On Monday, stablecoin issuer Tether (USDT) released its assurance opinion for Q2 of 2023, verified by BDO, an independent accounting firm. But questions remain about why the stablecoin issuer has not yet produced a full audit report. Does the company have something to hide?

The Consolidated Reserves Report (CRR), released on July 31, is a snapshot of the company’s assets as of June 30. BDO’s work reveals that Tether’s reserves remain extremely liquid, with 85% of its investments held in cash and cash equivalents.

SponsoredTether Once Again Avoids a Full Audit

If you believe the new attestation, Tether (USDT) appears to have excess reserves of about $850 million. Bringing its total excess reserves to approximately $3.3 billion at the end of Q2.

Tether’s consolidated total assets amount to at least $86,499,251,218, while its consolidated total liabilities come to $83,200,775,340, of which $83,178,020,411 relate to digital tokens issued. (All figures USD.)

In theory, an attestation confirms the accuracy of financial data. But it has a much narrower scope and requires only that the external company validate whether a particular statement is true. Whereas an audit thoroughly examines the entire financial state of a company.

Tether’s choice to continue to use attestations—and not audits—to prove its stability and solvency is controversial. After all, why not be as transparent as possible if there is nothing to hide?

The stakes are high, too. Tether is by far the most popular stablecoin and the third most popular cryptocurrency overall, according to CoinMarketCap.

What’s more, the entire crypto paradigm is supposed to rest on transparency. The sight of one of its biggest players opting for half-measures stains the reputation of the entire sector.

SponsoredIf the industry’s biggest players cannot be expected to be fully transparent, a dangerous precedent comes into being.

Stablecoins Require Trust and Transparency

For companies like Tether, that issue asset-backed stablecoins, transparency of reserves is paramount. Without them, issuers cannot build trust in the stability of their product.

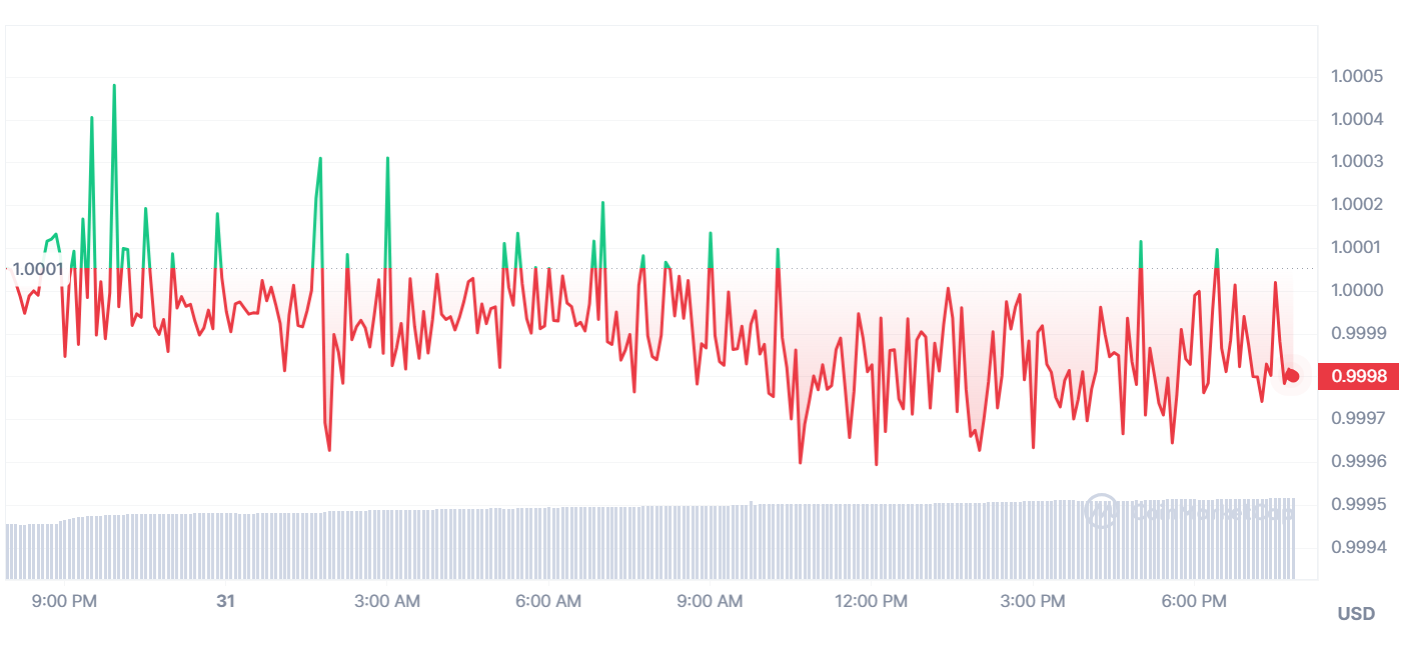

In order to maintain the peg of their stablecoin, issuers hold non-blockchain assets equal to the value of the circulating supply of their stablecoin. In this instance, Tether appears to be in good health.

However, without an audit, we cannot see the full picture. A fact that draws criticim from current and former regulators. One of whom recently called Tether “a mammoth house of cards.”

Algorithmic stablecoins work slightly differently, by controlling the supply of the token to maintain a level price.

Tether is not the only crypto big beast to avoid a full audit. Last year, on December 7, Binance, the largest crypto exchange on the planet, released an agree-upon-procedure (AUP) from Mazars for its Proof-of-Reserves.

With an AUP, the auditor provides factual findings without giving an overall opinion on the financial statements. To the untrained eye, they can look just as thorough. But AUPs only provide a snapshot of a particular area that the client has requested be looked at. Whereas an audit is a full and fair analysis.

Shortly after, on December 16, Mazars suspended all work with the crypto industry, citing “concerns regarding the way these reports are understood by the public.”

BeInCrypto has reached out to Tether for comment but at the time of publication, had received no response.