In today’s on-chain analysis, BeInCrypto takes a look at a rarely used indicator that appears to have just signaled the end of a bear market. The transfer volume in profit – as this indicator is referred to – has ended a nearly 2-year downward trend in recent days. For Bitcoin, this could be one of the early signals of the start of a new bull market.

Transfer Volume in Profit is calculated based on the number of transferred coins whose price at the time of their previous move was lower than the price during the current transfer. It is worth mentioning that spent outputs with a lifespan of less than an hour are discarded. This is done in order to reduce the noise coming from the ongoing trading of the asset.

On the long-term chart, we observe that the transfer volume in profit experiences very high volatility. It is observed even for 7-day (168h) and 10-day (240h) moving averages (MA). The volatility of this indicator ranges between 25-80%.

Naturally, the upper ranges of the percentage of transfer volume in profit are observed during short-term upward trends in the BTC price. Lower ranges are seen during short-term downward trends. At the same time, the long-term upward and downward trends of this indicator correspond to bull and bear markets on Bitcoin. Despite this, they still run in a wide range of tens of percent.

Transfer volume in profit bounces off of the bottom

Over the past few days, well-known on-chain analyst @SwellCycle tweeted a series of charts about the transfer volume in the profit indicator. His goal was to try to capture the moment of the reversal of the downtrend, which both on Bitcoin and on our indicator has been going on for a long time.

However, it is worth noting that the downward trend in the transfer volume in profit has been going on since the beginning of 2021, or almost 2 years. Thus, Bitcoin’s all-time high (ATH) of $69,000 in November 2021 was already reached during a clear downward trend in this on-chain indicator. The largest percentage of the transfer volume in profit came in early 2021 when BTC was heading toward its first peak at $64,900 in April.

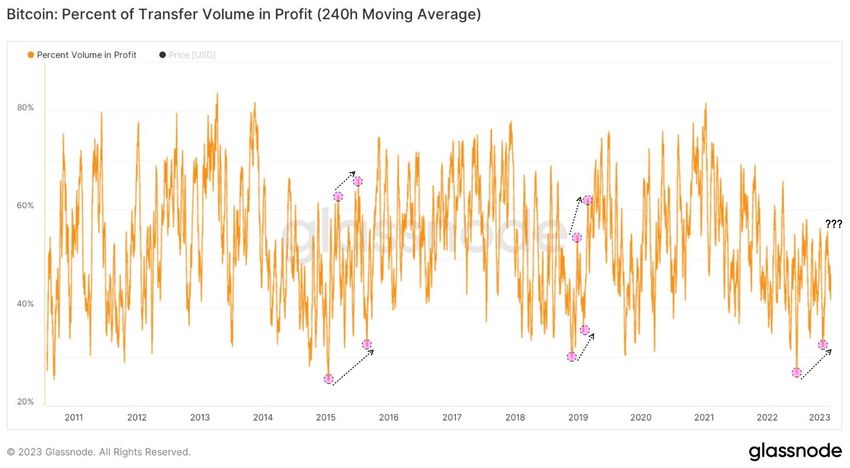

In the first chart from January 5, we see the percentage of transfer volume in profit, where the turning points of the two previous bear markets are marked (arrows and pink circles). The first occurred in 2015. At the beginning of the year, the indicator recorded a macro bottom, followed by a higher bottom in the second half of the year. At the same time, the chart generated two higher peaks, which confirmed the change in trend to bullish.

The same scenario played out at the end of 2018 and the beginning of 2019, with a macro bottom and a higher bottom confirmed by two higher peaks.

Also, in the current bear market, we could see the macro bottom of the indicator near 25% (May-June 2022 – Terra LUNA crash), followed by a higher bottom in November (FTX crash). The next signal, confirming the end of the downtrend, would have to be a strong breakout of the indicator towards the first higher peak.

Indicator breakout confirms bullish reversal

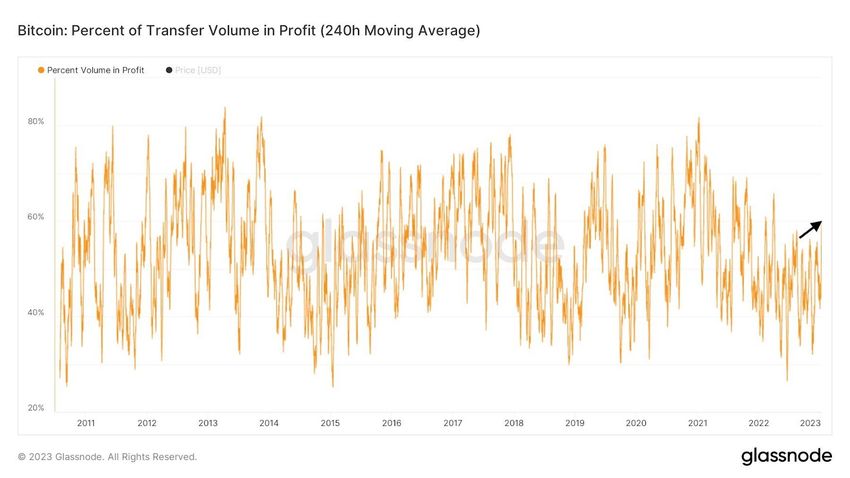

Indeed, the breakout has occurred. On the updated version of the chart of our indicator from January 11, we see a clear breakout that reaches above the previous peaks (black arrow). This means that another element of the historical pattern has just been confirmed.

The generation of the first higher peak is the penultimate signal that gives us a percentage of transfer volume in profit. If another higher peak appears in the following weeks or months, Bitcoin’s bullish trend reversal will be confirmed.

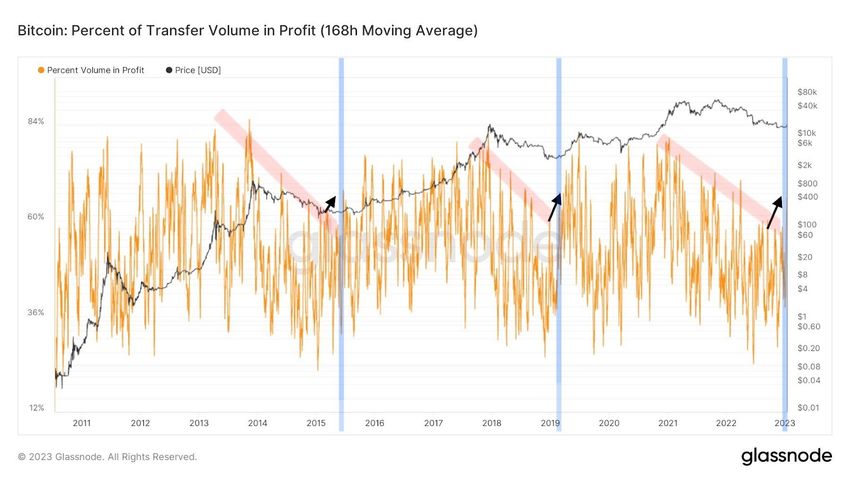

In the last of his series of charts, @SwellCycle also added a chart of the BTC price to the indicator. This helps to further define the turning point of Bitcoin’s bearish trend, after which the long-term uptrend began (blue area and arrows).

However, two more things should be emphasized here. First, the blue areas did not signal the start of large increases. Rather, they can be seen as signals of the end of declines and ongoing accumulation. The biggest increases in the BTC price did not appear until about 12-18 months later.

Second, the end of declines does not mean that BTC price lows no longer appeared after the blue areas. On the contrary, in both historical cycles Bitcoin still reached deep price lows – in August 2015 and March 2020. However, neither of them were lower than the macro bottoms reached earlier.

In conclusion, there is a chance that the percentage of transfer volume in profit will realize a similar pattern as at the end of the previous two bear markets. If so, Bitcoin has already reached the macro bottom of this cycle at $15,476 in November 2022. This does not mean an immediate rally to new peaks, but it does give hope that the cryptocurrency bear market has come to an end.

For BeInCrypto’s latest crypto market analysis, click here.