Stellar (XLM) holders witnessed massive losses as cryptocurrency markets continued to deleverage.

The global crypto market cap and prices of most cryptocurrencies tanked as FTX’s demise led to a larger market crash. SLM, the 25th ranked crypto by market cap, saw a similar fate to most of its counterparts losing over 25% in just two days.

XLM Price: A Grim Affair

XLM price was down 90% from its all-time high price $0.94 made in 2018. The coin has dropped by almost 38% in the last month, plunging to a two-year low of $0.078.

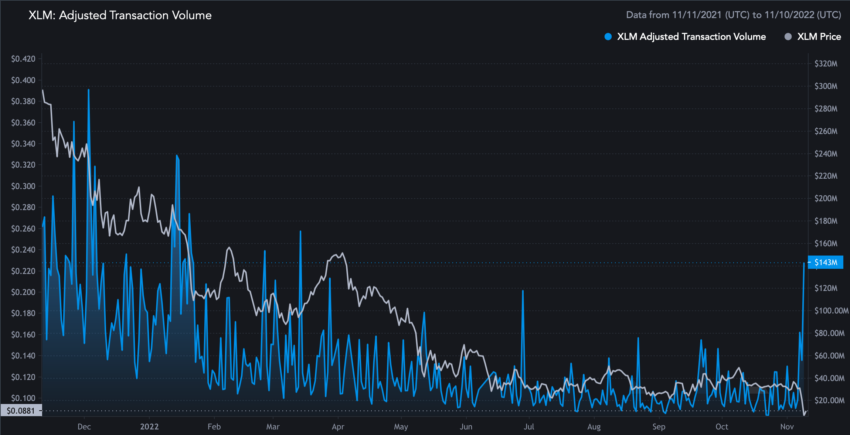

While XLM price was still up 230.70% from its cycle low price of $0.03 made in March 2020, this is hardly a cause for celebration. Stellar’s trade volumes reached over $300 million on Nov. 10, largely indicative of sell-offs alongside heavy price losses.

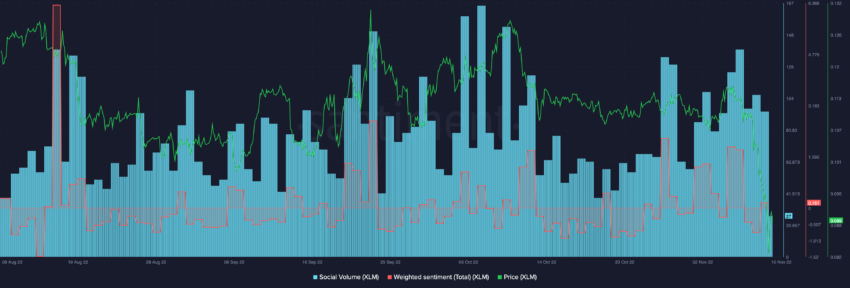

Despite the losses, weighted sentiment for Stellar turned positive, although social volumes fell as dramatically as the XLM price.

On a four-hour chart, however, XLM price appreciated by 4% even though short-term RSI still oscillated in the oversold zone. Looking at the massive losses, it could be argued that XLM climb upward to regain price momentum could prove a challenge.

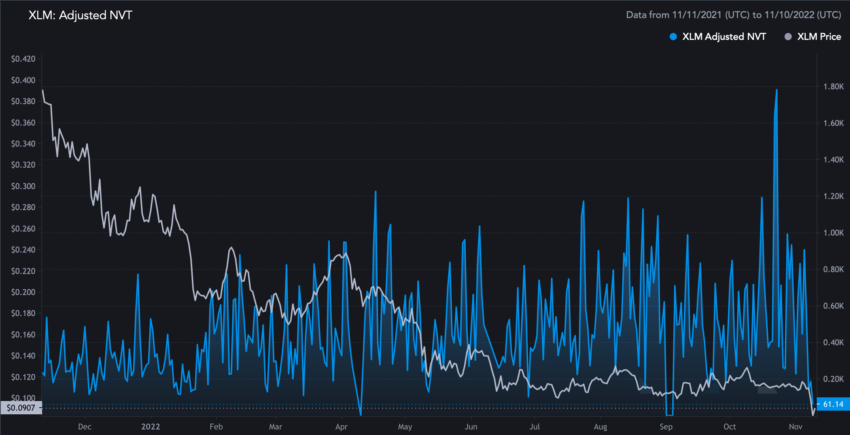

Network Value Depreciates

With XLM price hitting levels unseen in over two-years, its adjusted NVT took a hit. NVT is the ratio of the network value (or market capitalization, current supply) divided by the adjusted transfer value.

NVT stands for Network Value to Transactions Ratio and a low NVT presents largely bearish sentiment as investors place the asset at a discount. Furthermore, Stellar’s transaction volumes noted a major spike presenting mostly sell-offs in the market.

XLM adjusted transaction volume reached an eight-month high of $143 million. As seen in Jan. 2022 and Dec. 2021, spikes in adjusted transaction volume during bearish time periods has often led to more losses.

Thus, seemingly, Stellar on-chain health seemed rather weak to support aggressive price appreciation. However, a fall below the support area around the $0.06-$0.07 mark seems unlikely.

In the near term, if bulls can reenter the market and take control of the price action XLM could make a comeback above the $0.10 mark.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.