American brokerage firm TD Ameritrade announced its plans to invest in a new cryptocurrency exchange offering spot and futures trading.

US-based brokerage firm TD Ameritrade threw its hat into the cryptocurrency ring this week by announcing a new venture with Virtu Financial — and other investors — to open a digital currency exchange called ErisX.

The platform is set to launch in Q2 2019 and will support storage and trading of Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, as well as offering physically delivered futures contracts.

Old Dog, New Tricks

TD Ameritrade has historically dealt in traditional investment options — like stocks, mutual funds, futures contracts, and exchange-traded funds — on its existing online platform.

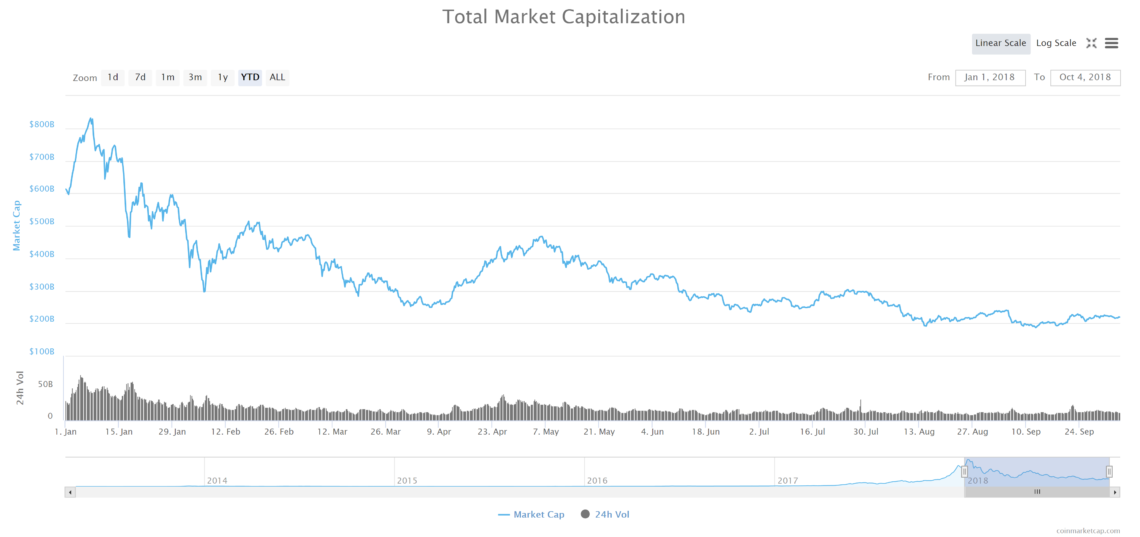

Opponents of digital currencies will be quick to point out the massive losses suffered across the board in the cryptocurrency market while citing a 600 billion dollar market cap correction since reaching an all-time high of 800 billion at the beginning of the year.

Managing director of futures and foreign exchange for TD Ameritrade JB Mackenzie remains confident.

A Positive Trend

TD Ameritrade’s ErisX platform will be hot on the trail of a similar platform set to be launched next month called Bakkt, created by ICE Futures U.S. and ICE Clear U.S.

Similar to the goals of the Bakkt platform, ErisX aims to clear a pathway for large-scale institutional investors to move into the market safely and securely by providing a storage and trading platform which will be fully compliant with the United States rules and regulations pertaining to the trading of digital assets.

This is of the utmost importance, as these entities cannot afford to invest large amounts of capital in platforms or organizations which operate outside of the legal limits of the United States.

This trend could potentially bring in enormous waves of investors who are on the sidelines waiting for the proper channels to open and are not yet comfortable investing in the current market and its ‘wild west’ state of affairs.

Do you think new exchanges like ErisX and Bakkt will open the door for institutional investors and a large influx of capital in the digital asset markets? Let us know your thoughts in the comments below!