STBL has faced a sharp correction after a strong rally fueled by major exchange listings. The token surged when Binance Alpha spot and ByBit Futures added support, driving momentum to new heights.

However, the recent drop of 25% from its all-time high suggests enthusiasm may be fading.

STBL Faces Selling

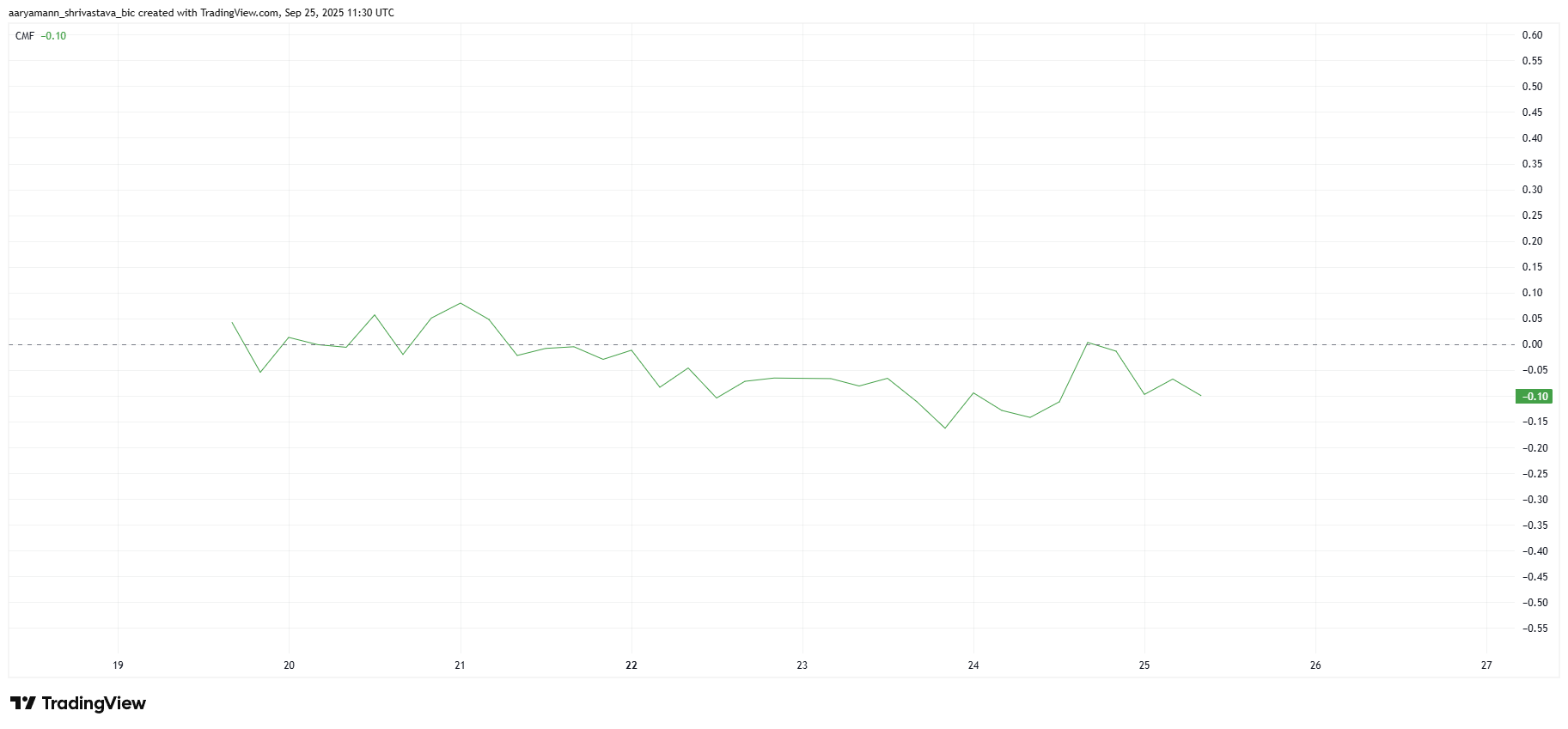

The Chaikin Money Flow (CMF) indicator highlights weakening investor confidence in STBL. Currently, the CMF is showing signs of capital outflows as investors secure profits after the ATH.

This signals that the bullish wave triggered by the exchange listings is losing strength, leaving the altcoin vulnerable to further downside.

With investors prioritizing profit-taking, STBL’s demand has slowed considerably. Outflows typically indicate weakening conviction among traders, making it harder for the token to sustain prior gains.

Unless new buying momentum builds, this could weigh heavily on near-term price performance.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

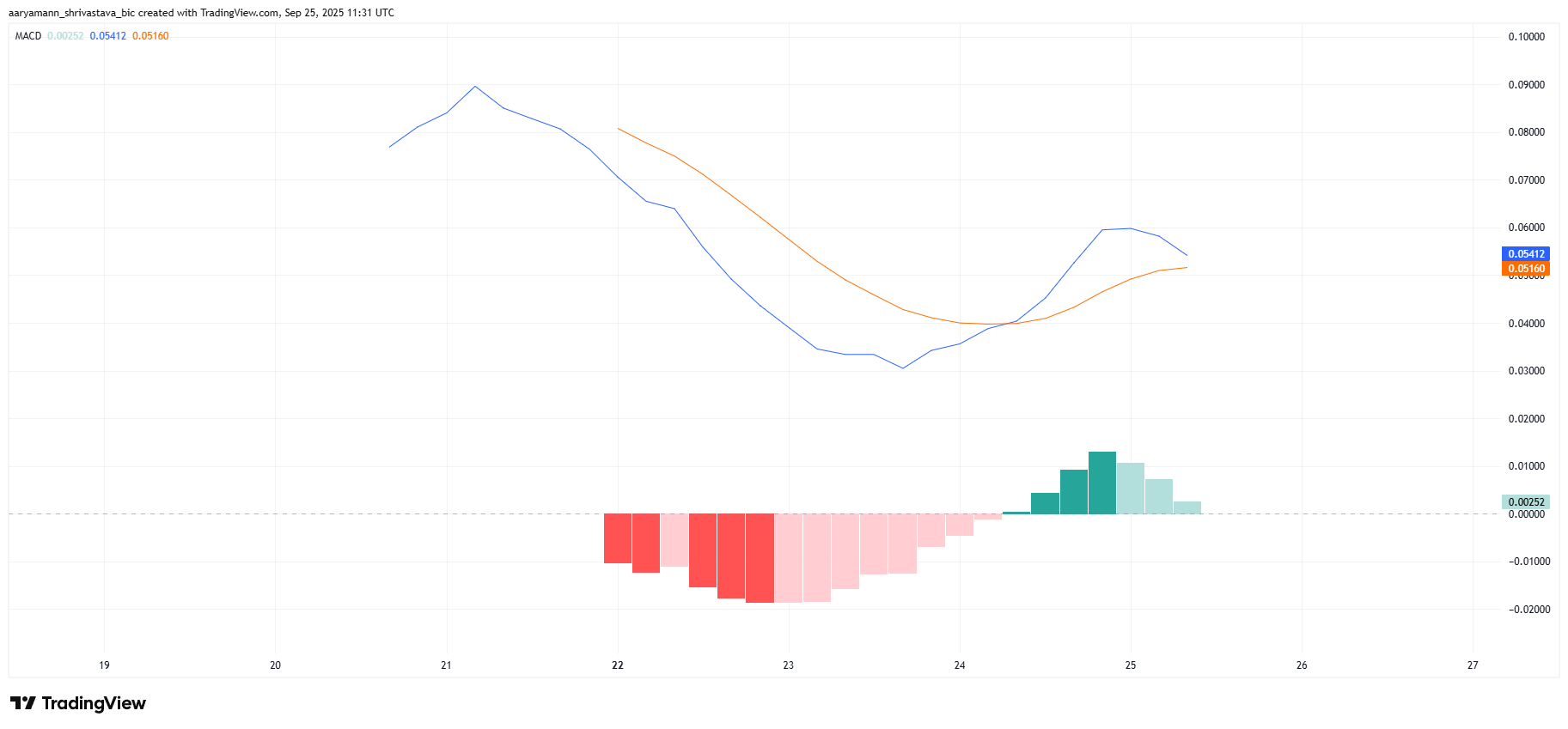

Technical indicators also reveal bearish risks building for STBL. The Moving Average Convergence Divergence (MACD) is nearing a bearish crossover, a setup that historically marks the end of upward trends.

Once the signal line crosses above the indicator line, STBL could officially enter a negative momentum phase.

Such a crossover would confirm that bullish momentum is fading quickly. Without strong inflows or renewed investor demand, STBL could remain under pressure, potentially accelerating the decline already in motion.

STBL Price Needs Support From Investors

At the time of writing, STBL trades at $0.47, down 17% from its $0.61 peak reached within the last 24 hours. The correction reflects both technical weakness and fading enthusiasm from exchange-driven hype.

If bearish signals play out, STBL could break below the $0.44 support level. A drop past this point would likely push the token down to $0.40, intensifying selling pressure.

On the flip side, if STBL successfully defends the $0.44 support, a recovery may still be possible. A bounce could drive the price toward $0.52 and potentially back to its $0.61 ATH, provided investors regain confidence.