SUI and Solana have recently made headlines with a notable shift in institutional interest. Over the past few weeks, SUI has gained significant traction, surpassing Solana to become one of the top assets for institutional inflows.

The question now arises: Is this a temporary trend, or are institutions genuinely shifting their focus toward SUI as the next big contender in the blockchain space?

Sui Overtakes Solana

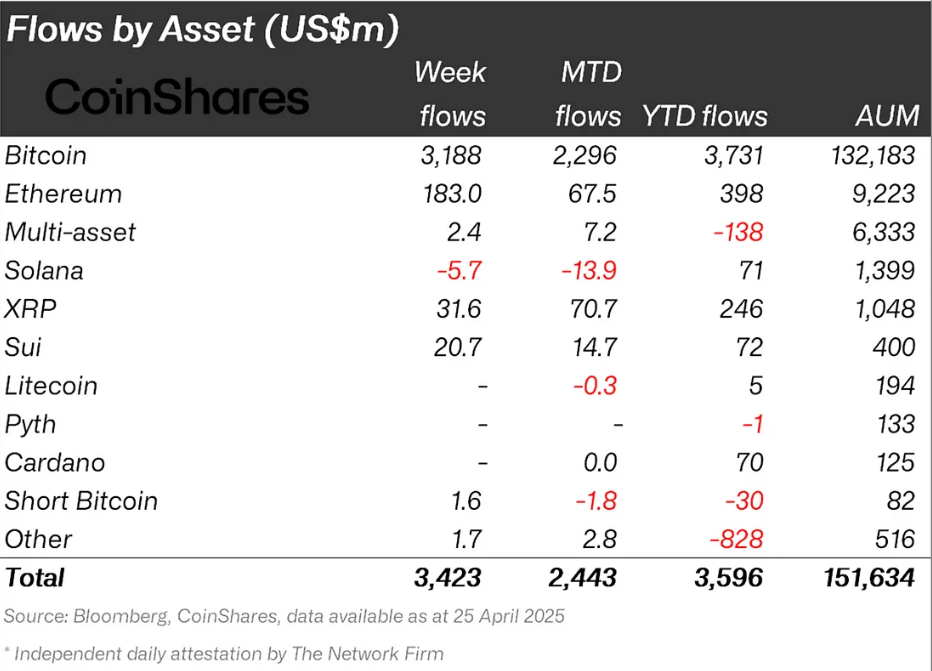

April proved to be a crucial turning point for SUI as it surpassed Solana in terms of institutional inflows. SUI attracted $14.7 million in inflows. Meanwhile, Solana saw $13.9 million in outflows during the same period.

Even year-to-date, SUI is giving tough competition to Solana, with inflows of $72 million. This shift in investor sentiment could indicate a broader change in the market, signaling that institutions are favoring SUI over its well-established counterpart.

The trend is particularly interesting, given the performance of both assets. While Solana has long been seen as a strong player in the blockchain space, SUI’s recent rise suggests that investors may be diversifying across leading platforms.

Juan Pellicer, Senior Research Analyst at IntoTheBlock, shared similar views with BeInCrypto regarding SUI.

“Institutions are diversifying rather than replacing Solana with SUI. Some capital has shifted, with cues that 60% of Solana’s outflows moving to SUI, drawn by its growth potential and newer technology. Yet, Solana’s $73 billion market cap, established ecosystem, and strong ETF momentum keep it a mainstay, complementing SUI’s role in diversified institutional portfolios,” Pellicer told BeInCrypto.

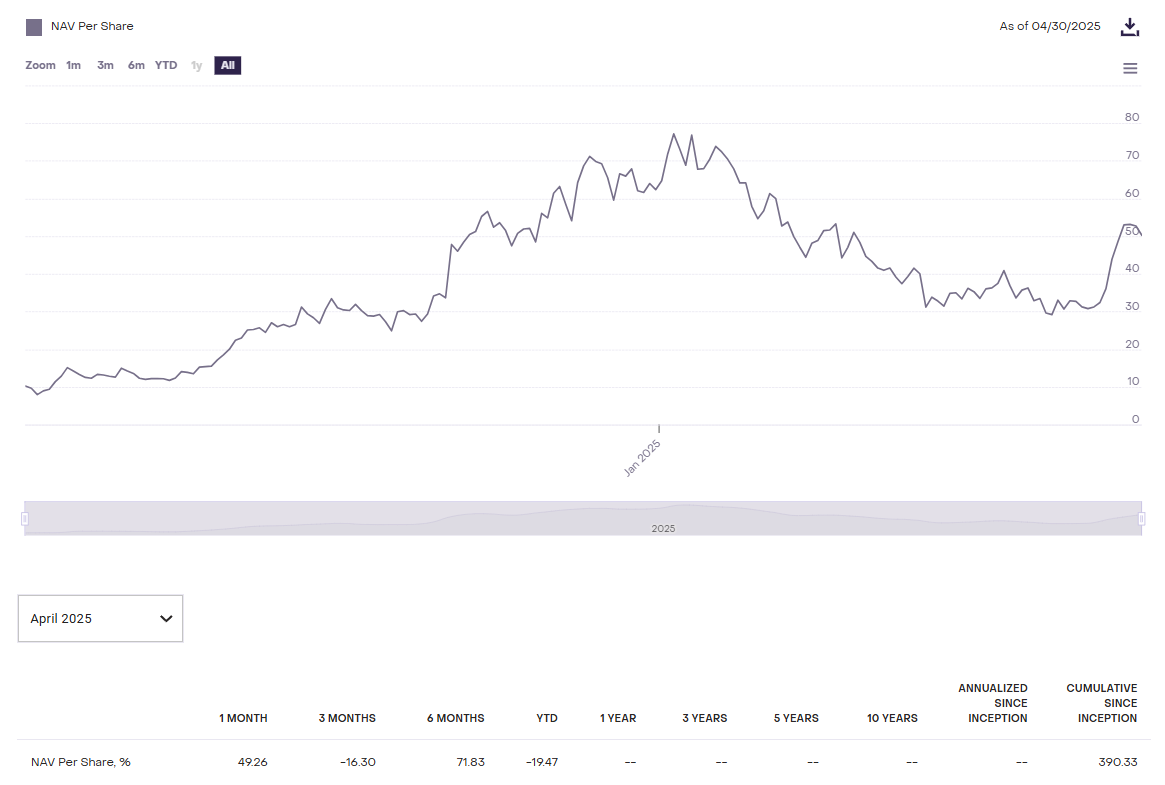

The macro momentum of both assets is also worth considering, particularly when comparing the Grayscale Trusts for SUI (SUIFUND) and Solana (GSOL). Over the past six months, the net asset value (NAV) of Grayscale’s SUI Trust saw a positive 71.8% change, while Solana’s NAV remained flat.

This stark contrast in performance highlights the differing demand for these tokens and the subsequent impact on their associated investment vehicles.

Furthermore, CBOE recently filed for SEC approval for Canary Capital‘s SUI ETF. However, Pellicer believes that this may not be happening anytime soon.

“A SUI ETF is less likely to be approved before a Solana ETF. Solana’s June 2024 filings, $73 billion market cap, and support from major firms like Fidelity prioritize it for mid-2025 decisions. SUI’s March 2025 filing and smaller market presence face delays due to its newer status and past allegations, though a pro-crypto SEC may enable approval earlier than expected.”

SUI vs. Solana Price Performance

Both SUI and Solana have experienced a decline in price since the beginning of the year, with SUI seeing a 14% decrease and Solana a 19% drop. However, April marked a significant shift for both tokens, with SUI rising by 56.6% to trade at $3.54, while Solana posted a more modest 21% rally, standing at $151.

Despite the growth in April, it’s important to note the difference in market capitalization between the two. Solana’s $11 billion market cap growth in April was equivalent to the entire market cap of SUI. This difference in market cap growth indicates that while SUI’s rally is impressive, Solana’s larger market capitalization gives it a more established presence in the market.

However, the strong performance of SUI in April highlights a native shift in interest, driven by its more scalable chain and growing partnerships. This trend could continue, fueling further growth for SUI in Q2 and Q3, as it builds on its momentum. However, SUI is still far from overtaking Solana as an institutional favorite.