Wall Street is embracing a new trading mantra, the TACO trade, short for Trump Always Chickens Out. This repurposing comes as markets digest another cycle of tariff threats and reversals from US President Donald Trump.

Financial Times columnist Robert Armstrong originally coined the TACO trade in early May. He referred to a pattern in which Trump’s aggressive tariff announcements spark market downturns, only for subsequent retreats to trigger rebounds. Traders are now anticipating and exploiting this cycle.

Wall Street Bets on Trump’s Walkbacks With the TACO Trade

The strategy gained fresh relevance this week after Trump once again walked back sweeping tariffs introduced on April 2, dubbed “Liberation Day,” that targeted nearly every US trading partner.

Market chaos ensued, prompting the president to reverse course days later. Still, new tariffs aimed at specific industries followed shortly after, and Trump publicly pressured Federal Reserve (Fed) Chair Jerome Powell to cut interest rates, before stepping back yet again.

According to Armstrong, the recent rally has much to do with markets realising that the US administration does not have a high tolerance for market and economic pressure. This means it could back off quickly when tariffs cause pain.

CNBC’s Megan Casella also questioned Trump about it, and the president bristled and called it “nasty.”

“You call that chickening out? It’s called negotiation,” Newsweek reported, citing Trump.

While the president defended his approach, market participants saw a clear pattern and were betting on it. The strategy has extended beyond equities.

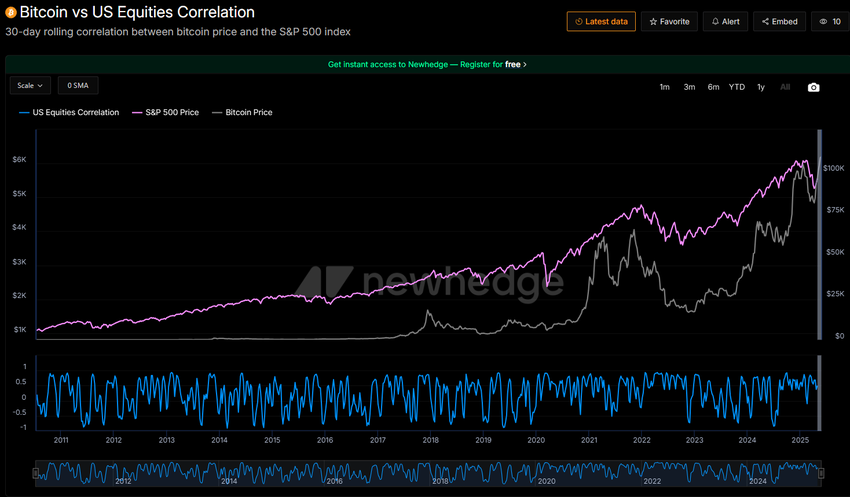

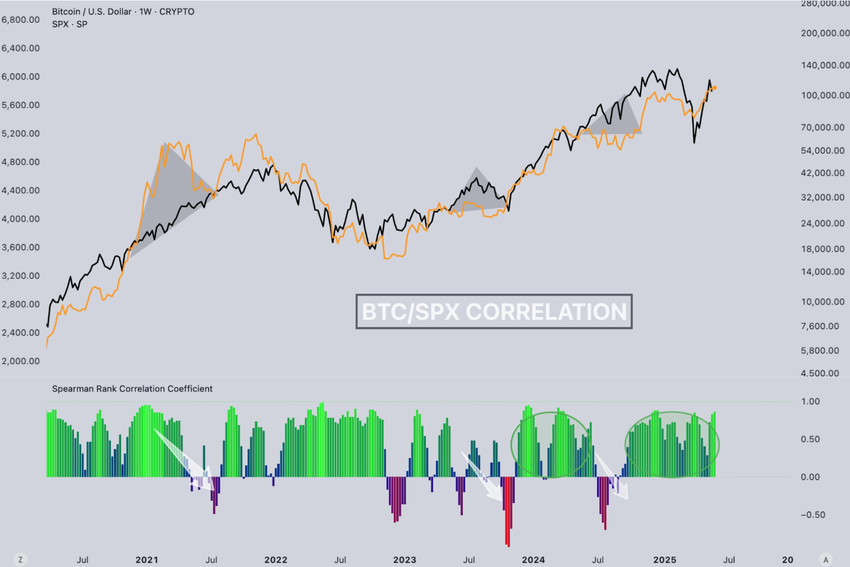

In a sign of the growing impact of macro narratives across asset classes, the correlation between Bitcoin and the S&P 500 has surged to its highest level in months.

Bitcoin Follows S&P 500 as TACO Effect Spills Into Crypto Markets

This convergence has traders wondering whether the TACO trade is bleeding into crypto markets.

“Bitcoin has once again re-synced with the S&P 500…Every time correlation drops, skeptics claim Bitcoin has decoupled. But time and time again, the correlation returns, and often marks the beginning of a bigger move,” noted analyst Volodymyr on X.

Meanwhile, CryptoRank.io notes that Bitcoin outperformed Gold and the S&P 500 in April, despite early-month volatility.

“The correlation between BTC and the S&P 500 remains strong. The S&P 500 only slightly outpaced Bitcoin, suggesting that BTC closely tracks the index’s dynamics… but with higher alpha,” read the post.

With Trump delaying the next round of EU tariffs until July 9, markets are bracing for another round of threats, walk-backs, and likely rebounds.

The TACO trade and the assumption that Trump’s bark is worse than his bite continue to guide investor behavior across traditional and digital markets.