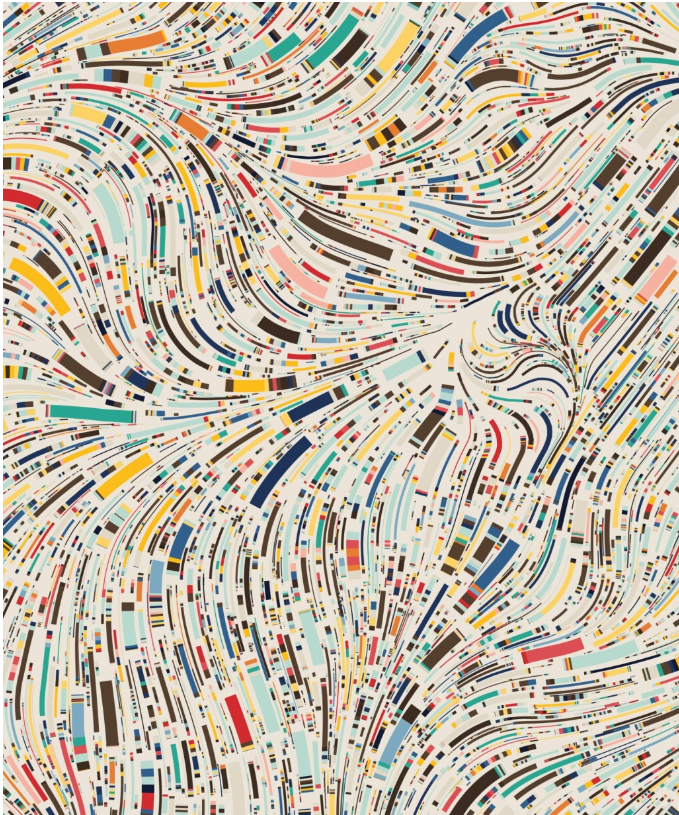

In Friday’s auction, Sotheby’s curated a collection of artworks from Hobbs’ Fidenza project, Cherniak’s Ringers collection, and Larva Labs’s pioneering NFTs, including Autoglyph #187 and Cryptopunk #1326. Overall, seven generative artworks were included in the lot.

In a catalog for the “GRAILS” collection, Sotheby’s stated that it represents “a fascinating exploration of the intersection of art and technology, and offers a unique perspective on the potential of algorithmic art to push the boundaries of creativity in the digital age.”

The highest-priced NFT from the first installation of the Grails collection was Fidenza #725. The piece sold for $1,016,000 USD, well above its estimate of $120,000-$180,000.

Going forward, Sotheby’s will continue to help Teneo offload 3AC’s NFT assets.

As the auction house states on its website, the collection will be released in chapters across various sales formats ranging from private sales to auctions. These will occur across multiple locations globally.

Sotheby’s Doubles Down on NFT Sales

While rival fine art auction house Christie’s may have beaten it off the mark with its seminal NFT auction of Beeple’s The First 5000 Days, Sotheby’s hasn’t exactly been resting on its laurels.

Following on from its first NFT sale in April 2021, Sotheby’s has become increasingly involved in the world’s high-end NFT market. And the auctioneer was a natural choice for the 3AC liquidators.

Earlier this month, Sotheby’s announced its intention to expand its own dedicated NFT marketplace.

In a move that sees the nearly 280-year-old institution step into direct competition with native digital platforms like OpenSea, the new marketplace will enable peer-to-peer NFT sales, executed on Ethereum and Polygon.

What’s more, Sotheby’s will use smart contracts to ensure artists generate resale royalties for every secondary sale.

Starry Night Portfolio Remains Off Market For Now

In addition to the digital artworks in the GRAIL collection, Three Arrows also held NFTs via Starry Night Capital.

Launched in mid-2021 during the height of the early NFT boom, Starry Night was a dedicated NFT fund. It worked worked with the collector and influencer Vincent Van Dough to snap up prized pieces. By one estimate, the fund had spent over 21 million USD in the short time it was active.

However, as 3ACs insolvency proceedings unfold, liquidating the Starry Night portfolio has proven complex. So far, only NFTs held directly by the Singaporean hedge fund have been cleared for sale.

According to the blockchain analytics firm Nansen.ai, NFTs collected by Starry Night were moved to a Gnosis Safe address in November 2022. This suggests that they are being kept secure pending a court order that will allow Teneo to sell them.

Furthermore, the liquidator has stated that the future of the Starry Night collection is subject to a high court application in the British Virgin Islands.