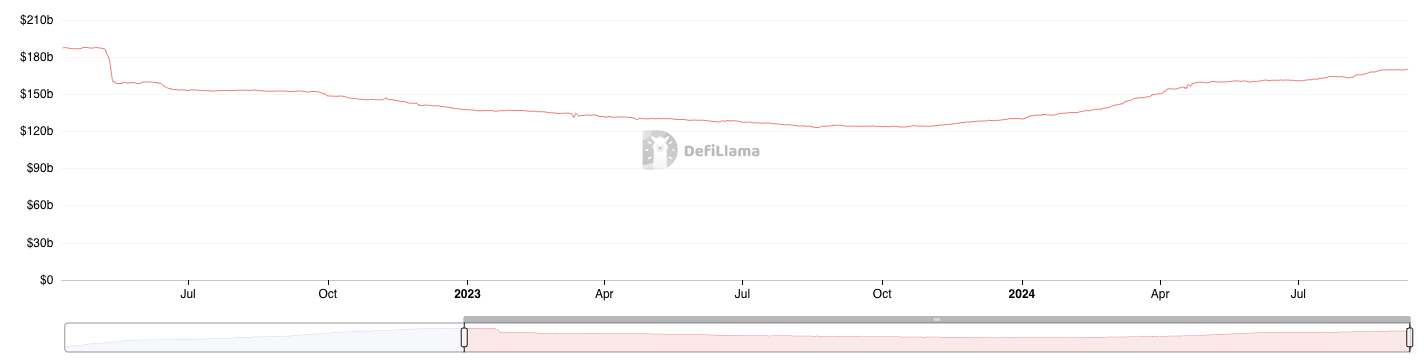

The stablecoin market has achieved a remarkable milestone, reaching a total market capitalization of $170 billion. This figure has not been observed since the collapse of TerraUSD (UST) in May 2022.

According to data from DeFiLlama, this marks a 42.86% increase from the $119.1 billion market capitalization in November 2023.

Analyst Explains How Rising Stablecoin Supply is Bullish For Bitcoin

Driving this resurgence are the top three USD-pegged stablecoins – Tether (USDT), with a market cap of $118.43 billion; USD Coin (USDC) at $35.10 billion; and Dai (DAI), which is valued at $5.27 billion. Together, these giants command 94% of the entire stablecoin market cap, with USDT alone accounting for nearly 69.54% of this figure.

Read more: A Guide to the Best Stablecoins in 2024

A recent CoinGecko report highlights that there are 8.7 million stablecoin holders, with the top three—USDT, USDC, and DAI—holding 97.1% of these users. USDT dominates with over 5.8 million wallets, significantly more than its nearest competitor, USDC.

Analysts now see the growing stablecoin supply as a bullish sign. Tarekonchain, a CryptoQuant analyst, believes this suggests that investors are preparing to make purchases.

Moreover, the decrease in Bitcoin reserves on crypto exchanges supports this bullish outlook, typically a precursor to price rallies. The trend suggests a reduced selling pressure as more investors move their Bitcoin to cold storage, thus limiting supply.

“The combination of shrinking Bitcoin reserves and rising stablecoin reserves sets the stage for a bullish price breakout. With reduced Bitcoin supply and growing buying power, the market is primed for a potential upward move. Historically, this supply-demand imbalance has led to significant price gains,” Tarekonchain explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Furthermore, there is an increase in fiat liquidity in the global market, which bodes well for Bitcoin and the broader crypto market.

“Liquidity is on the rise again, and Bitcoin – being extremely sensitive to changes in liquidity conditions – has the potential to move explosively as fresh liquidity flows into the system. The macro environment is shifting. A major liquidity wave is now on the horizon, and when it hits, Bitcoin looks primed for a strong push higher in Q4,” macro analyst Julien Bittel said.

As the Global Money Index (GMI) rises, indicating more money in circulation, the outlook for Bitcoin strengthens. This surge in liquidity, expected to continue into Q4, could propel a strong year-end rally for Bitcoin and stabilize the crypto market.